Health Insurance Short Coverage Gap Exemption

Household income is below the filing threshold. In general a gap in coverage that lasts less than three months qualifies as a short coverage gap and not subject to a penalty.

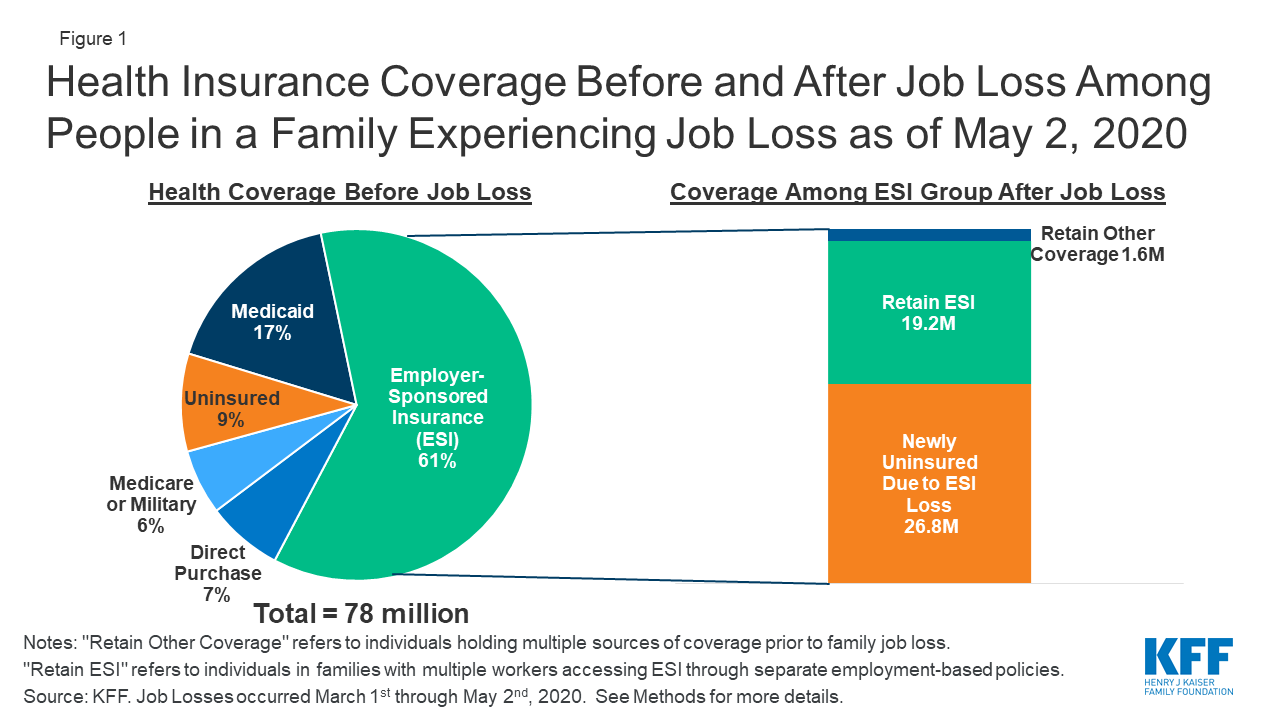

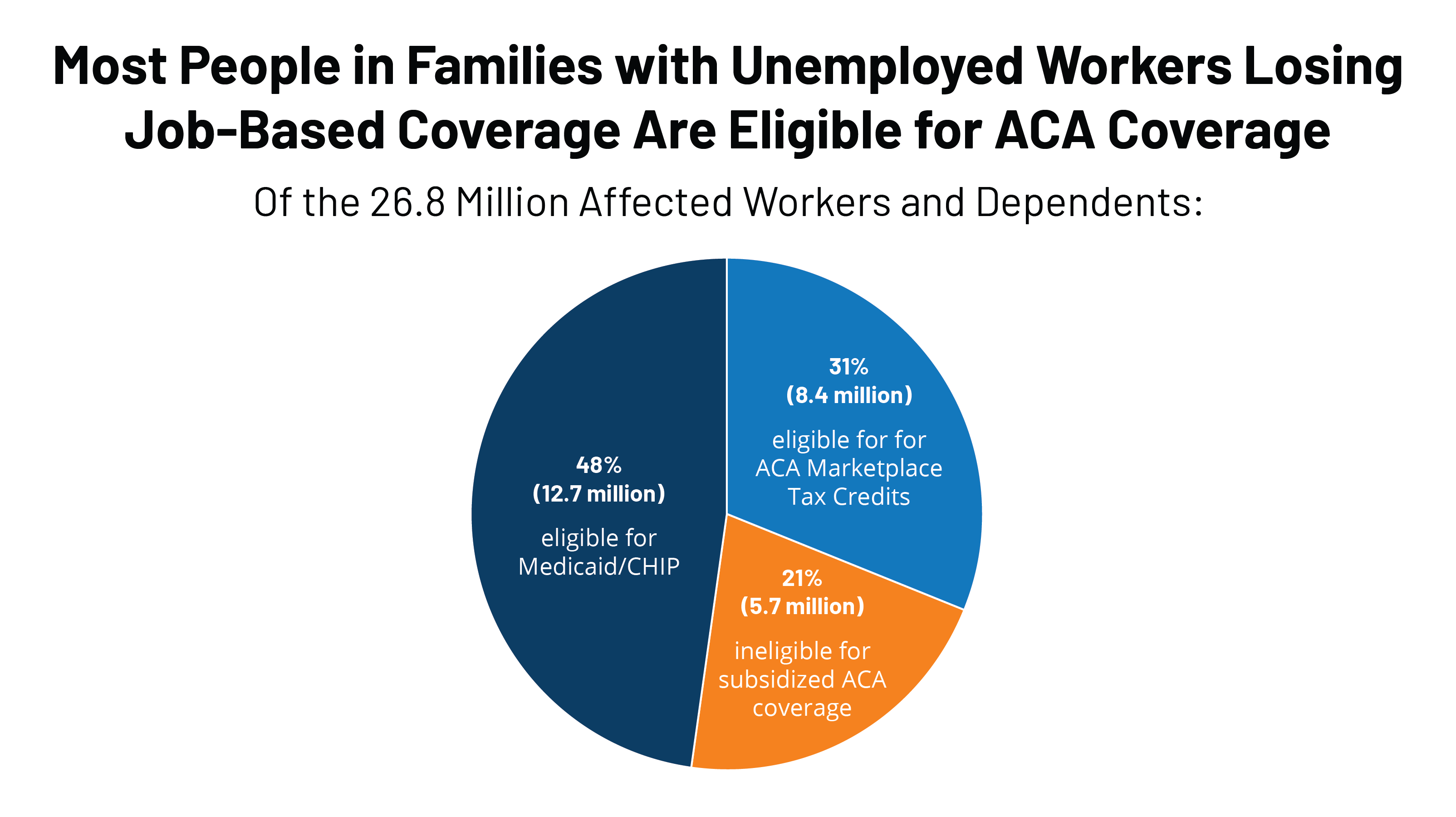

Eligibility For Aca Health Coverage Following Job Loss Kff

You can claim your exemption for a short gap in health coverage on your tax return when you file.

Health insurance short coverage gap exemption. Get the Best Quote and Save 30 Today. If you have more than one short coverage gap during a year the short coverage gap exemption only applies to the first gap. Health insurance coverage is considered unaffordable.

- Free Quote - Fast Secure - 5 Star Service - Top Providers. This one is called short gap exemption. You may be eligible for an exemption from the requirement to have health coverage for that period.

Ad Compare Top Expat Health Insurance In Laos. Specialists offer advice targeted towards your insurance provider and they can review your case and help you write appeals letters. Precisely 695 per adult 34750 per child or 25 of your household income whichever is higher up to a maximum of 2085.

Income is below the tax filing threshold. If anyone else on your tax return qualifies you can claim this exemption for them too when you file your taxes. Form 8965 Health Coverage Exemptions.

If you have a coverage gap of 3 months or more you are not exempt for any of those months. Here is what you need to know about this exemption. Health Marketplacecmsgov Get All.

Health coverage is considered unaffordable exceeded 824 of household income for the 2020 taxable year Families self-only coverage combined cost is unaffordable. Get A Quote Now. Beyond the short coverage gap exemption there are other important coverage gap.

If an individual has more than one short coverage gap during a year the short coverage gap exemption only applies to the first gap. Under ObamaCare you are allowed one short coverage gap exemption which covers less than three months in a row without coverage each year. In other words you are exempt for two full months but need to have coverage for at least one day of the third month.

Ad Contact Our Responsive Insurance Advisors. Short coverage gap of 3 consecutive months or less. Short coverage gap code B.

What qualifies as a short coverage gap. About twice what it was in 2015. If the gap includes January on screen 8965 more information is needed because IRS guidelines specify that any months for which coverage was not present in the prior year are also counted in the three months for a current year coverage exemption.

Access To More Than 110 Board Certified Doctors With Ranging Specialisms. How much is the 2016 healthcare insurance penalty. Youre considered covered any month you.

If you hold insurance through an employer sponsored health plan then your employer may have a participant advocacy specialist with experience applying for coverage gap exceptions. How to Claim a Short Gap in Coverage. TaxAct reports exemptions on your return with a special code.

Examples of some of the exemptions that may only be requested by filing Form 8965 with their 2014 federal return. By Webmaster Published January 28 2014. TaxAct reports a specific code on Form 8965 for the following exemptions.

If you have been uninsured for a limited period of time you may qualify for a short gap insurance exemption from the obligation to have health coverage. Youll simply select the exemption that applies to you and enter the corresponding code. Get A Quote Now.

A short coverage gap of three consecutive months or less. Cost of the lowest-cost Bronze plan through Covered California or the lowest cost employer-sponsored employee-only plan is more than 827 percent of income in 2021 on the tax return or 809 percent in 2022. Unaffordable premiums when the minimum amount you must pay is more than 816 percent of your household income.

Exemptions Claimed on State Tax Return Exemptions Processed by Covered California. A taxpayer generally can claim a coverage exemption for the taxpayer or another member of the tax household for each month of a gap in coverage of less than 3 consecutive months. Exemption Information If You Had A Gap In Health Coverage.

Form 8962 - Health Coverage Exemptions was retired starting with tax year 2019. The Affordable Care Act is making health insurance more. Exemption information if you had a gap in health coverage.

In Drake Tax a short gap in coverage is calculated automatically from the 8965 entries unless the gap includes January. The process is fast and easy. Ad Video And Telephone Consultations With Doctors Nurses Healthcare Specialists.

The information that follows is for tax years prior to 2019. Individual has a short coverage gap. Ad Video And Telephone Consultations With Doctors Nurses Healthcare Specialists.

Health coverage is unaffordable based on actual income reported on your state income tax return when filing taxes. Access To More Than 110 Board Certified Doctors With Ranging Specialisms. Youll simply select the exemption that applies to you and enter the corresponding code.

Ad Contact Our Responsive Insurance Advisors. In general a gap in coverage that lasts less than three months qualifies as a short coverage gap. How to Claim a Short Gap in Coverage You can claim your exemption for a short gap in health coverage on your tax return when you file.

But you do have healthcare short gap exemption. The process is fast and easy. Anyone with a gap in health coverage of no more than 2 consecutive months can claim this exemption.

Individual is not lawfully present in the US. For more information click here. Was there a short gap of time during which you did not have health coverage.

Short coverage gap no insurance for less than three months in 2017.

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

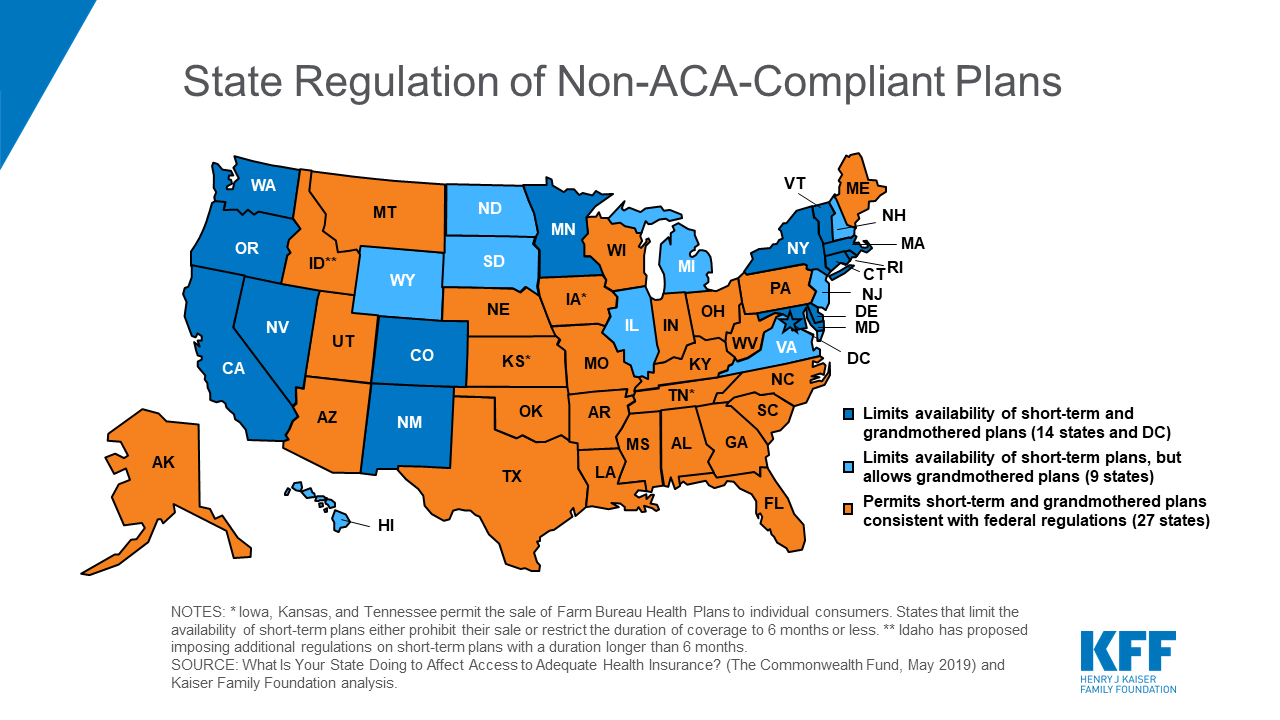

State Actions To Improve The Affordability Of Health Insurance In The Individual Market Kff

Types Of Health Insurance Under Obamacare

3 Steps To Understanding Obamacare Ehealth Insurance

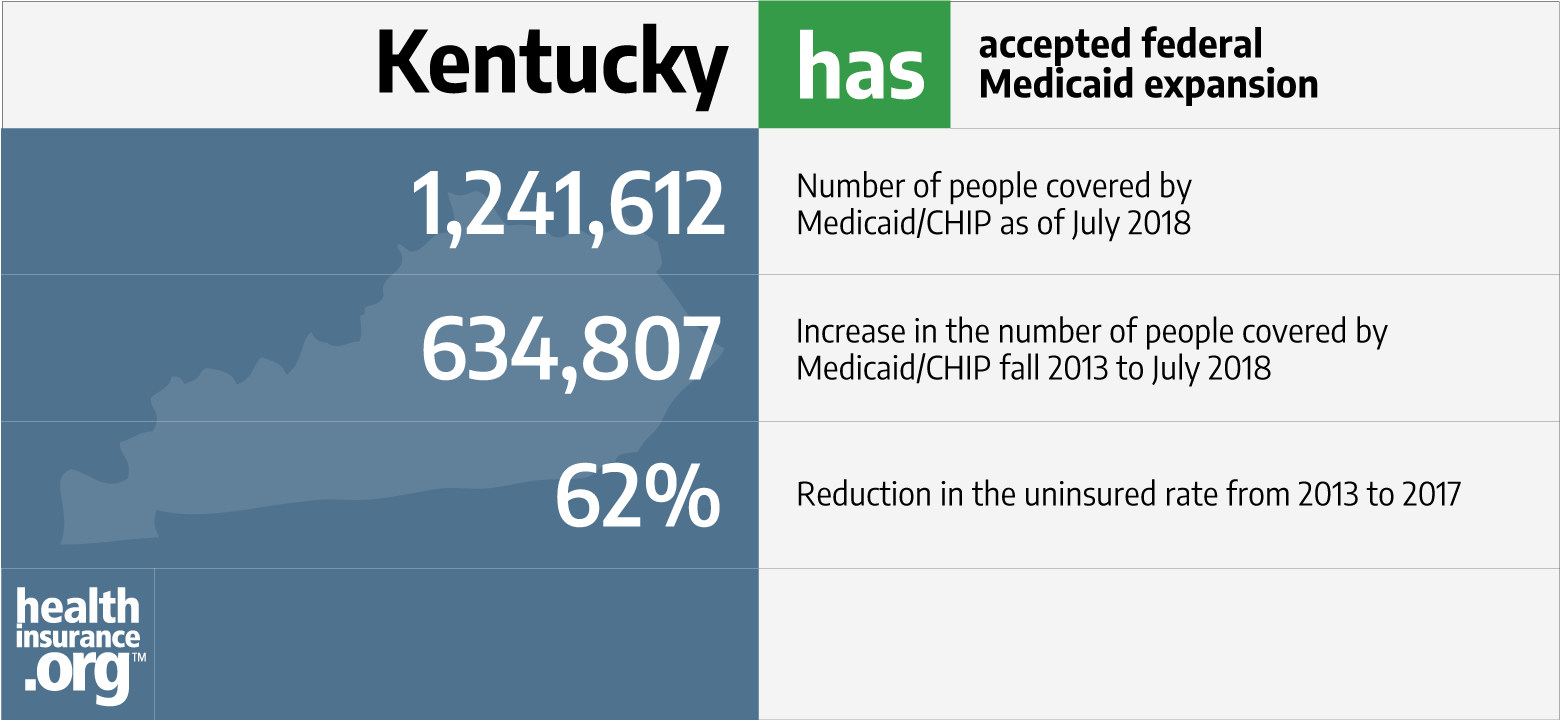

Kentucky And The Aca S Medicaid Expansion Healthinsurance Org

How To Buy Health Insurance If You Don T Qualify For A Subsidy Ehealth

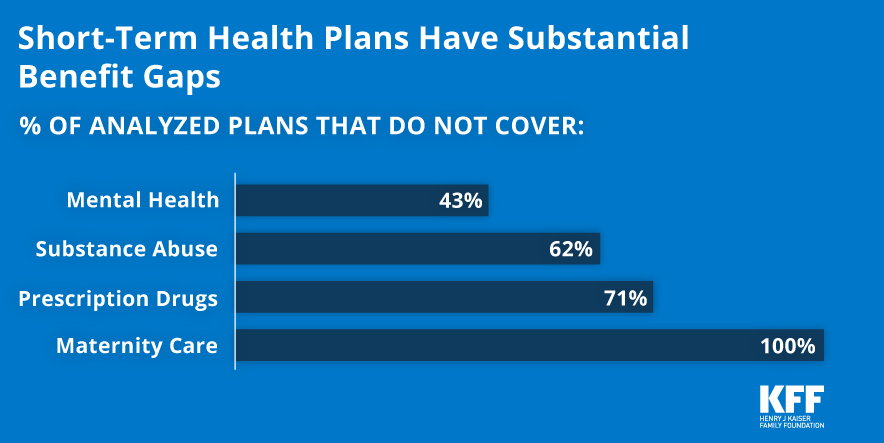

Understanding Short Term Limited Duration Health Insurance Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

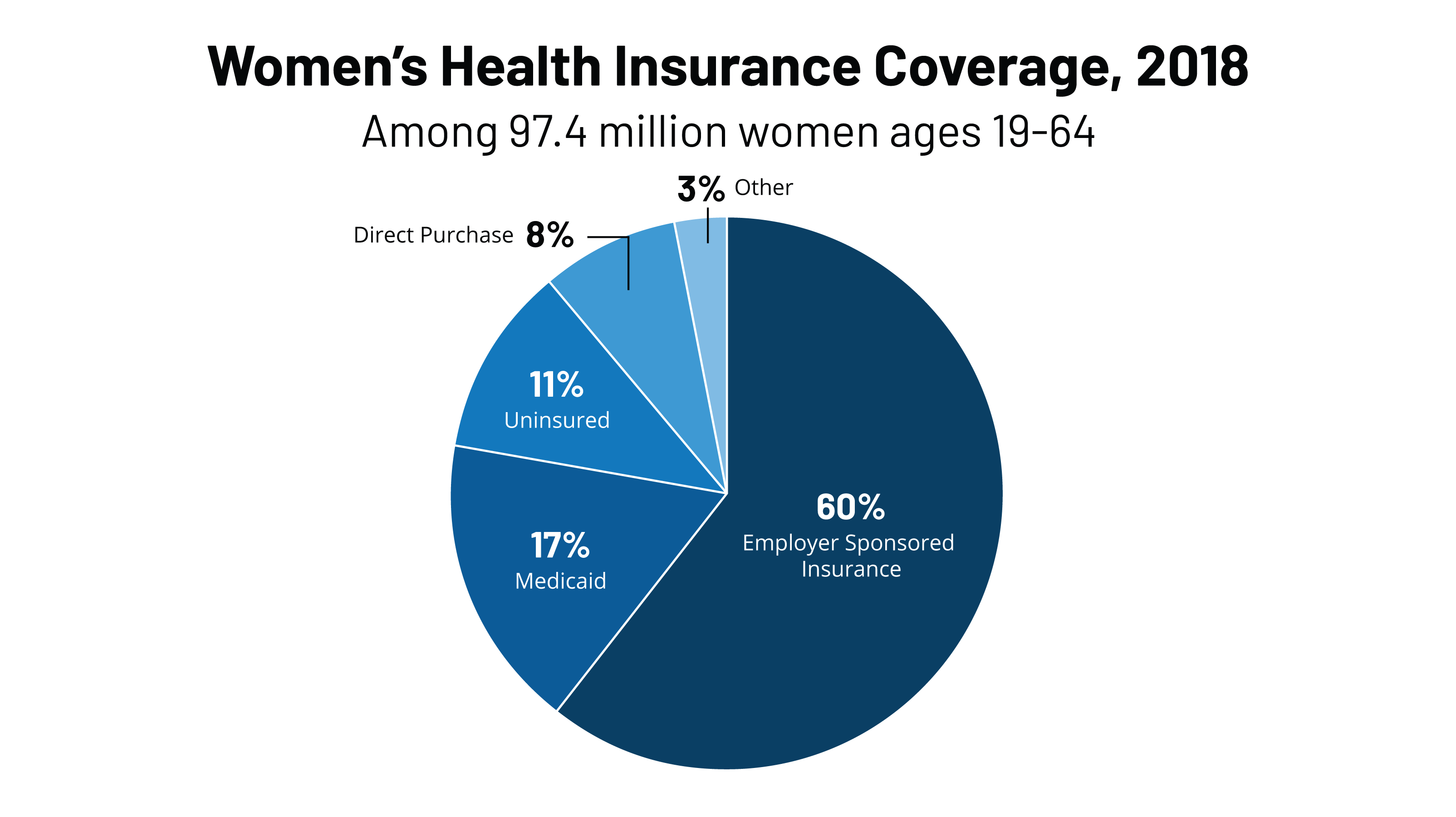

Women S Health Insurance Coverage Kff

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

Term Of The Day Co Insurance This Is Your Share Of The Costs Of A Service That Is Covered By Your Health Plan Co Insurance Health Plan Understanding Yourself

The Health Insurance Penalty Ends In 2019

What Is An Off Exchange Health Insurance Plan Healthinsurance Org

Short Term Health Insurance The Basics Infographic Health Insurance Health Insurance Plans Medical Insurance

Short Term Health Plans In California Health For California

Short Term Health Plans In California Health For California

The Difference Between Short Term Disability And Fmla Patriot Software Medical Social Work Disability Human Resources

3 Steps To Understanding Obamacare Ehealth Insurance

So Long To Limits On Short Term Plans Healthinsurance Org

Posting Komentar untuk "Health Insurance Short Coverage Gap Exemption"