What Does Ctp Insurance Cover Qld

As stated above CTP is a type of personal injury insurance. Why choose Suncorp for your.

Third Party Fire And Theft Car Insurance Moneysupermarket

Each state and territory in Australia has different regulations regarding CTP insurance.

What does ctp insurance cover qld. Your greenslip does not cover. CTP Insurance will cover at fault drivers for personal injury compensation claims made by others but will not cover the at fault driver for his or her own injuries. CTP insurance is part of the cost of your vehicle registration so every vehicle is covered.

What does CTP insurance cover. It can cover the personal injuries mental or physical of. It will also cover you for your own personal injuries if you were not at fault or only partially at fault for the accident.

Ad Encuentra Img Insurance. Buenos Resultados en iZito. CTP covers the costs of compensation claims made against you if you injure or kill someone in a car or road accident.

What if I dont have CTP. Queensland SA and WA have an at-fault scheme which means the driver who is at-fault cant claim CTP insurance compensation. The scheme provides motor vehicle owners drivers passengers and other insured persons with an insurance policy that covers their unlimited liability for personal injury caused by through or in.

Provide for compensation for people killed or injured in a motor vehicle accident. If you are injured in a motor vehicle accident and it was totally or partially due to the fault of another driver or vehicle owner you can claim on the CTP Insurance of the vehicle that caused the accident. Queensland operates a common law fault based Compulsory Third Party CTP scheme which was first introduced in 1936.

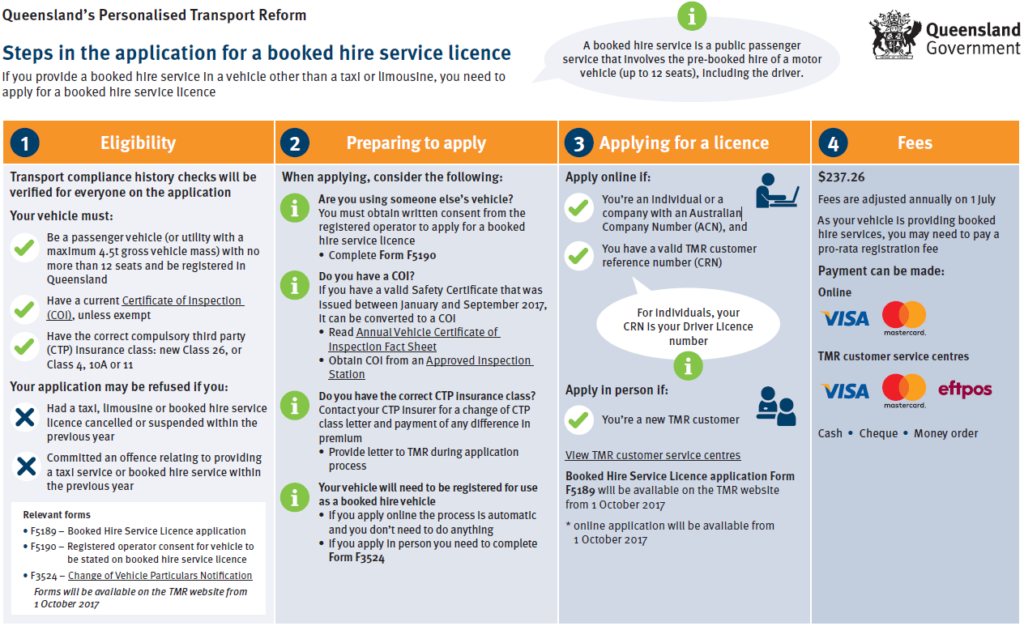

Passengers in your car. Ad Compare All NSW Insurers Online Find The Cheapest CTP Greenslip. Information about compulsory third party insurance CTP in Queensland.

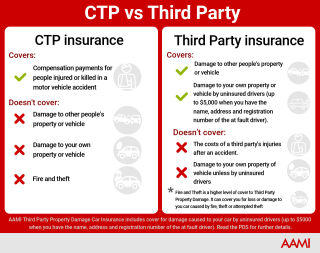

That means it does not cover damages to property such as your car trailer bulbar etc. CTP doesnt cover the cost of damage to anyone elses car or property or your car. CTP scheme overview.

When Registering A Vehicle Pick NRMA Insurance For Your Motor Accident Injuries Insurance. In Australia you must have CTP insurance in order to register your vehicle. Your CTP covers other drivers passengers or pedestrians who are injured or killed in an accident involving your vehicle.

This includes pedestrians passengers cyclists motorcyclists drivers of other vehicles and to a lesser extent the driver at fault. This includes other drivers passengers pedestrians cyclists and motorcycle riders. Why choose RACQ CTP Insurance.

Any person injured in a motor vehicle accident in Queensland due to the fault total or partial of the driver owner or another person insured by the at-fault vehicles CTP insurer. All vehicle owners in Queensland must have CTP insurance. What is CTP Insurance.

This can include injuries to. You might need to prove in court that another driver was negligent. Does CTP insurance cover damage to property or other vehicles.

Unlike many other types of insurance CTP provides unlimited indemnity to the insured. See Who can make a claim for more information. If youre injured youre usually covered for.

The Qld compulsory third party CTP scheme is a common law fault-based scheme. CTP insurance is mandatory in QLD you nominate a CTP provider when you register your car. Ad Compare All NSW Insurers Online Find The Cheapest CTP Greenslip.

Include trailers under the greenslip of the towing vehicle. Compulsory Third Party insurance CTP comes with your vehicle registration and provides protection to the at-fault driver against any compensation claims from individuals who are injured as a result of a motor vehicle accident. A period of time.

While the Qld CTP scheme pays compensation according to the type and extent of injury you may get less if you were partly at fault. CTP insurance is designed to cover the cost of compensation claims made against a driver if they kill or injure someone in a car accident. See the FAQ questions below in relation to what is covered under your CTP insurance.

If you or anyone driving your car causes an accident in which someone else is injured your CTP insurance covers the cost of their compensation claim. For that youll need car insurance. As the vehicle owner you are protected against any claims against you for the damage and losses that were caused.

What does CTP insurance cover in Queensland. Benefits paid to the injured party depend on the extent of the injuries and can include the cost of ambulance hospital and medical treatment rehabilitation loss. What does CTP insurance cover in Queensland.

CTP insurance provides compensation for people who are injured or killed when your vehicle is involved in an accident. What does CTP cover. Ad Get Quality CTP Greenslip NRMA Insurance Including At Fault Driver Cover Up To 500K Today.

CTP insurance only covers personal injury resulting from a motor vehicle accident. NSW has a mixed scheme where the at-fault driver receives less compensation. CTP Insurance covers your liability and the liability of anyone who drives your vehicle for injuries caused to others in a motor vehicle accident.

What is CTP insurance. Compulsory Third Party CTP covers claims made against you if you or anyone else driving your car has an accident and someone is injured or if they die. CTP insurance is a car insurance scheme that covers your financial liability should you or another driver of your car injure someone while driving 1.

CTP stands for compulsory third party and is an insurance system in Queensland that helps those injured in an incident to receive compensation for their injuries and also helps protect at-fault drivers from financial burden. Compulsory Third Party CTP Insurance is attached to the registration of your vehicle and provides protection to the at-fault driver against compensation claims from people injured in a motor vehicle accident. The driver and passengers in.

How does CTP insurance work in Qld. Generally as long as your vehicle is registered your QLD CTP insurance will cover you and the driver of your vehicle for any injuries caused to other road users if you or they are at fault in a motor vehicle accident anywhere in Australia. Car Road Injuries.

CTP insurance is compulsory for all drivers in QLD.

Ctp Car Insurance Queensland Learn What S Covered Iselect

Ctp Explained Does Car Rego Include Ctp Insurance Aami

Ctp Car Insurance Queensland Learn What S Covered Iselect

Rideshare Vehicles To Transition Into New Ctp Class Maic

What Type Of Car Insurance Is Right For You Racq

Vespa Primavera Midnight Blue Google Zoeken Skuter Vespa Motor

3 Insurance Myths Debunked Ctp Insurance Aami

How Does Ctp Insurance Work In Different Australian States Carchase

Compulsory Third Party Ctp Insurance In South Australia Canstar

Queensland Ctp Car Insurance How Does It Work Canstar

What S The Difference Between Ctp And Car Insurance The Hub By Nrma Insurance

What Is Ctp Insurance What Does It Cover And Who Does It Cover Mcw Legal

About Ctp Insurance Ctp Insurance Regulator

Understanding Ctp Insurance Motorama

Quarterly Ctp Scheme Insights Oct Dec 2020 Maic

Proposed Ctp Insurance Qld No Fault Ctp Scheme Suncorp Racq

Posting Komentar untuk "What Does Ctp Insurance Cover Qld"