Minimum Coverage Homeowners Insurance

Find out whats covered by Other Structures Coverage and how much protection you need from The Hartford. If you need.

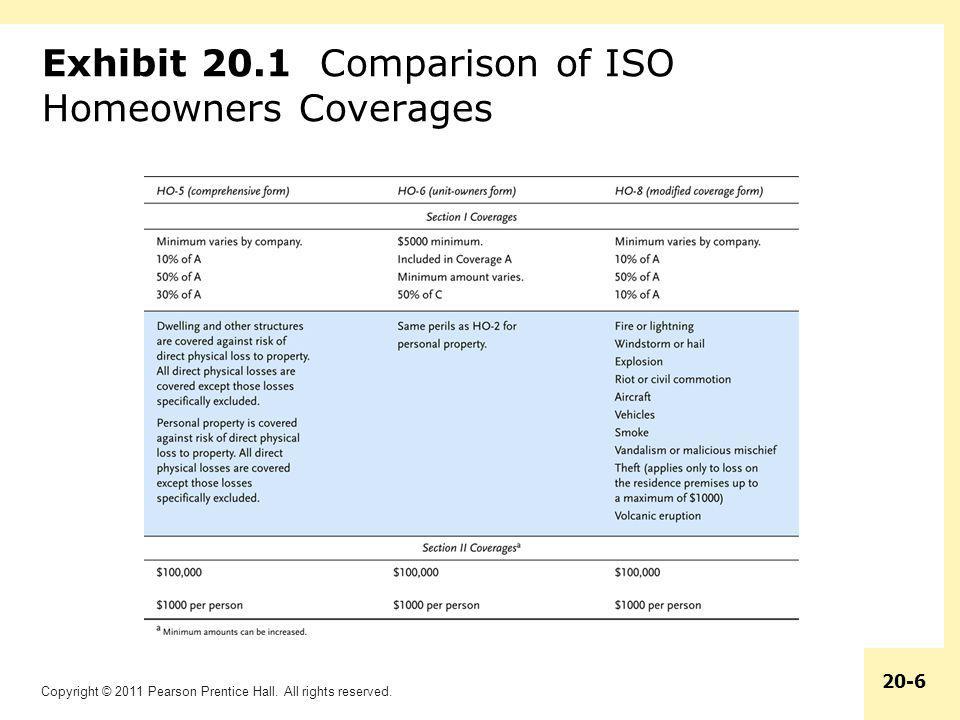

Solved Types Of Homeowner S Insurance Policies Insuring A Chegg Com

For a first mortgage secured by a property on which an individually held insurance policy is maintained Fannie Mae requires coverage equal to the lesser of the following.

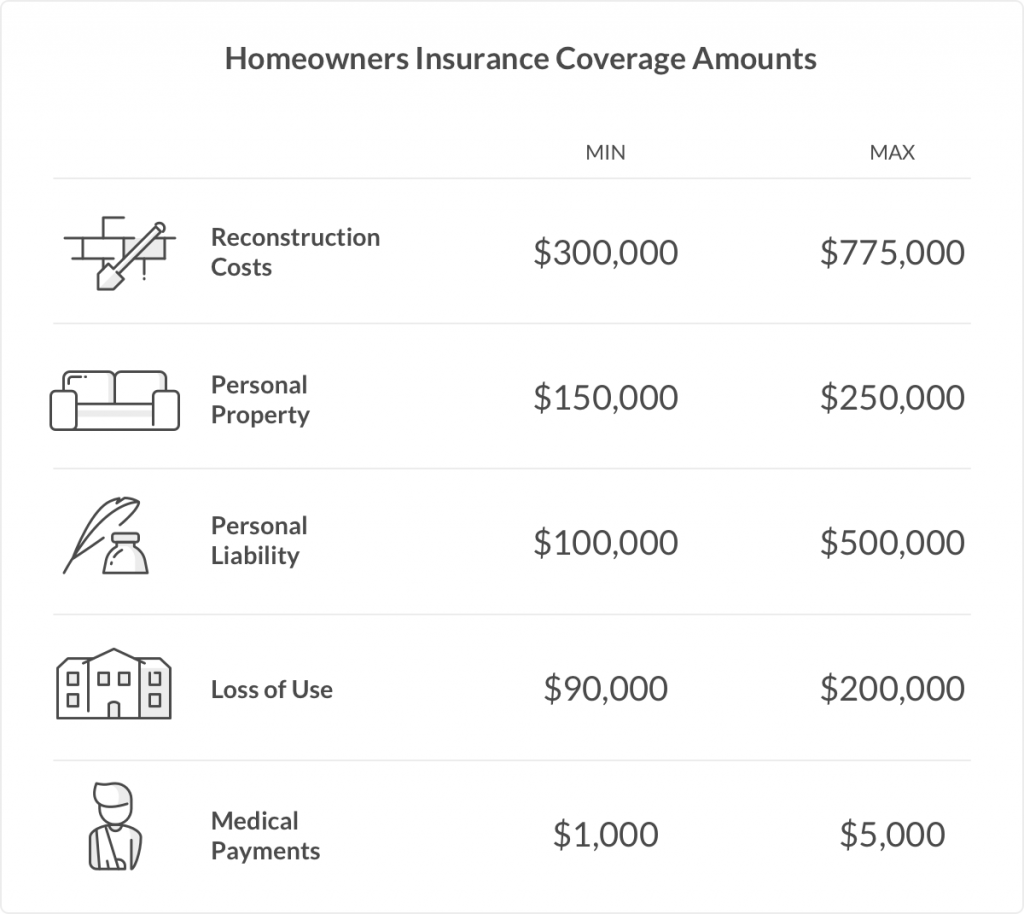

Minimum coverage homeowners insurance. At minimum coverage C should be 20 percent of your dwelling coverage. Minimum coverage requirements. So if your home is insured for 308000 you should have at least 61600 for your personal property.

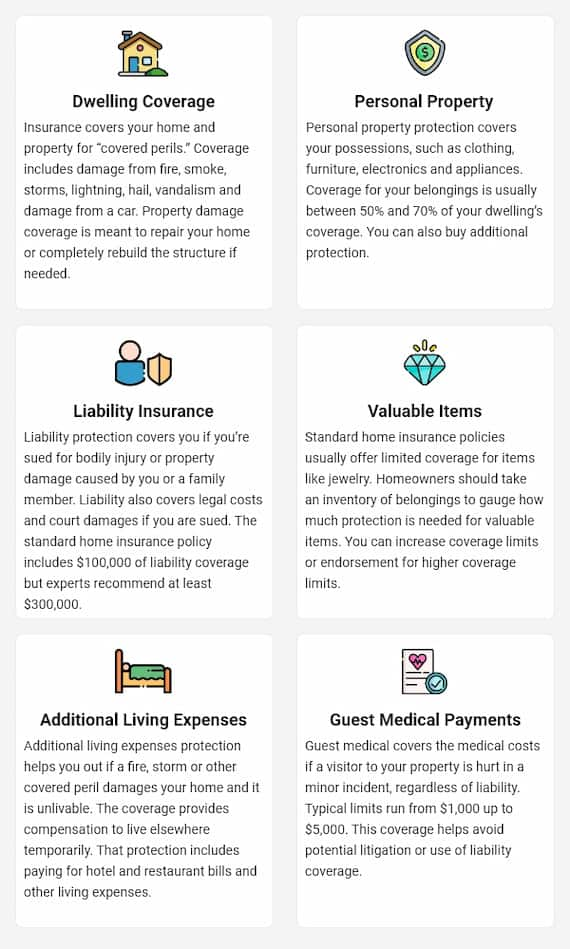

All coverage is subject to the limits specified in the policy. The cost of homeowners and renters insurance depends on a number of factors such as location local fire protection age and construction of building choice of deductibles application of discounts and the scope and amount of insurance coverage you purchase. Typically medical payments are subject to the personal liability limit attached to a homeowners policy.

Do mortgage lenders require homeowners insurance. 100 of the insurable value of the improvements as established by the property insurer. Under California law each insurance company calculates.

Higher limits of liability for these two types of coverage can also be purchased. For borrowers with a mortgage the answer is yes. Personal liability limits of 25000 per occurrence including a medical payments limits of 1000 per person are typical.

Lenders often have minimum requirements for dwelling coverage. The minimum coverage allowed by most companies including Kin is 10 percent of your homes replacement value. Most homeowners insurance policies have at least 100000 in liability coverage.

Minimum coverage on a home insurance policy will be calculated on your homes estimated replacement cost so keep in mind that replacing your home in the future could cost more than its current value. Other Structures Coverage is part of your homeowners insurance policy and helps cover costs to repair or replace other buildings or objects on your property such as sheds and fences. Ad Search Faster Better Smarter Here.

Lenders establish homeowners insurance minimum. Is homeowners insurance required. If your home is located in a high-risk flood zone your lender may also require you to get separate flood insurance.

The more valuable your stuff is the more property coverage you need. Your lender will likely have scope of coverage requirements that detail what must be covered by the policy. Most homeowners insurance policies provide a minimum of 100000 worth of liability insurance but higher amounts are available and increasingly it is recommended that homeowners consider purchasing at least 300000 to 500000 worth of liability coverage.

Your lender likely requires you to carry a minimum amounttypically 80 of your dwellings replacement costbut sometimes may require as much as 100. Additional Living Expense ALE and coverage for Liability is also normally included. 100 of the insurable value of the improvements as established by the property insurer.

Its a good idea to bump that up to at least 300000or more if you can afford to do so. In some cases your lender may only require you to maintain a policy that covers your current mortgage balance. The UPB of the mortgage loan or if the mortgage loan is a second lien mortgage loan the combined UPB of the first lien and second lien mortgage loans as long as the UPB of the mortgage loan or the combined.

Standard homeowners insurance typically offers up to 500000 maximum in personal liability coverage but to know how much coverage you actually need youll need to add up all of your assets like your home car savings retirement funds boat etc. The UPB of the mortgage loan or if the mortgage loan is a second lien mortgage loan the combined UPB of the first lien and second lien mortgage loans as long as the UPB of the mortgage loan or the combined. If your home would cost 200000 to rebuild this gives you a minimum of 20000 in personal property coverage.

Estimating replacement costs is important because it ultimately. At minimum your policy will need to cover wind hail fire and vandalism. Insurance coverage must equal the lesser of.

However the minimum homeowners insurance coverage mortgage lenders require borrowers to possess is the unpaid mortgage balance amount. Ad Search Faster Better Smarter Here. Each homeowners insurance policy has a coverage limit.

Mortgage Lender Closing Requirements. Insurance coverage must equal the lesser of. Thats the amount to be paid out for structural damage caused to your home.

100 of the insurable value of the improvements as established by the property insurer. Homeowners insurance typically covers the dwelling including attached structures certain unattached structures and your personal property.

Topic 11 Homeowners Insurance Ppt Download

Topic 13 Homeowners Insurance Bus 200 Introduction To Risk Management And Insurance Jin Park Ppt Download

Understanding Your Home Insurance Declarations Page Policygenius

Importance Of Homeowners Insurance Coverage Diamond Cu

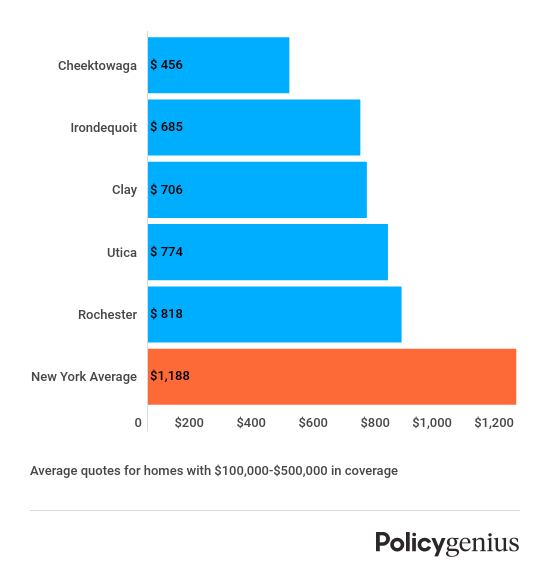

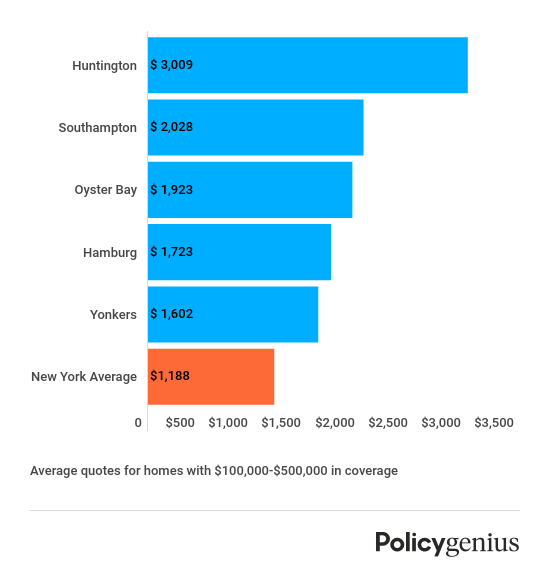

Homeowners Insurance In New York Policygenius

What Does Homeowners Insurance Cover

7 Homeowners Policy Diagram Quizlet

Topic 11 Homeowners Insurance Ppt Download

How To Buy Homeowners Insurance Insurance Com

Average Cost Of Condo Insurance 2021 Valuepenguin

Homeowners Insurance Section I Ppt Download

What Makes You Ineligible For Homeowners Insurance

The Eight Types Of Homeowners Insurance Quotewizard

Homeowners Insurance In New York Policygenius

What Is Dwelling Coverage Insuropedia By Lemonade

Homeowner S Insurance The Lawyers Jurists

Homeowners Insurance Nc North Carolina Home Insurance

Homeowners Insurance How It Works And What S Actually Covered

Topic 11 Homeowners Insurance Ppt Download

Posting Komentar untuk "Minimum Coverage Homeowners Insurance"