Minimum Insurance Coverage North Carolina

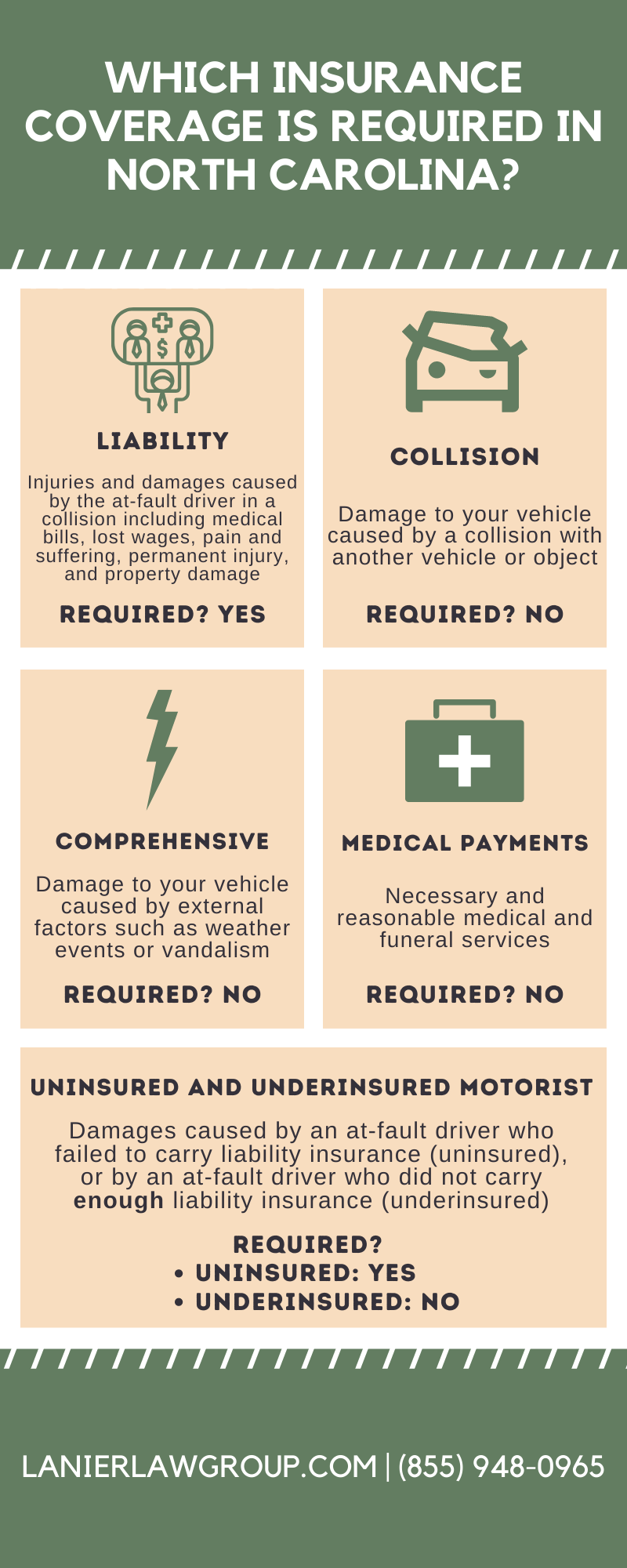

UMUIM North Carolina requires drivers to protect themselves from uninsured and underinsured drivers. Here are some of the parameters of our insurance coverage in North Carolina.

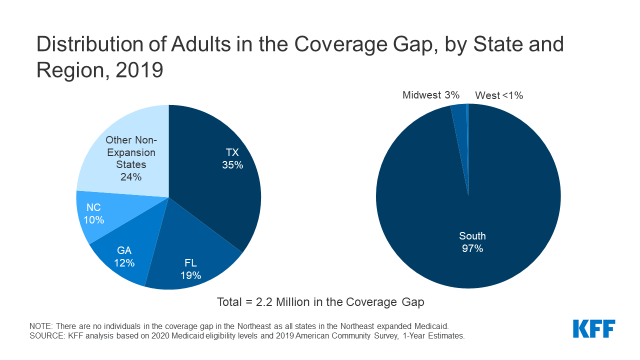

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

Minimum car insurance in North Carolina is fairly straightforward North Carolina drivers must pay 100 the first time they are caught without insurance North Carolina drivers must pay 150 the second time they are caught without insurance North Carolina drivers.

Minimum insurance coverage north carolina. Minimum Coverage requirements State law requires that liability coverage which the the coverage that pays out for someone elses damages if you are responsible for a crash be maintained continuously. Drivers must purchase the following minimum amounts of coverage in North Carolina. This coverage helps pay for injuries and damages from a car accident for which you are at fault.

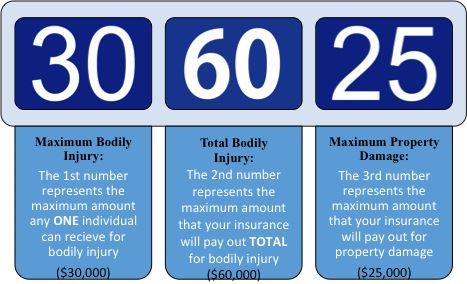

North Carolina Car Insurance Laws State Minimum Coverage Limits 2020 North Carolina car insurance requirements are 306025 for bodily injury and property damage liability coverage. NC Department of Insurance 1201 Mail Service Center Raleigh NC 27699-1201. North Carolina requires that ALL drivers have liability insurance.

Salisbury Street Raleigh NC 27603-5926. Get multiple North Carolina car insurance quotes with our comparison tool below to find the lowest North Carolina car insurance rates. North Carolinas minimum coverage limits are as follows.

What are the minimum limits for North Carolina. This is the maximum amount your insurance policy will pay out for damages to the other drivers property. North Carolina Minimum limits insurance requires that you carry.

Bodily injury liability coverage. 30000 bodily injury per person 60000 bodily injury per accident 25000 property damage per accident or 306025 Dairyland coverage in North Carolina At Dairyland were proud to be able to help drivers in North Carolina meet their insurance needs. The minimum requirements are as follows.

The average car insurance costs 121 per month or 1460 per year in North Carolina for full coverage insurance and 41 per month or 502 per year for state minimum coverage for a 30-year-old driver with a clean driving record. North Carolina car insurance minimum requirements are 306025 for bodily injury and property coverage. Ad 1000s Coupons For 1000 Stores Updated daily coupons promo codes discounts.

The minimum liability coverage limits are. How Much is North Carolina Car Insurance per Month. North Carolina Department of Insurance.

North Carolina law requires drivers to carry a minimum amount of driving insurance. For 4000 online stores Discounts Beat Buys Deals Sales and Promotions Products. Even if you have the minimum auto insurance coverage to be legal in North Carolina you might not be carrying enough to be protected.

University of North Carolina-Charlotte Minimum Insurance Coverage and Requirements July 2016 Coverage Low Risk Profile Medium Risk Profile Requirement Standard Requirement High Risk Profile Specialty Encroachment Premises Lease Commercial General Liability ProductsCompleted Operation. 30000 bodily injury liability per person 60000 bodily injury liability per accident 25000 property damage liability per accident 30000 uninsured motorist bodily injury liability per person 60000 uninsured motorist bodily injury. In the event of a covered accident your limits for bodily injury are 30000 per person with a total maximum of 60000 per incident.

How Much Is Full Coverage Car Insurance in North Carolina. Contact NCDOI Careers at. Minimum legal requirement 30000 per person and 60000 per accident.

Ad Find Quality Results Answers. Minimum insurance requirements for North Carolina The minimum amount of North Carolina auto insurance coverage is 300006000025000. 30000 of bodily injury liability one person 60000 of bodily injury liability two or more people 25000 of property damage liability.

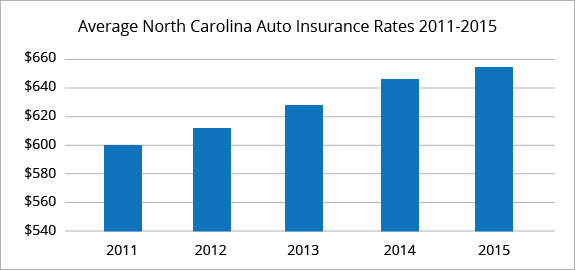

A minimum insurance policy in North Carolina pays whats due to the other driver and shields. 25000 of coverage per accident. The average North Carolina Insurance rates are 6576mo.

North Carolina insurance law requires drivers to hold continuous liability coverage and carry coverage for uninsured motorists. The minimum liability coverage is 30000 per person 60000 per accident and 25000 in property damage or 306025. 30000 for bodily injury liability per person per accident.

Ad Find Quality Results Answers. Albemarle Building 325 N.

The Best Cheap Renters Insurance In North Carolina Valuepenguin

What Are The Minimum Auto Insurance Requirements In North Carolina

Best Cheap Health Insurance In North Carolina 2021 Valuepenguin

Nc Auto Insurance Requirements Fisher Stark P A

North Carolina Business Insurance Faq 2021

Understanding Motorist Insurance Coverage In Nc

How Much Car Insurance Do You Need And How Much Is Required Moneygeek Com

Car Insurance In Charlotte North Carolina What To Know

Car Insurance 101 How Much Car Insurance Do I Really Need Insurify

How To Close The Health Insurance Coverage Gap

Liability Coverage Car Accidents Wallace Pierce Law

The Cheapest Car Insurance Rates In North Carolina From 37 Mo Valuepenguin

Best Car Insurance In North Carolina

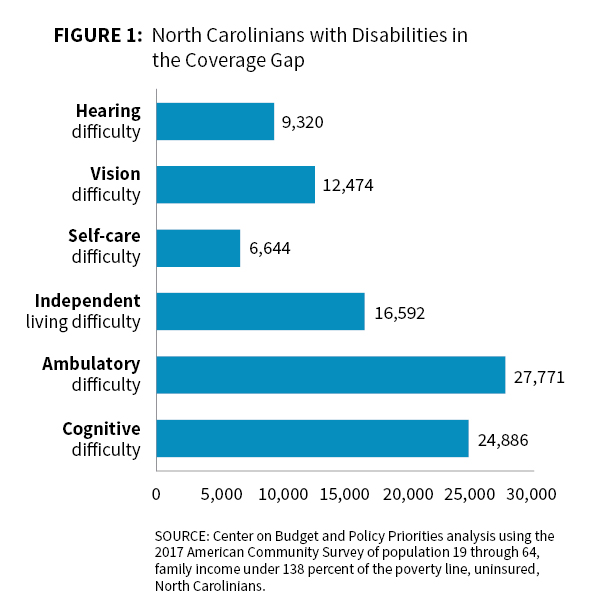

Uninsured North Carolinians With Disabilities And Chronic Illnesses Stand To Gain If Nc Closes The Coverage Gap North Carolina Justice Center

The Cheapest Car Insurance Rates In North Carolina From 37 Mo Valuepenguin

Commercial Auto Insurance Requirements By State

Best Car Insurance Rates In Charlotte Nc Quotewizard

Nc Auto Insurance Requirements What You Need To Know Protective Agency

Uninsured Underinsured Motorist Claims Uninsured And Underinsured Motorist Coverage In North Carolina

Posting Komentar untuk "Minimum Insurance Coverage North Carolina"