Does Cmhc Insurance Cover Job Loss

Monthly payment is 123385. CMHC will cover the banks behind on the mortgage and everything will be hunky-dory.

With Great Power Comes Great Responsibility In Imf Working Papers Volume 2014 Issue 083 2014

CMHC Insurance introduction.

Does cmhc insurance cover job loss. Choose between 50 or 100 coverage must be equivalent to the percentage of your disability coverage of your regular mortgage payment up to a maximum monthly amount of 3000. Unlike traditional private mortgage insurance PMI which protects the lender in the event of default unemployment mortgage insurance actually pays your mortgage and helps you stay in your. Mortgage default insurance is required on all mortgages with down payments of less than 20 which are.

Mortgage disability and critical illness insurance may make mortgage payments to your lender if you cant work due to a severe injury or illness. You may want to consider unemployment mortgage insurance. You may be able to pay for half of your mortgage with the rent collected from a basement apartment.

The Canadian Mortgage and Housing Corporation better known as CMHC plays an important role in helping Canadians buy a home. CMHC insurance does not protect you from a foreclosure or prevent you from defaulting on your mortgage. The condominiums master policy covers the structure of the building and common areas.

If you lose your job it helps to have an in-law basement apartment or duplex to bring in some much needed income until you land a new job. Mortgage disability and critical illness insurance is usually a combination of several insurance products including. CMHCs online Mortgage Calculator can also help you with your estimations.

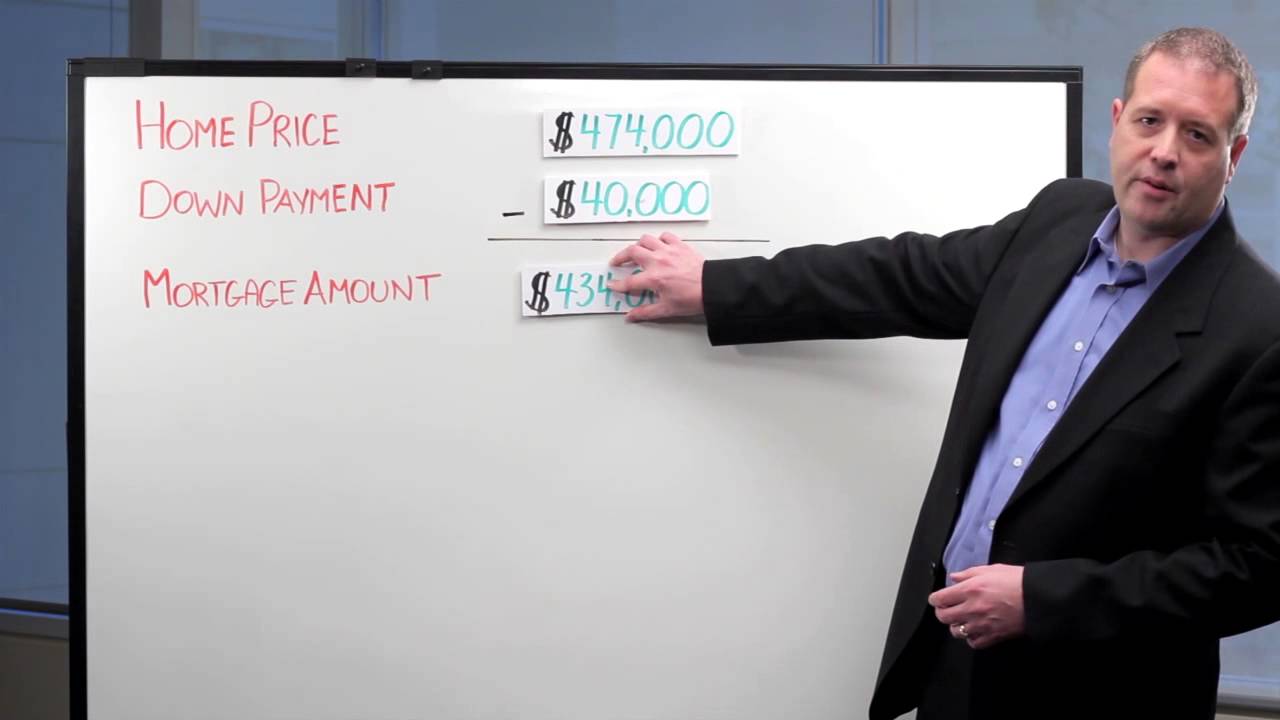

CMHCs loss is Sagens gain as private sector mortgage insurer sees market share grow. Your home insurance will cover loss and damages. 240000 mortgage is 117305 a month 20 down.

Mortgage life insurance also called mortgage protection insurance helps cover your mortgage if you cannot make mortgage payments due to job loss disability critical illness or death. It is also designed to minimize risks to CMHC and therefore the Canadian economy. A no Banks are not double-dipping b the CMHC insurance is actually between the insurer and the Bank.

CMHC fees are to insure the bank against loss should the person default. If you fear that you will have difficulty making your mortgage payments contact your lender immediately. Your CMHC insurance doesnt protect you.

CMHC offers whats generally called mortgage insurance. It also ensures you get a reasonable interest rate even with your smaller down payment. When you deal with one of our mortgage brokers however an insurer decline means its time to reanalyze your situation to see if there may be other creative options.

Mortgage loan insurance helps stabilize the housing market too. Does mortgage insurance cover job loss. By Gail Vaz-Oxlade on April 3 2012.

Lenders will usually offer mortgage holders insurance for job loss due to lay off or illness. It does not as we know it pay your mortgage due to loss of a job. CMHC Genworth and Canada Guaranty.

The lender pays these premiums and passes these costs onto you. What CMHC insurance does is guarantee the bank or credit union that it will not lose money on this high ratio mortgage if the borrower happened to default. The minimum down payment requirement for mortgage loan insurance depends on the purchase price of the home.

It will affect the cost of real estate in Canada. CMHC mortgage loan insurance lets you get a mortgage for up to 95 of the purchase price of a home. This insurance protects the lender and not the buyer.

Due to the current economic situation in Alberta Edmonton-based insurance and mortgage provider First Foundation is offering layoff insurance to cover up to six months of mortgage payments for homeowners who lose their jobs. The Homeowner buys the policy when they first get the mortgage by paying a fee calculated as a. Job loss benefits are paid for up to 6 months per job loss.

Mortgage insurance Mortgage default insurance commonly referred to as CMHC insurance protects the lender in the case the borrower defaults on the mortgage. CMHC provides mortgage loan insurance for home buyers with a down payment between less than 20 and 5. Mortgage default insurance is also commonly referred to as CMHC insurance.

When lenders receive applications from mortgage borrowers who have down payments of less than 20 who are also known as high-ratio borrowers they must secure high-ratio mortgage-default insurance from one of three insurers. If you have a down payment of 20 or more mortgage default insurance isnt necessary. Earlier this week CMHC admitted the higher standards were a mistake and reversed them but some in the financial industry are wondering if the damage has ever been done.

Home insurance is different than condominium insurance. And actually has almost nothing to do with the Homeowner and c Banks when faced with non-payment can either i foreclose extremely rare happens with huge commercial properties and gain the Title themselves then do whatever they want or ii sell the property under power of sale extremely. Purchase or convert your existing home in to an owner occupied rental says Schumacher.

This type of insurance is only mandatory if you make a down payment of less than 20. When you deal with your bank if CMHC declines your loan there are no other options. NO they absolutely do NOT.

Also known as job loss mortgage insurance this sort of policy will cover your mortgage payments if you become involuntarily unemployed. There are three official mortgage insurance providers in Canada with the Canada Mortgage and Housing Corporation CMHC being the largest and most commonly used. Does CMHC protect the homeowner in the event of default.

Condominium insurance covers the contents of your unit and storage locker as well as personal liability. Cost of CMHC insurance is 7140 with 15 down HST of 92820 806820 for the insurance. It is not going to be worth while to pay the CMHC fee.

Benefits will kick in after a 60-day qualifying period. CMHC has been around since 1944 when it was created by Parliament to provide low-cost housing and affordable mortgages to World War II. The first thing to look at is what loan to value you are wanting to get 85 loan to value is much.

When the home buyer has more skin in the game ie 20 downpayment he or she is considered less of a risk. CMHC insurance is helping to stabilize Canadas economic system as well as sustain the financial health of families during the COVID-19 pandemicEffective July 1 2020 CMHC insurance rules are changing. In the 5 years of your term you will pay.

Private sector mortgage insurers say they are gaining market share as CMHC rules tighten. You may be able to qualify for modification or work out some other deal with them depending on how long you have been in the house your rate if you will be able to get unemployment etc. High ratio rate is 295 and the mortgage will be on 255000 7140 for 262140.

This is a premium that would be in addition to the mortgage and would have been voluntary when she signed her mortgage. For a purchase price of 500000 or less the minimum down payment is 5. CMHC is by far the biggest so high-ratio default insurance is often loosely referred to CMHC insurance.

Cmhc S New Mortgage Insurance Guidelines May Not Make Home Buying Easier

Canada Mortgage And Housing Corporation Wikiwand

Oracion Por Una Casa Propia Peticion A Santa Eduviges Por Una Casa

Canada Mortgage And Housing Corporation Cmhc According To Our Report On The Housing Market Canada S 6 Largest Urban Centres Are Likely Going To See Declines Across Home Prices Sales And Housing

Canada Mortgage And Housing Corporation Cmhc Homeowner Mortgage Loan Insurance Premiums Are Changing As Of March 17 For The Average Cmhc Insured Homebuyer This Means An Increase Of Around 5 To Your

Residential Intensification Case Studies Canadian Home Builders

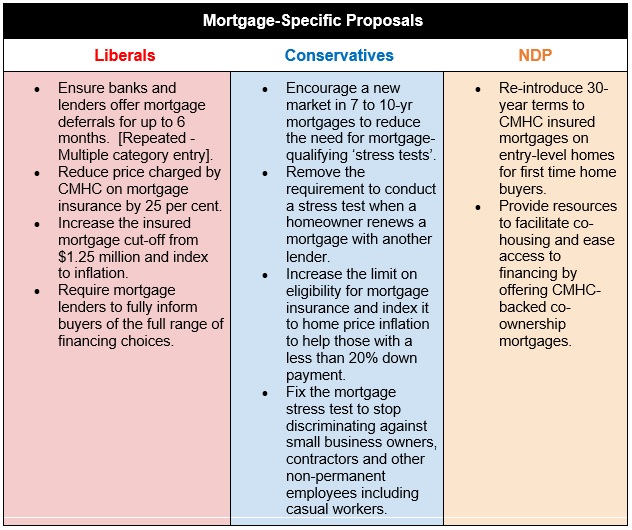

Federal Election Primer Mortgage Specific Proposals Dave The Mortgage Broker

Canada Mortgage And Housing Corporation Wikiwand

Does Declaring Bankruptcy Get You Out Of Paying Cmhc Ratesdotca

Cmhc Eases Mortgage Insurance Rules Admits Tightening Was A Mistake Personalfinancecanada

What If Cmhc Lowered The Mortgage Insurance Ceiling Toronto Realty Blog

Do I Have To Pay Cmhc Fees If I Renew My Mortgage Loans Canada

Cmhc Insurance Mortgage Insurance Cmhc Mortgage Calculator Cmhc Insurance Rates

How To Avoid Cmhc Fees Loans Canada

Pdf International Comparison Of Mortgage Product Offerings

Understanding The Cmhc Mortgage Changes Sterling Homes Edmonton

Cmhc Insurance Mortgage Insurance Cmhc Mortgage Calculator Cmhc Insurance Rates

Sal Bertucci Mortgage And Real Estate Consultant Home Facebook

Posting Komentar untuk "Does Cmhc Insurance Cover Job Loss"