Singapore Deposit Insurance Coverage

Monetary Authority of Singapore 3 1 Preface 11 The deposit insurance scheme DI Scheme in Singapore was established in 2006 with the primary objective of protecting small depositors. The Singapore Deposit Insurance Corporation SDIC administers the scheme in Singapore.

Campana Curifor Compra De Autos Usados Compra De Autos Usados Comprar Autos Autos Usados

The Singapore Deposit Insurance Corporation SDIC administers the.

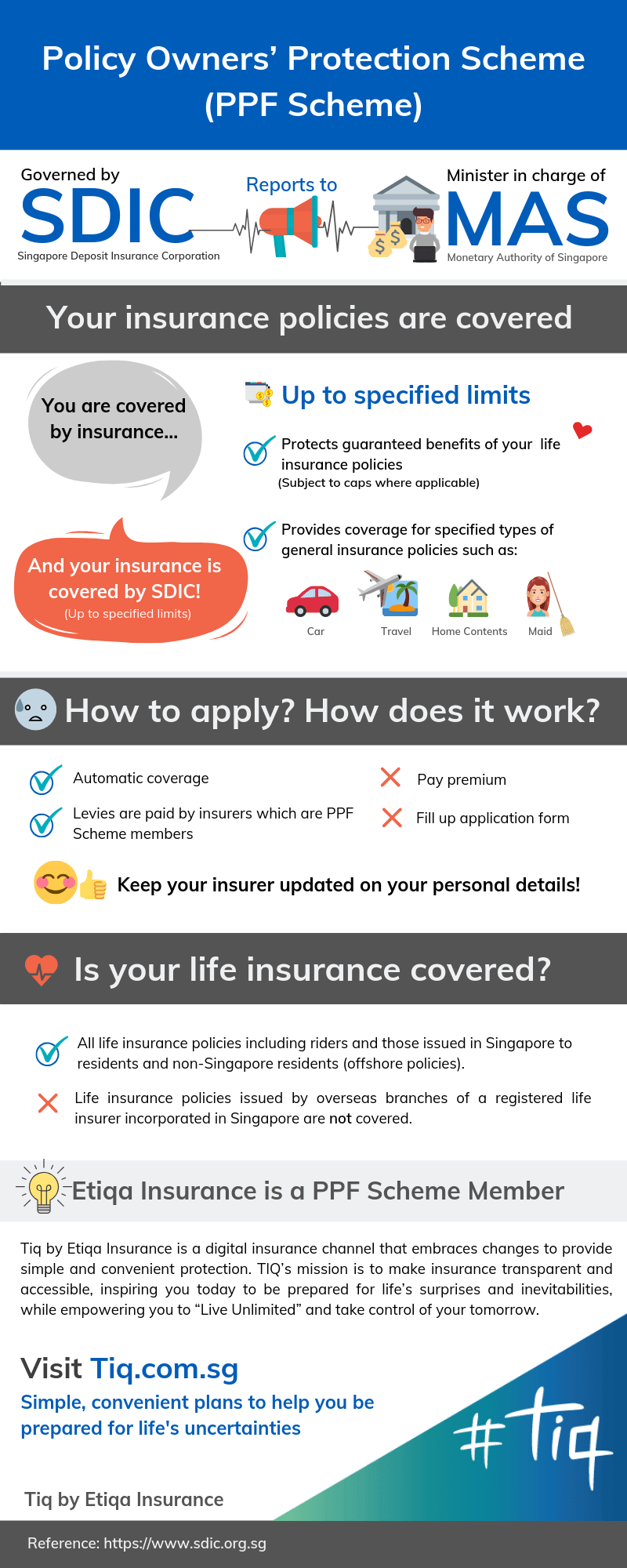

Singapore deposit insurance coverage. SDIC insures Singapore dollar denominated deposits placed with a full. Coverage for your policy is automatic and no further action is required from you. These policies are protected under the Policy Owners Protection Scheme which is administered by the Singapore Deposit Insurance Corporation SDIC.

This policy is protected under the Policy Owners Protection Scheme which is administered by the Singapore Deposit Insurance Corporation SDIC. Anyone can save with as little as S1000 to start up to a maximum of S18000 per person. SDIC administers the Deposit Insurance Scheme and Policy Owners Protection Scheme in Singapore.

Coverage for personal deposits only. Whats more your policy will be automatically protected under Singapore Deposit Insurance Corporations Policy Owners Protection Scheme. Ad Health Cover Wherever You Are.

The protection limit of 75000 would fully insure 91 of individual and non-bank depositors covered under the DI Scheme. This is a high level of coverage and. It is automatic if the savings falls under the type of savings covered and are with banks and finance companies that are Scheme members.

Important change to deposit insurance coverage limit Please be informed that the deposit insurance coverage limit for eligible accounts insured by the Singapore Deposit Insurance Corporation will be increased from S50000 to S75000 with effect from 1 April 2019. The objective of the Deposit Insurance Scheme is to provide adequate protection to small depositors. Starting from April 1 deposit insurance coverage will go up from S50000 to S75000 the Singapore Deposit Insurance Corporation SDIC announced on.

For more information on the types of benefits that are covered under the scheme as well as the limits of the coverage where applicable please contact Manulife or visit the Life. Monies and deposits denominated in Singapore dollars under the CPF. Singapore will provide protection of policyholders in the case of bankruptcy of an insurer while more than doubling the coverage of bank and finance company deposits.

The latest changes to the deposit insurance DI and policy owners protection PPF schemes protect deposits up to S75000 per depositor and extend protection to personal assets used for commercial purposes it said. Deposits in Singapore is covered by the Singapore Deposit Insurance Corporation SDIC up to a maximum of 75000 per bank or finance company for each individual depositor. Depositors and insurance policy owners will enjoy such enhanced protection from April 1 2019 said the Singapore Deposit Insurance Corporation SDIC on Thursday.

Achieve your goals sooner. Currently the Deposit Insurance Scheme protects non-bank depositors individuals charities sole proprietorships partnerships companies and unincorporated entities by covering their SGD monies placed with a Scheme member for up to 75000 per depositor per Scheme member. Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation for up to S75000 in aggregate per depositor per Scheme member by law.

This policy is protected under the Policy Owners Protection Scheme which is administered by the Singapore Deposit Insurance Corporation SDIC. The deposit insurance scheme will provide compensation to individuals and charities for the first S20000 of their Singapore dollar deposits net of liabilities in the event that their bank or. Coverage for Singapore dollar deposits only.

What types of deposits are covered under the Deposit Insurance Scheme. Coverage for your policy is automatic and no further action is required from you. Coverage for cancellations or interruptions to your cruise holiday due to covered conditions.

Generally all Singapore dollars deposits in savings fixed deposit and current accounts are covered. South Korea covers bank deposits by Korea Deposit Insurance Corporation KDIC to maximum of 50 million wons per bank per each individual. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage where applicable please contact us or visit the Life Insurance.

Only applicable for selected plans. Are foreign currency deposits covered under the Deposit Insurance Scheme. Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation for up to S75000 in aggregate per depositor per Scheme member by law.

Ad Health Cover Wherever You Are. What types of deposits are covered under the Deposit Insurance Scheme. Only Singapore dollars deposits are covered under the Deposit Insurance Scheme.

Coverage for both resident and non-resident depositors. Consumers need not apply for deposit insurance coverage. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S75000 for each depositor per Scheme member.

Deposit Insurance Coverage Coverage limit of 20000 per depositor per institution.

Must Know About Ppf Scheme For That Life Insurance You Plan To Buy

Illustrated Map Infographic Illustration

Coinex Maintenance Deposit Maintenance Resume

Odc Is A Singapore Based Management Corporate Training Company Providing Management Training Courses And Wsq Traini Courses Training In Singapore Maste

Understanding Deposit Insurance

Want To Improve Your Finances Here Are 6 Things You Should Do Now Personal Finance Finance Improve Yourself

Rapidest Funding Foundation For Short Term Emergency Requirements Installment Loans Loan Payday Loans

Njoi Participates In Numerous Insurance Plans Including But Not Limited To United Healthcare Hor Health Insurance Buy Health Insurance Health Insurance Plans

Car Insurance Quotes Online Young Drivers Https Goo Gl 9jyxyp Car Insurance Auto Insurance Quotes Car Insurance Rates

Life Insurance Leads Buy Life Insurance Leads Buy Life Insurance Leads Uk Health Insurance Cost Universal Life Insurance Health Insurance Coverage

3 Year Endowment Plan Singapore In 2021 Medical Health Insurance Savings Plan Health Insurance Plans

Buy Or Renew Car Insurance Policies Online Buy Car Insurance Policy In Easy Steps Get 24x7 Spot Assistance Insurance Marketing Car Insurance Insurance Policy

Singapore Deposit Insurance Corporation Sdic A Complete Guide

Explainer How The Enhanced Deposit Insurance Scheme Protects Your Money Today

Deposit Insurance Coverage Limits Download Scientific Diagram

Singapore Deposit Insurance Corporation Sdic

Singapore Deposit Insurance Corporation Sdic

Posting Komentar untuk "Singapore Deposit Insurance Coverage"