Does Life Insurance Cover Permanent Disability

Insurance companies classify disability as temporary or permanent and pay out benefits accordingly. Otherwise you can buy it yourself often through life insurance companies.

You can choose between two types of personal disability insurance.

Does life insurance cover permanent disability. If purchasing a separate disability insurance policy is not feasible you can add disability riders to your life insurance policy for more robust coverage. Any individual is required to read the details of the life insurance term policy and the term insurance riders including the fine print before zeroing in a term insurance policy with disability benefits. But while the principle is simple the definitions of exactly what constitutes a total and permanent disability can vary between insurers.

Criteria governing total and permanent disability insurance. During a period of disability it may become difficult to keep a life insurance policy in force. Apart from natural death a term life policy also has your back in cases where you are incapacitated and develop a physical disability due to an accident.

Does Life Insurance cover it. Compassionate disability You will need to show that youre working fewer hours and have thus lost a certain percentage of your income. What is Total and Permanent Disability TPD Insurance.

If you apply for life insurance and disability insurance at the same time you can use the lab results from your medical exam for both insurance applications. Total or absolute permanent disability. Find out how much life insurance cover costs at Compare Insurance Quotes Online.

Total and Permanent Disability or TPD insurance provides a cash lump sum if you suffer a permanent disability arising from illness or injury and this prevents you from ever working again. If you were to become totally disabled unable to work and couldnt afford to pay your life insurance premiums the waiver of premium rider could allow you to stop making your premium payments while continuing to keep your policy in force until you are able to return to work fulltime. Student loans may be discharged under certain conditions if an individual faces total permanent.

Life insurance and disability insurance cover very different things. Occupation-based Disablement also called Lump Sum Disablement which pays out the full amount if you are permanently disabled and cannot work. We can find it in pretty much every major class of policy there is out there Term Plans Whole Life Plans Endowment Plans.

Life insurance wont pay out for disability and vice versa. Since we are trying to get to know if a term insurance covers disability let us explore the accidental permanent total or partial disability rider. It does this by giving your loved ones a guaranteed 1 and fixed death benefit payout also called the sum assured.

The most basic versions cover temporary and permanent total disability due to accident. Total Permanent Disability is a phrase used in the insurance industry and in law. The definition of disability and exceptions to the rider remains the same as mentioned above in the case of permanent disability rider.

However term insurance doesnt just cover death. Does life insurance cover a disability. Life insurance plans may not cover critical illnesses and disability depending upon the policy of the company however add on riders that cover permanent and total disability are present in almost all of the insurance plans.

You can also choose to supplement a policy through your workplace with your own coverage. Its related to short term disability insurance. An individual or group of individuals can insure themselves against it through a disability insurance policy as part of a life insurance package or through workers compensation insurance.

Its a type of life insurance that pays a lump sum when the policy holder becomes totally and permanently disabled due to an illness or injury and is unable to work ever again. In case you are disabled fully and permanently you will receive the full sum insured. May 4 2021 admin Life insurance 0 The potential for struggling a complete or absolute everlasting incapacity It is among the causes that ought to most encourage individuals to think about hiring an insurance coverage that covers these conditions.

By opting for the above rider you can effectively expand the coverage of your term insurance policy to provide you with a monetary benefit in the event of total or partial disability due to an accident. Often it is embedded within the plan without the option to decouple or remove it such is its fundamental nature. 1Life Disability Insurance pays out in the event of disablement.

Total and permanent disability insurance is also often called long term disability insurance. Life insurance pays your beneficiaries if you die. Generally speaking it means that because of a sickness or injury a person is unable to work in their own or any occupation for which they are suited by training education or experience.

Coverage from life insurance is far higher than that offered by disability insurance survivor benefits and pays out even if you dont have a disability. What is total and permanent disability insurance. Total and permanent disability insurance covers the costs of living of individuals who are disabled for life due to injuries sustained in an accident or debilitating illness rendering them unable to fend for themselves.

In a nutshell no. If the disability is partial the policy will pay a percentage of the sum insured depending on the degree of disability. The life assured offers covera.

Most life insurance policies dont build in clauses for disability meaning your provider wont pay you if you face a sudden impairment to your mental or physical health. The Total and Permanent Disability Cover clause is a mainstay of many Life Insurance plans.

Over 57 Insurance Quotes Insurance Quotes 91744 Life Insurance Quotes Insurance Quotes Insurance

10 Facts About Life Insurance Life Insurance Marketing Life Insurance Facts Life Insurance Marketing Ideas

Individual Life Insurance Vs Group Term Life Insurance Fbs Life Insurance Facts Term Life Term Life Insurance

Life Insurance Life Insurance Quotes Life And Health Insurance Whole Life Insurance

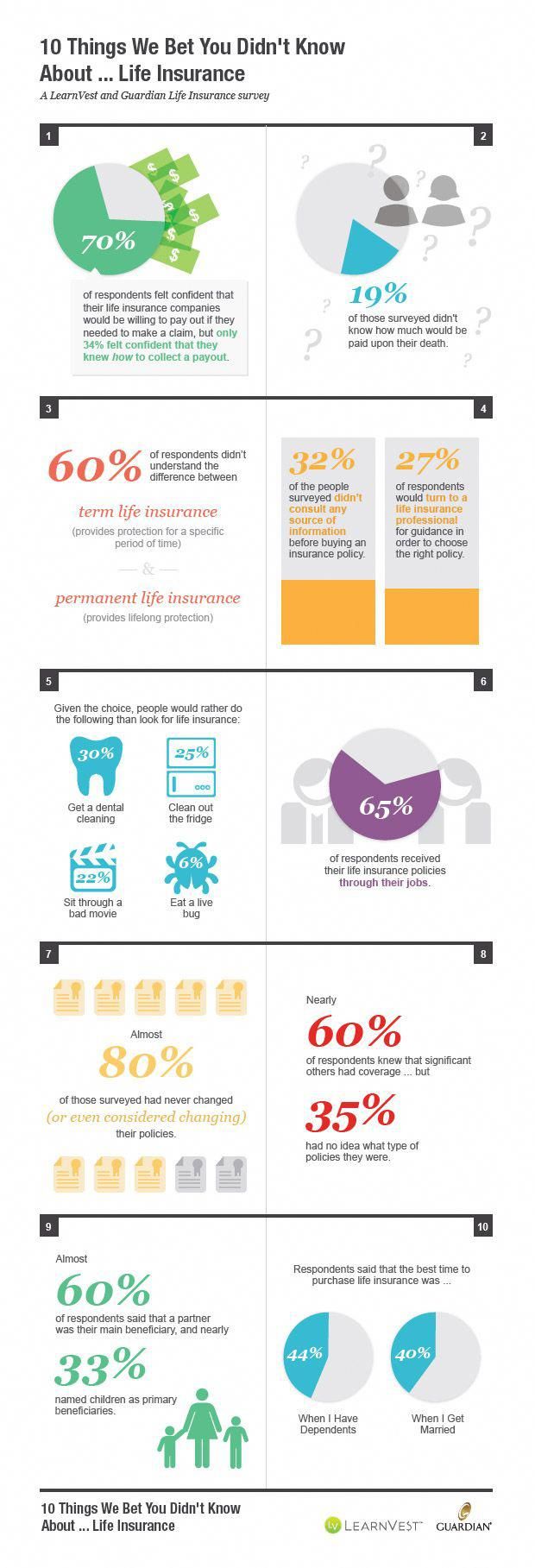

10 Things We Bet You Didn T Know About Life Insurance Life Insurance Policy Life Insurance Life Insurance Facts

Life Insurance Cheat Sheet Life Insurance Facts Life Insurance Sales Life Insurance Agent

Here Is Comparison Between Term Life Insurance And Permanent Life Insurance Life Insurance Marketing Permanent Life Insurance Life Insurance

Pin By Ninya Alyssa Josol On Finance Insurance Budgeting Life Insurance Life Insurance

Reasons To Get Life Insurance For Your Baby Life Insurance For Children Life Insurance Benefits Of Life Insurance

You Need Life Insurance If You Are Ibanding Making Better Decisions Life Insurance Facts Life Insurance Marketing Life Insurance Quotes

Types Of Life Insurance Policies Local Life Agents Life Insurance Types Life Insurance Life Insurance Policy

Pin On Outline Financial Infographic

Your Options Life Happens Life Insurance Quotes Life Insurance Insurance

Wondering If You Need Life Insurance And If So Which Type And How Much Use This Helpful Life Insurance Facts Life Insurance Marketing Life Insurance Quotes

Insurancequotes Life Insurance Facts Compare Life Insurance Term Life Insurance Quotes

Types Of Life Insurance Bankrate Life Insurance Insurance Marketing Life

Individual Life Insurance Vs Group Term Life Insurance Fbs Life Insurance Facts Term Life Term Life Insurance

Posting Komentar untuk "Does Life Insurance Cover Permanent Disability"