Travel Insurance Covid Coverage Canada

Air Canada announced in September that it would partner with Manulife to provide COVID-19 insurance including medical and quarantine expenses on all new international round-trip bookings departing Canada made between September 17 and October 31 2020 for travel until April 12 2021 on a trip of up to 21 days in duration. A typical travel insurance plan with COVID-19 coverage provides between 50 and 300 per day for meals and accommodations.

No Charge Covid 19 Travel Insurance Up To 200 000 For Flights And Westjet Vacations Sitio Oficial De Westjet

This insurance includes COVID-19 emergency medical and related quarantine expenses if you test positive for and are diagnosed with COVID-19 while on your trip.

Travel insurance covid coverage canada. At least three insurance providers Medipac TourMed and Blue Cross in Ontario and Quebec now offer COVID-19 medical coverage as part of their regular travel insurance. Since October 1 2020 you are covered for emergency healthcare including care related to COVID-19 even if you visit a destination for which the Government of Canada issued a Level 3 Avoid non-essential travel. Good travel insurance and travel medical insurance plans should provide coverage for medical expenses incurred while traveling abroad.

Yes you can purchase travel insurance for future travel. It also offers trip interruption coverage if the Canadian Governments travel advisory changes to Avoid all travel level 4 while on your trip. It also includes a Trip Interruption benefit if the Government of Canadas travel advisory changes to a Level 4 avoid all travel during your trip and you choose to come home early.

COVID-19 will be covered for travel departing on or after January 1 2021 while there is a Level 3 Avoid Non-Essential travel advisory or lower issued by the Government of Canada. Canadians who have purchased private health insurance coverage directly through Best Doctors Global Medical Care will be covered for COVID-19 related expenses both at onset and for any ongoing complications whether. Charges covered are immediate medical treatment on being diagnosed by a physician upon entering a new country transportation to the nearest medical facility and in some cases partial or full responsibility for return to your home country.

Desjardins will cover its members and clients who have travel insurance and decide to travel despite an advisory issued by the Government of Canada to avoid all non-essential travel. We offer COVID-19 medical and assistance coverage so that you can travel safely. This Manulife COVID-19 Insurance covers eligible Canadian residents who are Aeroplan Members when travelling internationally on a booking made with Air Canada for travel completed by October 31 2021.

As the situation related to COVID-19 continues to affect global travel we appreciate that you may have questions about your travel insurance coverage and how your current or future travel plans may be affected. Today Allianz Global Assistance a leading Canadian travel insurance and assistance provider announced the launch of its COVID-19 Insurance and Assistance Plan which provides up to 1000000 in coverage for emergency medical treatment related to COVID-19 along with additional value-added benefits. If you have to travel abroad verify the terms conditions limitations exclusions and requirements of your insurance policy before you leave Canada.

Whether youre travelling for business or pleasure unexpected trip and health problems can occur. For details on Visitors to Canada Travel Emergency Medical Insurance COVID-19 medical coverage see the BCAA Visitors to Canada Travel Emergency Medical Coverage FAQ section below. Help protect your trip and keep disruptions to a minimum with CoverMe travel insurance for travelling Canadians simple affordable coverage for emergency medical expenses baggage loss trip cancellations and more.

Not all travel insurance plans cover Covid problems so if youre planning overseas travel youll want to look for a plan that covers Covid-related trip cancellation and medical expenses. Free quote available online. 5 million travel insurance coverage with or without deductible.

CAA Travel Insurance Emergency Medical Plans include coverage for COVID-19 related illnesses which includes up to 25 million CAD in coverage for any COVID-19 related illnesses that may occur while travelling during a Level 3 avoid non-essential travel advisory as issued by the Government of Canada. The Unvaccinated plan includes COVID-19 emergency medical and related quarantine expenses during Canadas level 3 travel advisory with coverage up to. AMA Travel emergency medical plans now include up to 25 million CAD if partially vaccinated or up to 5 million CAD if fully vaccinated for COVID-19 related illnesses that may occur when travelling at a time when the Canadian government has issued a related Level 3 travel advisory ie.

With this COVID-19 coverage TuGo covers you up to 200000 CAD for emergency medical and quarantine related expenses if you have tested positive and been diagnosed for COVID-19 while on your trip. The COVID-19 Pandemic Travel Insurance plan covers COVID-19 related emergency medical expenses non COVID-19 related emergency medical benefits and trip interruption coverage in the event you need to self-isolate or quarantine during your trip. Travel advisories issued by the Government of Canada are a critical element in determining your travel insurance coverage related to trip.

Your travel insurance benefits can cover your meals and accommodations during quarantine in this case. COVID-19 and travel insurance. Travel assistance available 247 for.

Our Group Benefits medical emergency coverage has changed effective January 1 2021. Avoid non-essential travel outside Canada. All Travel Emergency Medical Insurance policies for Canadian residents provide up to 10000000 in coverage for COVID-19 related emergency medical expenses including when travel is within Canada.

Note that COVID-19 coverage continues to be available for in-Canada travel. Travel Insurance Coverage for COVID-19 Expenses. Simple affordable travel insurance for Canadians and Visitors to Canada.

Given the Official Global Travel Advisory issued by the Government of Canada on March 13 2020 Canadians have been instructed to avoid all non-essential travel outside of Canada until further notice. Canadas 1 travel insurance brand and recognized worldwide. Book a trip to a destination after the.

Students and expatriates can also obtain Coronavirus coverage for travel outside of Canada. For the COVID-19 Pandemic Travel Insurance Plan expenses related to COVID-19 will not be covered if the Government of Canada issues an Avoid All Travel Advisory advising or recommending that Canadians not travel to a specific country region or city on their date of departure. Over 75 years of expertise in insurance.

This means that you are not eligible for Trip CancellationTrip Interruption coverage due to COVID-19 if you. Manulife coverage will be automatically included if eligible when. Flexible and affordable travel insurance solutions.

Travel Insurance under RBC Insurance Group Benefits Plans.

Annual Multi Trip Travel Insurance Plans Ama Travel

What Canadian Travellers Need To Know Before Beginning Their Next Trip

Insurance Coverage And Covid 19

What Canadian Travellers Need To Know Before Beginning Their Next Trip

Planning A Trip This Year You May Need Travel Insurance Td Newsroom

Covid 19 Travel Insurance Updates Manulife Bank

Is Cfar Travel Insurance Worth It If You Re Planning A Trip During This Outbreak Of Coronavirus

Top 10 Canada Travel Insurance Changes Initiatives To Address The Coronavirus Insurance Business Canada

Student Travel Insurance Travel Insurance For Students With Covid 19 Coverage Reliance General Insurance

Required Travel Insurance For Costa Rica

Most Travel Insurance Plans Won T Help With Coronavirus

Travel Insurance With Covid 19 Cover Multitrip Com

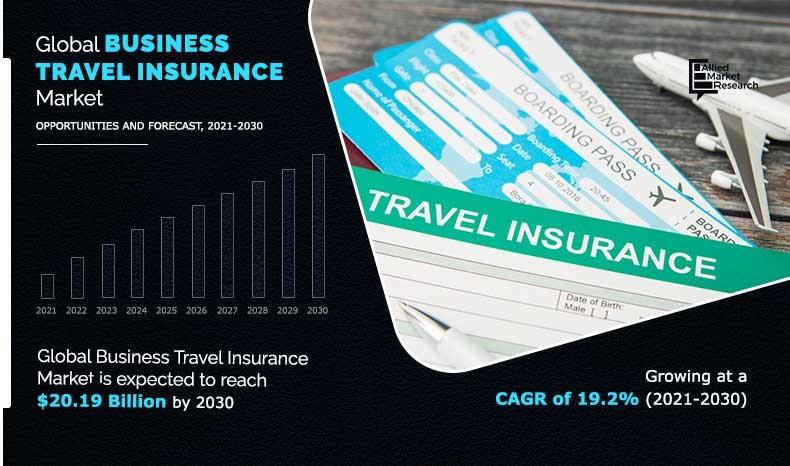

Business Travel Insurance Market Size Share And Analysis 2030

No Charge Covid 19 Travel Insurance Up To 200 000 For Flights And Westjet Vacations Sitio Oficial De Westjet

Travel Medical Insurance The Complete Guide Tir

Before You Start Visitors To Canada Travel Emergency Medical Insurance Insurance Bcaa

/TravelexInsurance-be1e75dcfb4a45ae81cc04988c3d931a.png)

Posting Komentar untuk "Travel Insurance Covid Coverage Canada"