Reserve Coverage Ratio Insurance

This isnt as complex as it might sound. Companies measure their rainy day fund by using the loan loss coverage ratio.

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

The reserve ratio set by the central bank is the percentage of a commercial banks deposits that it must keep in cash as a reserve in case of mass customer withdrawals.

Reserve coverage ratio insurance. Its considered good practice for an investor to compare the insurer to other insurers with similar portfolios to see if the Quick Liquidity Ratio is appropriate for the risks insured. The Federal Reserve the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency collectively the agencies are jointly issuing the attached Frequently Asked Questions FAQs regarding implementation of the LCR and modified LCR rules. Insurers with mixed product portfolios are less easy to evaluate.

The Committee has developed the LCR to promote the short-term resilience of the liquidity risk profile of banks by ensuring that they have sufficient HQLA to survive a significant stress scenario lasting 30 calendar days. Administrative Services Only ASO Definition. To use this equation follow these steps.

Expected future development on. A company reports an operating income of 500000. The Liquidity Coverage Ratio.

The liquidity coverage ratio is the requirement whereby banks must hold an amount of high-quality liquid assets thats enough to fund cash outflows for. Modified LCR banks stepped up their accumulation of liquid assets as well and achieved 12 percent HQLA-to-asset ratio. Walter In 2014 US.

An actuarial reserve is used to account for the amount of money that an insurance company will be liable to pay in the event of a claim based on an estimate of the present value of all future income that is derived from a contingent event. Your rainy day fund is the money you set aside in case you lose your job and stop making money. This quantitative framework is applied to calculating the cost of a regional insurance arrangement eg.

The standard LCR banks nearly doubled their liquid assets between January 2010 and January 2015 to 20 percent which is more than 5 times the corresponding ratio in 2006. On September 3 2014 the Office of the Comptroller of the Currency OCC the Board of Governors of the Federal Reserve System and the Federal Deposit Insurance Corporation issued a final rule that implements a quantitative liquidity requirement consistent with the liquidity coverage ratio LCR standard established by the Basel Committee on Banking Supervision BCBS. Bests Capital Adequacy Relativity BCAR is a rating of an insurance companys balance sheet strength.

An ICR below 15 may signal default risk and the refusal of lenders to lend more money to the company. Especially as it remains the primary reason countries accumulate reserves for insurance purposes the metric is based on balance of payments drains experienced during EMP episodes ie a measure of sufficient reserves during periods of pressure and ahead of a full-blown crisis. Whereas a liability insurance company might only need to have a Quick Liquidity Ratio of 20 or more.

The Office of the Comptroller of the Currency OCC the Board of Governors of the Federal Reserve System Board and the Federal Deposit Insurance Corporation FDIC collectively the agencies adopted a final Liquidity Coverage Ratio rule 1 LCR rule in September 2014 that implements a quantitative liquidity requirement consistent with the standard established by the Basel Committee. To facilitate use of these Federal Reserve facilities and to ensure that the effects of their use are consistent and predictable under the Liquidity Coverage Ratio LCR rule the Office of the Comptroller of the Currency the Board and the Federal Deposit Insurance Corporation together the agencies are adopting this interim. EB16-01 - Federal Reserve Bank of Richmond Understanding the New Liquidity Coverage Ratio Requirements By Mark House Tim Sablik and John R.

The LCR should be a key component of the supervisory approach to liquidity risk. This regulation based on. Interest coverage ratio Operating income Interest expense.

It examines an insurers leverage underwriting activities and financial performance. The insurance value of reserves is quantifled as the market price of an equivalent option that provides the same insurance coverage as the reserves. Errors and omissions insurance is a type of professional liability insurance that protects against claims of inadequate work or negligent ac.

An Asian Monetary Fund and to analyzing one leg of optimal reserve-holding decision. The Federal Deposit Insurance Corps first-quarter report on bank earnings said the ratio of loan-loss reserves to noncurrent loans rose for the sixth straight quarter but some doubt the reserve coverage ratio is rebounding fast enough. Its probably a good idea to define what an actuarial reserve actually is.

Proved Reserves Coverage Ratio means the ratio of the i PV10 of the Proved Reserves of the Issuers and Guarantors Oil and Gas Properties as of the latest Reserve Report to ii the Consolidated Senior Secured Debt as of the date such ratio is calculated. Incurred But Not Reported IBNR The loss reserve value established in recognition of the total liability for future payments on losses which have occurred but have not yet been reported to the insurance company. A companys loan loss coverage ratio is calculated by.

Financial regulators introduced new liquidity coverage ratio requirements for qualified banking institutions. 1 In the attached FAQs the agencies provide interpretations based on the facts and circumstances described in each question. The ratio applied to loss costs at a given per occurrence limit.

As a general benchmark an interest coverage ratio of 15 is considered the minimum acceptable ratio.

How To Reduce Insurance Claims Leakage And The Loss Ratio Via Standardization Business Intelligence And Robotic Process Automation Rpa The Lab Consulting

The 2021 Insurance Value Creators Report Reinvention Paves The Way To A Bright Future Bcg

Pandemic Impact On The Insurance Industry Deloitte Insights

Combined Ratio In Insurance Definition Formula Calculation

What Is Persistency Ratio Importance Of Persistency In Insurance Sectoraegon Life Blog Read All About Insurance Investing

The 2021 Insurance Value Creators Report Reinvention Paves The Way To A Bright Future Bcg

Combined Ratio Benefits And Limitations Of Combined Ratio

What Is Persistency Ratio Importance Of Persistency In Insurance Sectoraegon Life Blog Read All About Insurance Investing

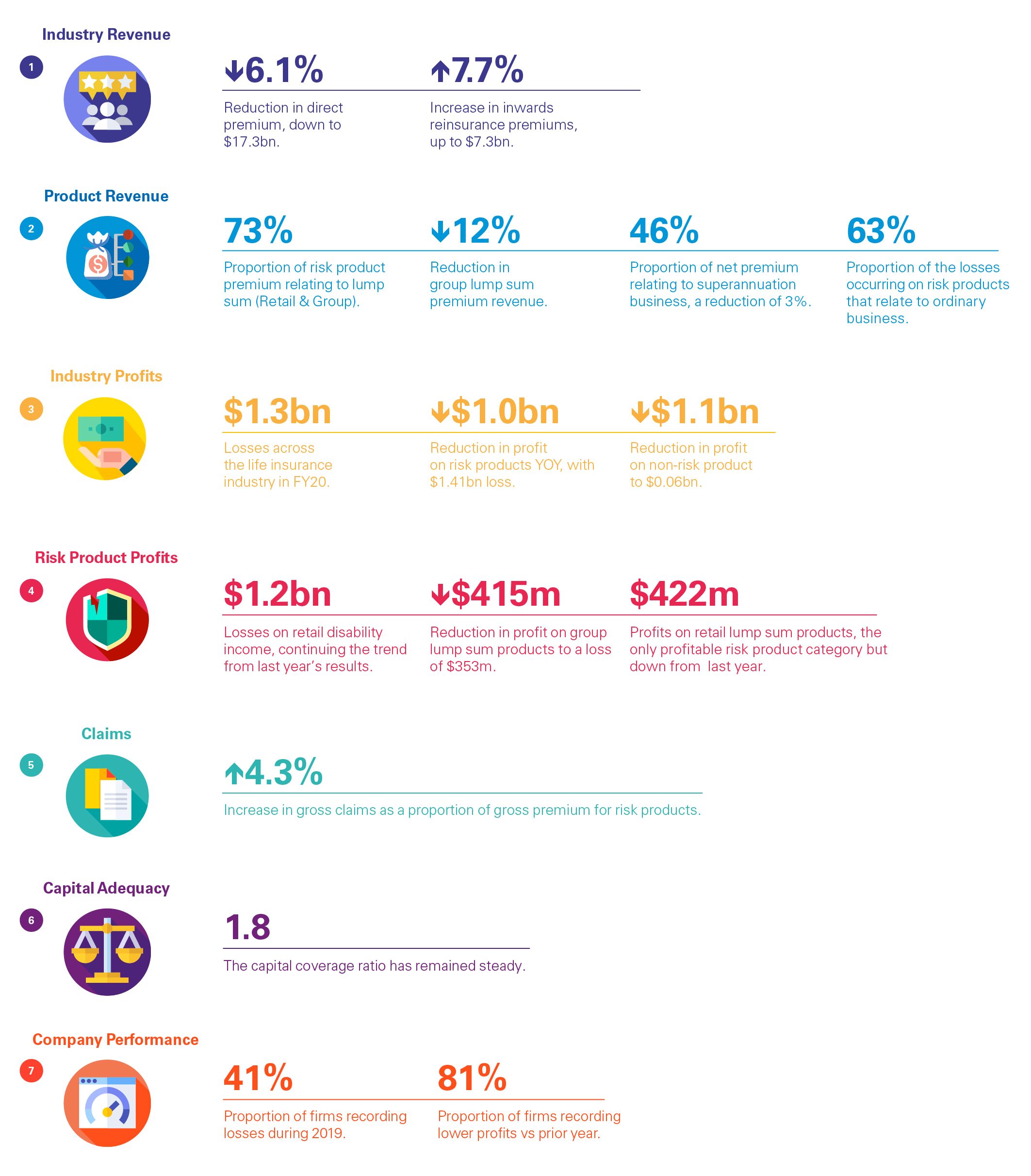

Life Insurance Insights 2020 Kpmg Australia

Corporate Insurance Policies Protect Companies From Loss

Loss Ratio Formula Calculator Example With Excel Template

North America Industrial Insulation Market Worth 2 55 Billion By 2025 Grand View Research Inc Energy Conservation Environmental Degradation Insulation

Data Note 2020 Medical Loss Ratio Rebates Kff

Corporate Insurance Policies Protect Companies From Loss

Combined Ratio In Insurance Definition Formula Calculation

How To Reduce Insurance Claims Leakage And The Loss Ratio Via Standardization Business Intelligence And Robotic Process Automation Rpa The Lab Consulting

Posting Komentar untuk "Reserve Coverage Ratio Insurance"