Existing Health Insurance Cover Covid 19

Under the Covid insurance plan comorbidities and pre-existing comorbidities are covered. Does my existing health insurance cover Coronavirus-related ailments.

Private Health Coverage Of Covid 19 Key Facts And Issues Kff

One smart way to do that is with travel insurance.

Existing health insurance cover covid 19. The Thaiger have compiled and compared the best options so you can save your time and get instant coverage. Existing health insurance policies will cover hospitalisation costs if the person has been hospitalised for more than 24 hours after being diagnosed with COVID-19. See our ratings of the best pandemic travel.

A standard health insurance plan the Arogya Sanjeevani policy covers you for COVID-19 hospitalization expenses day care procedures AYUSH treatment day care treatments road ambulance expenses cataract treatment and many listed modern treatment methods. Insurance for medical care. Cancellation if you or anyone covered by the policy gets coronavirus before you travel.

We at HDFC ERGO cover hospitalization expenses for Coronavirus under all our health insurance plans subject to all terms and conditions of the policy. The insurance company has introduced the cover under Digit Health Care Plus Policy specifically to cover coronavirus or COVID-19. Under the COVID-19 insurance plan AYUSH treatment recommended by a medical practitioner is covered.

The benefit of Covid-19 health insurance is that it covers all the costs associated with Covid-19 treatments. The cover is offered as a part of a Sandbox product - Need Based Insurance IRDAI Regulatory Sandbox Regulations 2019 which motivates insurance companies to launch innovative products so as to help the customers in the time of. Specifically for Accidental Hospitalizations and Critical Illnesses at zero cost.

Medical costs if you or anyone covered. Are comorbid diseases covered in the coronavirus health insurance policy. Health Insurance and Its Role During COVID-19 Outbreak.

Were working hard to support you. If you are hospitalized for a minimum of 24 hours for treatment of Covid-19 medical expenses will be covered in standard health insurance policies. Health insurance plans to cover COVID-19 testing administration of the test and related items and services as defined by the acts.

We are ready to be there for you when you need us the most. All this comes as Covid-19 uncertainty continues to make travel insurance an. Apart from these the existing health insurance plans also now provide coverage for hospitalisation arising due to COVID-19.

The IRDAI had earlier advised all insurance firms to accept any claims with respect to covid-19 expenses. This coverage must be provided without consumer cost sharing. This is because insurance companies will consider COVID-19 as a pre-existing condition.

Additional Sum Insured Available. What COVID-19 risks can travel insurance cover. Travel insurance providers should still include cover for COVID-19 even if you have pre-existing medical conditions as long as you declare the condition when you take out the policy.

People who already have a health insurance policy will be able to file claims arising out of the treatment of Coronavirus disease. Typically policies with cover for COVID-19 disruption will offer cover for. If you get COVID-19 and need help you can be covered as long as youve declared your pre-existing medical conditions.

We cover pre-hospitalization expenses to post-hospitalization expenses seamlessly. This means that your existing health insurance plan will offer cover for coronavirus-related medical expenses. Is coronavirus covered under your existing health insurance policy.

If you already have a travel insurance contract your insurance company may have added an endorsement to it to clarify the conditions specific to COVID-19. This plan called Corona Kavach for individual and family specific needs has been offered to health insurance firms. Health insurance policies cover all kinds of respiratory diseases which means they cover coronavirus provided the affected person does not have COVID-19 at the time of the purchasing the policy.

We analysed insurers levels of covid protection twice in October last year and AprilMay 2021. These are unsettling times for everyone and the health of our customers and staff remains priority. Covid-19 Insurance is essential if you live in Thailand.

There are no federal requirements that specifically require coverage of COVID 19 treatment. Our enhanced COVID-19 cancellation cover above applies to all new policies bought from 29 April 2021 as long. Existing health insurance policies will cover treatment expenses for Coronavirus COVID-19 disease.

From the process of buying a health insurance to making claims is paperless and can be done online in just a few minutes. Coverage will be available in all products that offer hospitalisation cover. COVID-19 insurance is a customised health insurance policy that offers coverage for expenses related to treatment required due to a positive diagnosis of COVID-19.

Even fully vaccinated travelers may want to guard against Covid-related problems when they travel. Of the 40 insurance brands that participated in both surveys and are currently selling policies 16 40 improved their Covid-19 cover while the remaining 24 60 kept their cover the same. Therefore we ensure that our Covid-19 Insurance plan covers everything you need.

This means youll have cover for cancellation or curtailment as well as emergency medical expenses if youre diagnosed with COVID-19 both at home and on your holiday. Despite the COVID-19 being a pandemic coronavirus is covered for in our health insurance. We want to reassure you that whilst we are all doing things slightly differently right now were doing everything we can to keep you updated on how coronavirus COVID-19 affects your insurance.

As Covid-19 is a novel health issue existing health insurances may not cover it other than hospitalization in some cases. Can You Get Health Insurance if You Have Been Diagnosed With COVID-19. More and more insurance companies are covering COVID-19 whether through individual insurance products or their regular products.

Yes most likely you can still get health insurance if you have been diagnosed with COVID-19 but the insurance company might exclude Coronavirus from your coverage.

Health Insurance Compare Medical Insurance Plans In India Oct 2021

Health Insurance Compare Medical Insurance Plans In India Oct 2021

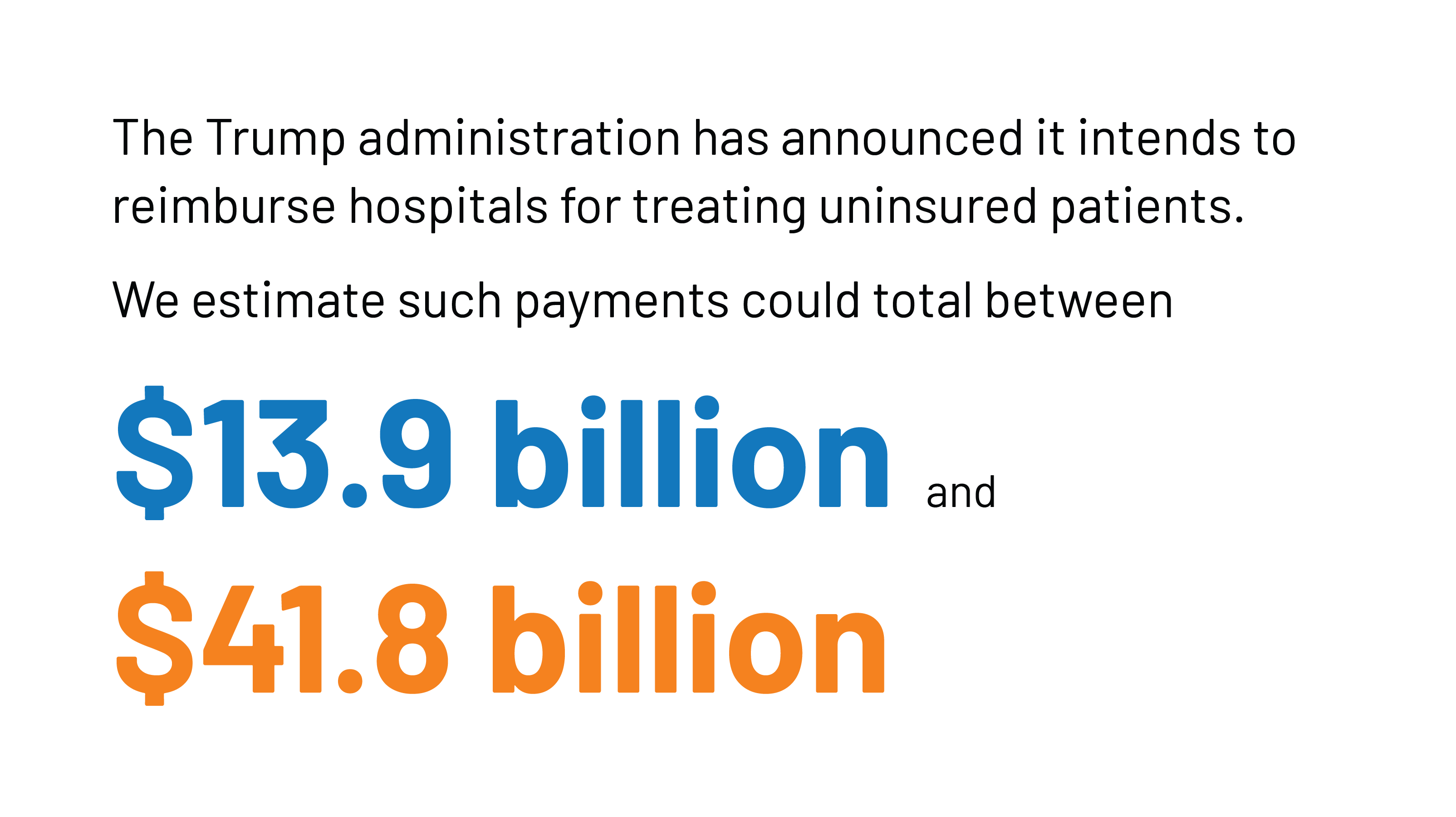

Private Health Coverage Of Covid 19 Key Facts And Issues Kff

Health Insurance Plans Best Medical Insurance Policy In India Max Bupa

Philhealth Information On Covid 19 Philhealth

Health Insurance Compare Medical Insurance Plans In India Oct 2021

Eligibility For Aca Health Coverage Following Job Loss Kff

Amid Covid 19 Pandemic India S Insurance Sector Has Seen Contrarian Growth Business Standard News

Mediclaim Policy Compare Buy Best Mediclaim Policy In India 7 Day

Student Essay The Disproportional Impact Of Covid 19 On African Americans Health And Human Rights Journal

Health Insurance Compare Medical Insurance Plans In India Oct 2021

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Women S Health Insurance Coverage Kff

Covid Insurance For Foreigners In Thailand

Women S Health Insurance Coverage Kff

How To Register For Covid 19 Vaccine For Above 45 60 Years In India

Posting Komentar untuk "Existing Health Insurance Cover Covid 19"