Professional Indemnity Insurance Cover Meaning

Professional indemnity Contents 3 In July 2005 the Dentists Act 1984 Amendment order 2005 Indemnity for all registrants to have adequate and appropriate professional indemnity 3 Indemnity providers being Mutual indemnifiers Insurance indemnifiers powers to treat any lack of indemnity as misconduct. Professional indemnity insurance should not be confused with other types of business insurance which cover more tangible grievances such as.

Professional Indemnity Insurance Policy Presentation Ppt Video Online Download

Professional Indemnity insurance is designed for professionals who provide advice or a service to their clients.

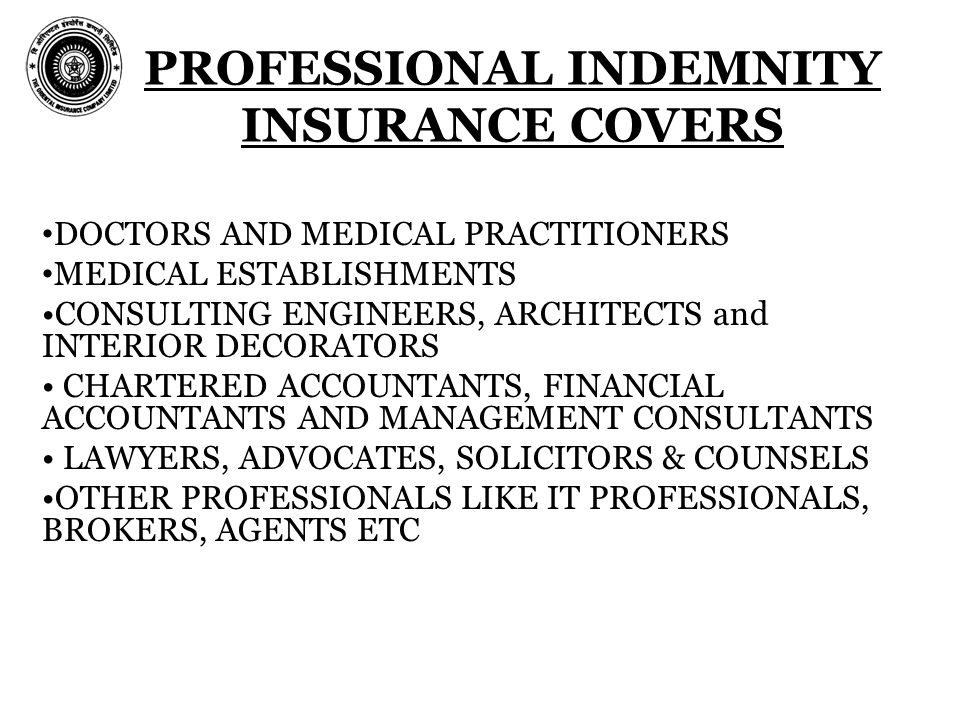

Professional indemnity insurance cover meaning. Professional liability insurance PLI also called professional indemnity insurance PII but more commonly known as errors omissions EO in the US is a form of liability insurance which helps protect professional advice- and service-providing individuals and companies from bearing the full cost of defending against a negligence claim made by a client and damages awarded in such a civil lawsuit. Indemnity insurance is designed to protect professionals and business owners when found to be at fault for a specific event such as misjudgment. Professional indemnity insurance covers claims made by the businesses in case their clients have sued them for making them endure any significant financial loss due to their advices and services.

Professional indemnity insurance can cover a broad range of potential risks. Cover providing insurance against damage or loss Meaning pronunciation translations and examples. Professional indemnity PI insurance is a commercial policy designed to protect business owners freelancers and the self-employed if clients claim a service is inadequate.

Professional Indemnity Insurance is a type of business insurance typically for organizations that provide consultation or any professional services to its clients. The compensation payment will usually take into account the financial loss that the client has suffered. Professional indemnity PI insurance is an important type of business insurance designed to cover you for costs you might face if your work service or advice causes clients to suffer a loss either reputationally or financially.

What is Professional Indemnity Insurance. Any organisation which provides a professional service or gives advice could be sued if the recipient is unhappy with their work. Professional Indemnity insurance is designed for professionals who provide advice or a service to their customers.

Professional indemnity insurance enables you to pursue legal avenues to clear your name and defend your reputation with the backing of a legal and insurance team. Professional indemnity insurance is a type of cover to protect your business if you provide designs specifications advice or instructions as any part of your job. Professional Indemnity insurance protects professionals against claims of negligence or breach of duty made by a client as a result of receiving professional advice or services from your business.

It protects you against legal costs and claims for damages to third parties which may arise out of an act omission or breach of professional duty in the course of your business. Defining Professional Indemnity Insurance Professional Indemnity Insurance covers against claims for liabilities owed to a third party typically a client of the insured for the loss suffered by the third party arising out of the insured providing professional services. It typically covers any legal costs compensation or expenses and the cost of work to rectify the mistake should a.

What is Professional Indemnity insurance. Professional indemnity insurance can cover compensation payments and legal fees if a business is sued by their client for a mistake theyve made in their work. When advice is your livelihood the right professional indemnity cover can offer peace of mind security and most importantly protect your valuable reputation.

What does professional indemnity insurance cover. 4 Contractual Choosing your professional insurance vs discretionary cover. Certain professionals must carry indemnity insurance.

Quite simply it covers the cost of mistakes made when providing professional services. Professional indemnity insurance also referred to as PI insurance is a type of business insurance that covers you for costs if you make a mistake in a piece of work for a client that causes them financial or reputational loss. It can cover compensation claims if a business is held l iable by a client for making a mistake that leads to financial loss.

Some mistakes are minor with little or no financial cost or consequence. Personal indemnity protects you against any damages that may be claimed from you by clients or third parties due to an act omission or breach of professional duty in the course of your business as well as legal costs associated with a claim. Typically South African law uses a benchmark to test negligence - the reasonable person test.

Professional indemnity insurance is an important type of business insurance especially for businesses that give advice or provide a professional service to clients. If someone alleges that youve made a mistake overlooked a critical piece of information misstated a fact or they have misinterpreted you in the course of your work resulting in a financial loss for your client they may take legal action against you to recover those losses. If any of your recommendations or advice have caused a financial loss for a client and youre found to.

In todays busy business world anyone is at risk of making a mistake no matter how professional or diligent they may be. Typical professional liability policies will indemnify the insured against loss arising from any claim or claims made during the policy period by reason of any covered error omission or negligent. Public liability insurance Cover for claims made by third parties members of the public if they are injured or have their property damaged during the course of your work.

Professional Indemnity is an insurance policy that will cover you for the full amount of any compensation award that a court makes subject to the policy limit and also for any legal costs you incur in defending your case as well as the other sides legal costs should they be awarded against you. Do I need professional indemnity insurance.

Rating Surveyors Public Liability Insurance In Ireland Professional Indemnity Insurance Liability Insurance Mortgage Brokers

Professional Indemnity Ppt Download

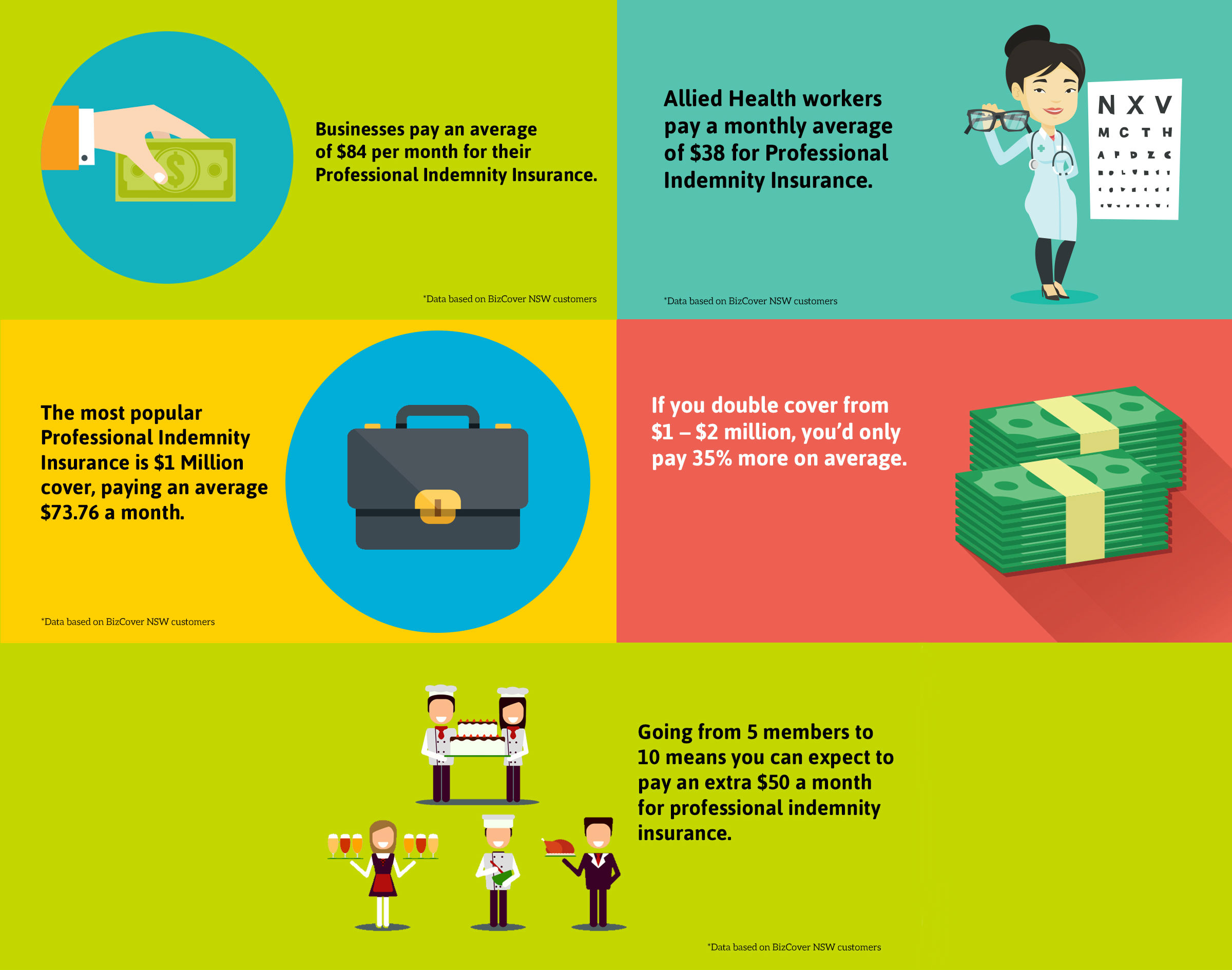

Professional Indemnity Insurance Cost Bizcover

What Is The Material Damage Proviso In A Business Interruption Insurance Policy Shop Insurance Professional Indemnity Insurance Indemnity Insurance

Know About Professional Indemnity Insurance With Rachel

What Is Design And Construct Professional Indemnity Insurance Uk Insurance From Blackfriars Group

Professional Indemnity Insurance An Ultimate Guide

Event Advertisement Max Is Not Dead Whymaxissoexcited Professional Indemnity Insurance Liability Insurance Insurance

Professional Indemnity Ppt Download

Professional Indemnity Insurance Policy Presentation Ppt Video Online Download

What Is Professional Indemnity Insurance Lifecare International Insurance

Professional Liability Insurance Definition Professionalliabilityinsurance Professional Indemnity Insurance Liability Insurance Professional Liability

How Much Does Professional Indemnity Insurance Cost Get Smart Advice

Pin On Professional Liability Insurance

How Much Professional Indemnity Insurance Do I Need Policybee

Professional Indemnity Insurance Kenya A Complete Guide Allianz

Professional Liability Insurance Meaning Professionalliabilityinsurance Professional Indemnity Insurance Liability Insurance Liability

How Much Does Professional Indemnity Insurance Cost Bizcover Nz

It Shields Me And Other Professionals Or Businesses Insurance Quotes Professional Indemnity Insurance Indemnity Insurance

Posting Komentar untuk "Professional Indemnity Insurance Cover Meaning"