Medical Malpractice Insurance Coverage Limits

The cost of medical malpractice insurance varies depending on your specialty the state in which you practice and the amount of coverage you need. When the corporation and mid-level have separate limit coverage at a limit of 1M per claim note that the limit can vary they would be covered by the carrier and each has 1M available for a claim.

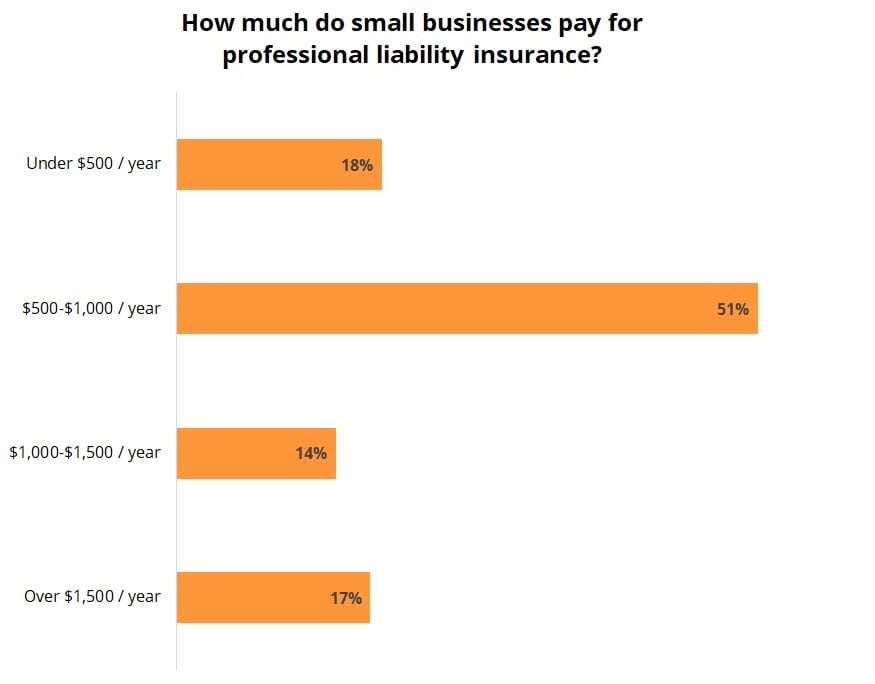

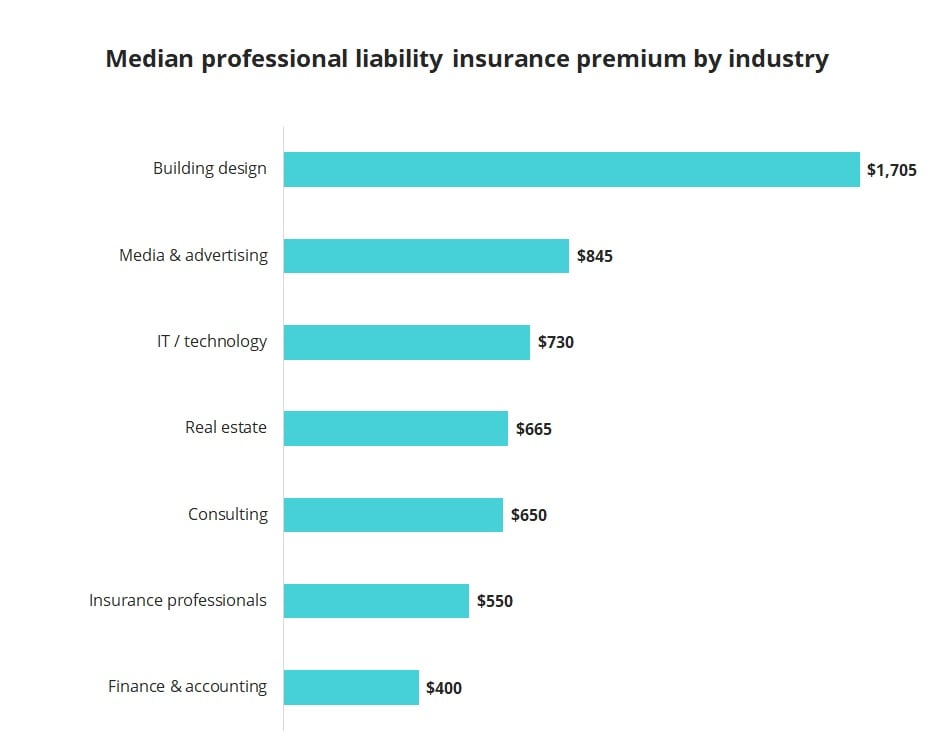

Professional Liability Insurance Cost Insureon

Occurrence Coverage - provides funding for all claims which arise out of a given policy period regardless of when the claim is actually made no tail required Policy Period the duration of the policy From the day the contract starts until the policy cancels.

Medical malpractice insurance coverage limits. Ad - Free Quote - Fast Secure - 5 Star Service - Top Providers. For example if your policy has a 5000000 per-occurrence limit with a 8000000 aggregate annual coverage limit that means the most your policy will pay for a single claim is 5000000 and it will not pay more than 8000000 in a year regardless of how many claims you have. Ad Contact Our Responsive Insurance Advisors.

Of excess medical malpractice coverage limits available under the Mcare Fund Fund. Medical malpractice insurance liability limits vary from state to state. Compare Top Expat Health Insurance In Laos.

And the right answer is YES. Medical malpractice insurance policies will limit the amount of liability they will cover in a year. Keep in mind those limits are often geared toward high-risk specialists.

The cost of the medical malpractice rates by state may vary based on the state limits. According to the Act the mandatory medical malpractice primary coverage limits were scheduled to increase with corresponding decreases in the Fund coverage limits in 2006 subject to a study regarding the availability of additional basic insurance coverage capacity pursuant to Section 745a of the Act. Your medical malpractice insurance limits by state can be found on your medical practice insurance declaration page.

While the average physician spends approximately 7500 per year in malpractice insurance premiums several factors affect medical malpractice insurance coverage pricing. How much coverage you need will directly affect how much you will pay in insurance premiums. For example many medical malpractice policies will have limits of 10000003000000 meaning the insurance company will cover up to 1000000 per claim and provide up to 3000000 in total coverage for all claims in a given policy year.

Insurers will typically add each entity name for no additional premium charge. Coverage Amount and Liability Limits. Ad Contact Our Responsive Insurance Advisors.

Commonly referred to as the Medical Malpractice Insurance limits by state these limits are the maximum amount that will be paid out for the policy under the contract. Under an occurrence insurance policy your medical malpractice lawyer knows going into the lawsuit what the liability limits will be in your case and plans the strategy of your case accordingly. The importance of good personal coverage as a nurse cant be overemphasized.

It is critical to understand how these options will apply because this becomes an important part of your malpractice insurance coverage. Ad - Free Quote - Fast Secure - 5 Star Service - Top Providers. Get the Best Quote and Save 30 Today.

While a Certificate of Insurance COI may appear to cover each physician with separate limits of 13M39M this amount of coverage may not actually be available to each physician if the total aggregate is less than 39M times the number of insured practitioners. A pre-occurrence limit refers to the total amount of money an insurance company will pay for one claim. Typically there are two types of coverage limits for medical malpractice insurance namely pre-occurrence limit and aggregate limit.

Get the Best Quote and Save 30 Today. However typical policies stipulate between 100000 and 1 million per occurrence and 300000 to 3 million aggregate coverage. Imagine an incident of malpractice.

Average annual malpractice insurance premiums range from 4k to 12k though surgeons in some states pay as high as 50k and OBGYNS may pay in excess of 200000. You need medical malpractice insurance. Medical Malpractice Insurance Two Types 1.

This means 3M would be available for coverage. For non-catastrophic injuries the cap was initially established at 400000 while the. Simply put sharing coverage limits with the entity will take away coverage from the physicians.

Aviso Insurance is an. Your malpractice policy should contain the names of all registered practice entities along with each physician name no matter if you carry a shared or separate limit of coverage for the entity. Any damage award in excess of these limits must be covered by the policyholder.

A typical policy will set a cap of 1 million per occurrence and 3 million in total liability claims in a year. This is most necessary especially when you change to a new job and your former employers liability insurance no longer covers you. Compare Top Expat Health Insurance In Laos.

Malpractice insurance policies offer shared limits or separate limits of liability coverage for the Practice Entity Entity or Organization and licensed employees NPs and PAs. How does malpractice coverage work. Usually at end of employment term.

Coverage Limits Another factor to take into account when getting malpractice insurance is the coverage limits. Occurrence policies take into account current and future claims of malpractice although the limits of liability are those in effect when the incident occurred. Senate Bill 239 signed into law in 2015 establishes caps on the amount of non-economic damages recoverable by a plaintiff in a medical malpractice action.

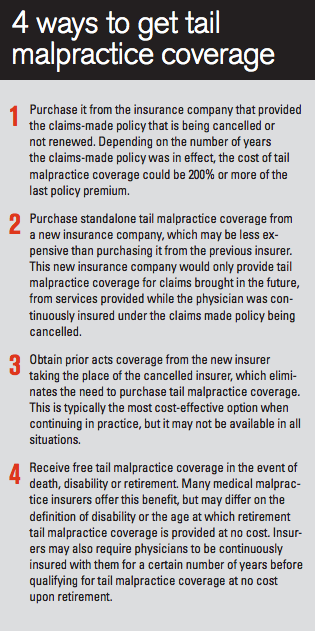

Do You Need Malpractice Tail Coverage

What Does Car Insurance Include American Family Insurance

Malpractice Insurance Basics Aapa

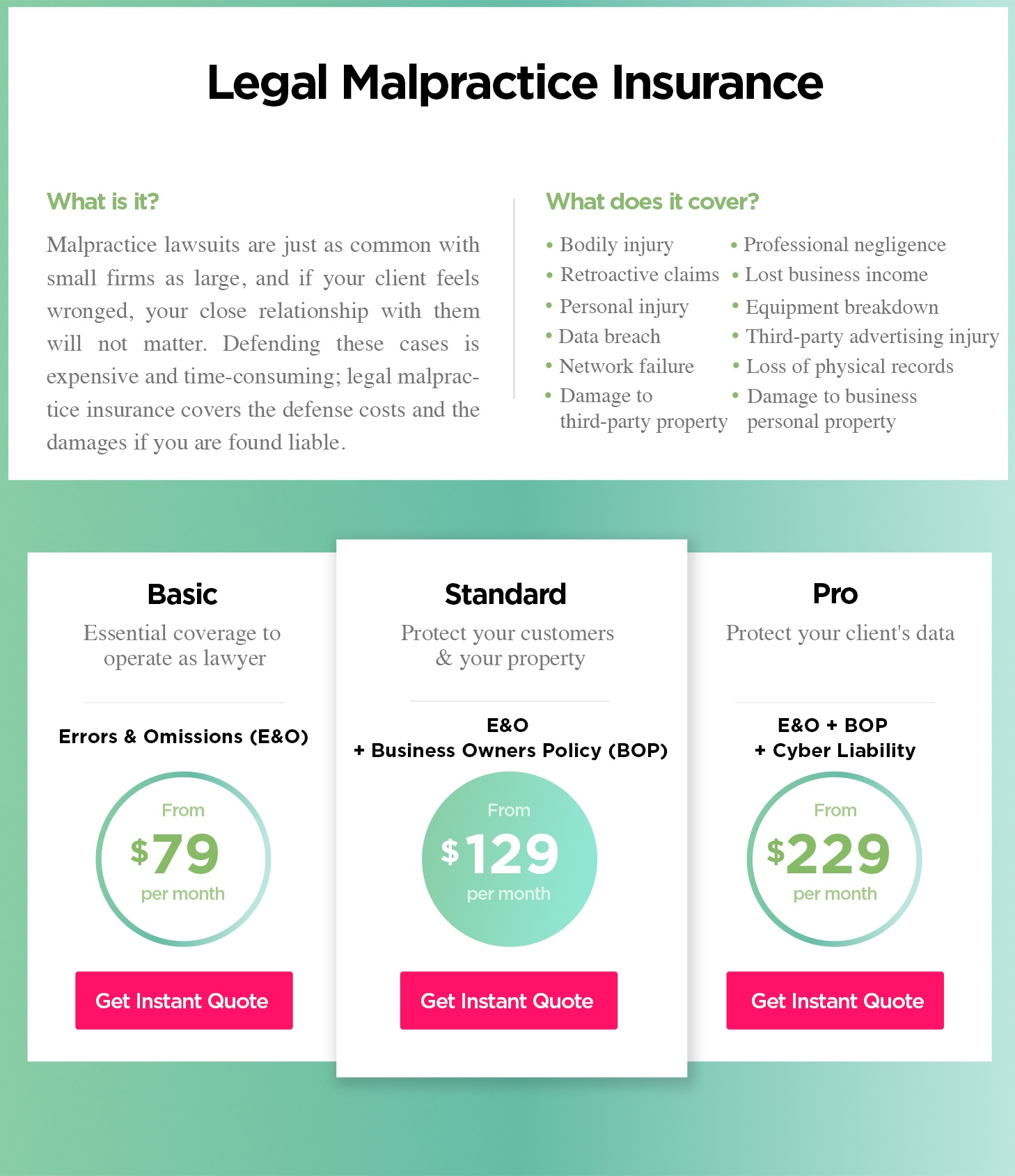

How Much Does Legal Malpractice Insurance Cost Commercial Insurance

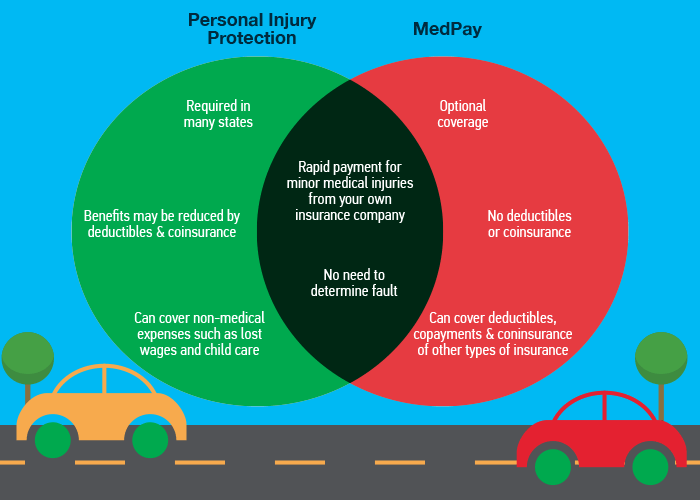

No Fault Insurance What Is No Fault Insurance Pip The Hartford

Medical Malpractice Insurance For Small Business Coverwallet

Full Coverage Car Insurance Cost Of 2021 Insurance Com

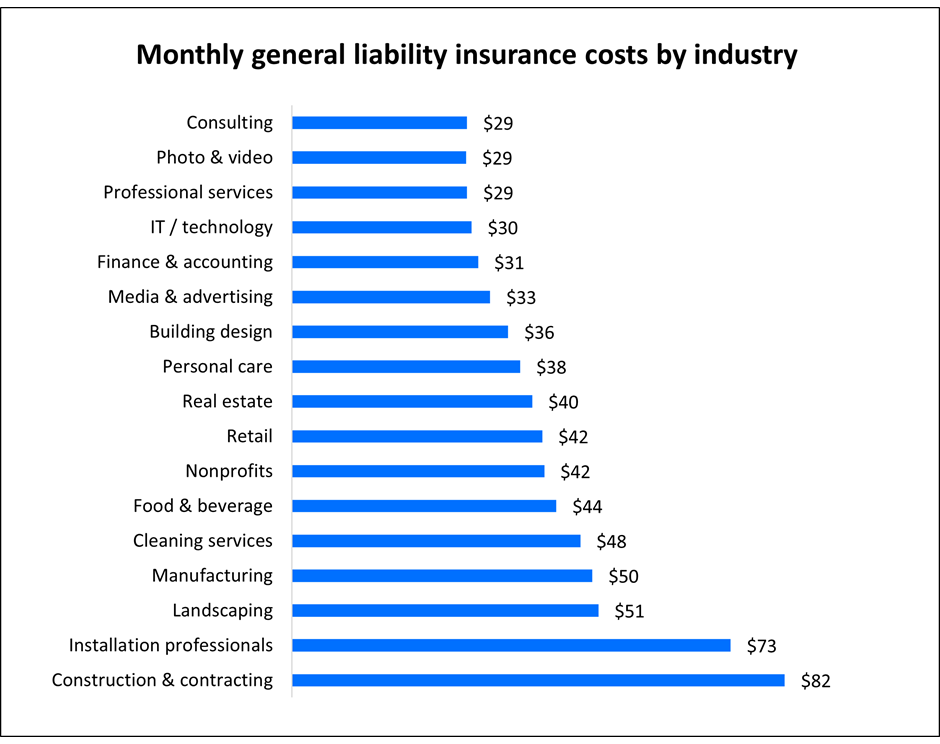

General Liability Insurance Cost Insureon

Medical Malpractice Insurance For Small Business Coverwallet

How Much Car Insurance Do You Need And How Much Is Required Moneygeek Com

General Liability Insurance For Small Business Coverwallet

Medical Payments Coverage A Medpay Guide For 2021

General Liability Insurance For Small Business Coverwallet

Professional Liability Insurance Cost Insureon

5 Types Of Car Insurance Get Average Rates Insurance Com

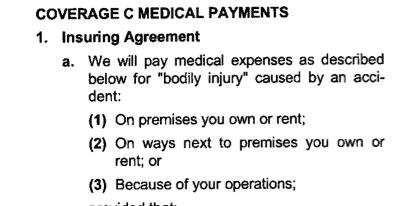

Medical Payments Coverage In Business Liability Policies

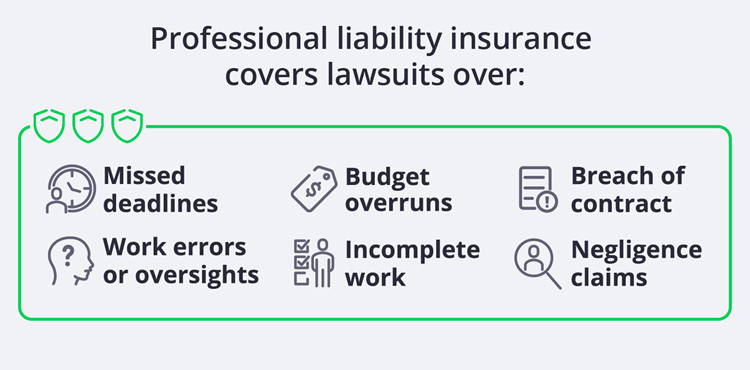

Who Needs Professional Liability Insurance Insureon

How Much Does Legal Malpractice Insurance Cost Commercial Insurance

Posting Komentar untuk "Medical Malpractice Insurance Coverage Limits"