Minimum Insurance Coverage For A Leased Vehicle

The coverage limit could be as high as 150 of your cars new or retail value or it could have limits such as waiving a loss of up to 75000. However they may allow you to have the state-required minimum coverage for bodily injury liability personal injury and property damage liability.

Do You Have To Have Full Coverage Insurance To Lease A Car

You will not leave the leasing office without an insurance cover.

Minimum insurance coverage for a leased vehicle. In most states basic coverage includes bodily injury liability coverage of at least 25000 per person and 30000 to 50000 per accident. Liability coverage helps pay for someone elses expenses if you cause a car accident that injures them or damages their property. Honda Lease Trust HVT Inc.

How Gap Insurance Works for a Leased Car. As a result if youre making the leap from state minimum insurance to lease minimum insurance you should conservatively expect to pay around 900 annually for the extra coverage. Most states require drivers to carry a minimum amount of liability coverage.

However read the fine print. If you drive a leased car youre required to carry car insurance. Leased vehicles are subject to the same liability insurance minimums as owned and financed vehicles so when you lease a car you are still required to purchase at a minimum bodily injury liability and property damage liability insurance.

Because of that you might spend more to insure a leased car than a financed car. Below are common insurance coverage options for a leased car. Whether a vehicle is owned leased or financed all states have their own minimum car insurance requirements.

Here are a few coverages to consider for a leased vehicle. This will be the maximum amount that an insurance company will pay to others for any that are sustained. The bank leasing company or other entity that is financing your leased car has a monetary stake in the vehicle.

Leasing companies typically require 100000 in bodily injury coverage per person 300000. Gap insurance or loanlease coverage is an optional type of car insurance covering the gap between your cars actual cash value ACV and the total amount you owe on the lease or auto loan. It does not matter that you do not own the car.

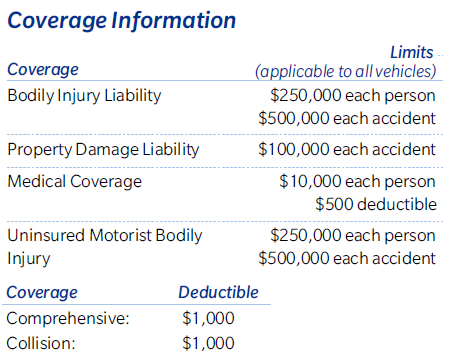

You must meet the minimum state requirements as well as the minimum requirement by. Generally this higher level of coverage is more common. Uninsured and Underinsured Motorist Coverage.

The leasing company may require Gap insurance as. On top of your states minimum car insurance requirements your lender may require you to carry additional coverage. A limit of 300000 for bodily injury liability coverage is required on the policy for multiple injured persons.

500 to 1000 for comprehensive and collision coverage. Other companies may require as much as 15000030000050000 liability coverage. A leased vehicle is quite arguably the type of vehicle that needs the most insurance coverage when compared to vehicles that are owned or financed.

This may be more coverage than you would normally buy which could mean an additional leasing expense unless you know how to get better rates. In some states youll also need to have uninsured and underinsured motorist coverage which covers you when someone is driving without insurance or doesnt have enough coverage hits you. The limitations when you are financing a vehicle are the same as the state minimum which is as follows.

Because youll need to return your leased vehicle in the same condition you received it you should remain properly insured for the duration of your lease agreement. See our list of lenders and service providers. The lessor under an agreement to lease a motor vehicle for 1 year or longer which requires the lessee to obtain insurance acceptable to the lessor which contains limits not less than 100000300000 bodily injury liability and 50000 property damage liability or not less than 500000 combined property damage liability and bodily injury liability shall not be deemed the owner of said motor vehicle for the purpose.

Facts About Insurance for Leased Cars 1. You are and you must have full coverage insurance to lease a car on the day you take possession of the vehicle. Insurance Requirements for Leased Vehicles.

Honda Financial Services requires you to maintain physical damage comprehensive and collision insurance coverage for the duration of your contract for the minimum coverages required by the laws of the state in which you reside. The minimum required coverage on vehicles leased to a driver by a dealership is liability-only coverage plus comprehensive and collision coverage. Limitations based on financing a vehicle.

In NY and VA should be listed as an additional insured and loss payee. Comprehensive and collision coverage are options that each pay for damage repairs or vehicle replacement. Not only do you have to carry physical damage coverage but you must also carry GAP insurance.

Your leasing company will require collision and comprehensive auto coverage. Per accident and 50000 in property damage liability insurance. 15000 per person30000 per occurrence.

Liability coverage helps pay for someone elses expenses if you cause a car accident that injures them or damages their property. Despite the cost having car insurance for a leased car is important. Car insurance coverages required by law.

You may still be responsible for a remaining balance in some cases and there may be limits on vehicle value or. Thats a lot and factors into why leasing almost never makes financial sense. If you lease a car youll still need to purchase your own state-mandated basic auto insuranceand youll very likely need additional coverages.

When you buy a car your lender generally requires that you have a certain amount of collision and comprehensive coverage that protects the vehicle. Usually they require 100000 of bodily injury liability coverage per person 300000 per accident and 50000 in property damage liability insurance. The minimum amount of coverage that is typically required on a leased vehicle set at 100000 per person.

Your lessor may also require gap insurance or set a maximum amount deductible eg.

Find Cheap Car Insurance In 8 Easy Steps Insuremeta Cheap Car Insurance Car Insurance Cheap Cars

Auto Insurance Types And Purpose Of Coverage

5 Types Of Car Insurance Get Average Rates Insurance Com

Online Best Car Insurance In Pakistan Best Car Insurance Comprehensive Car Insurance Car Insurance

Online Car Insurance Car Insurance Banner Car Insurance Cheap Car Insurance Online Cars

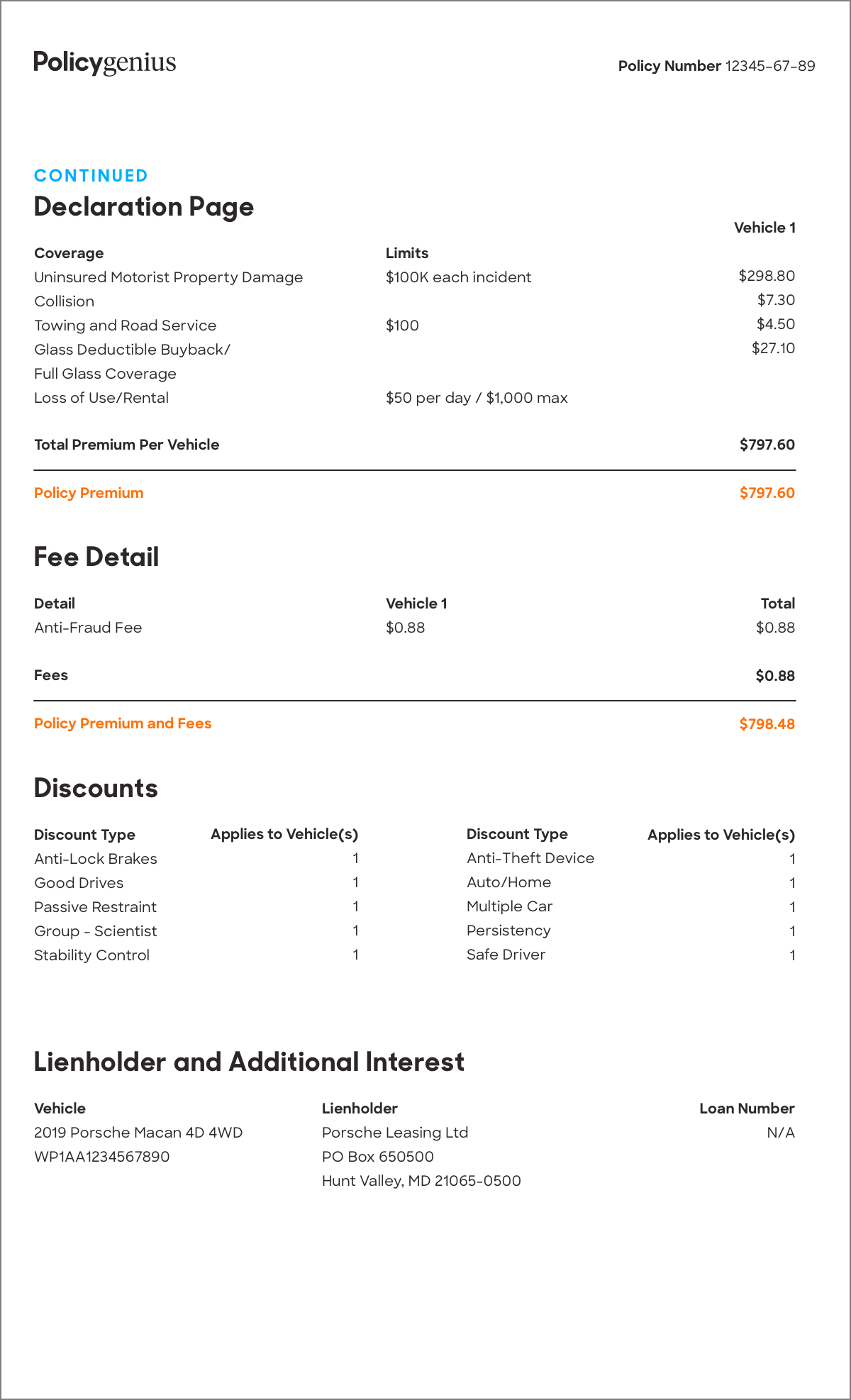

Understanding Your Car Insurance Declarations Page Policygenius

10 Reasons Why Car Fire Happens Car Care Tips Car Facts Car Maintenance

Leasing Agreement Pdf Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

Fantasy Car Insurance The Cost Of Insuring The Most Famous Vehicles Of All Time Car Insurance Fantasy Cars Auto Insurance Quotes

Pin By Finnart Connect On Vehicle Insurance Car Insurance Commercial Vehicle Insurance Accident Insurance

Image Result For Car Hire Agreement Template Free Rental Agreement Templates Car Hire Car Rental

What Is Automobile Collision Insurance Insurance Car Insurance Finance

Full Coverage Car Insurance Cost Of 2021 Insurance Com

Understanding Your Car Insurance Declarations Page Policygenius

Lease Agreement With Option To Purchase Contract Form With Sample Lease Agreement Rental Agreement Templates Contract Template

Pin By Legalraasta Simplifying Your On What Is The Difference Between Private Limited Section 8 Nidhi Company Creative Thinking Material For Sale Car Insurance

Ascotmotorcars On Twitter New Cars Motor Car Brand New

Having Great California Auto Insurance Coverage Without The Price Tag Is Possible Promax Insurance Agency He Car Insurance Insurance Coverage Insurance Agency

Posting Komentar untuk "Minimum Insurance Coverage For A Leased Vehicle"