Medical Insurance Coverage Tax Form

They are forms 1095-A 1095-B and 1095-C. Under the ACA most US.

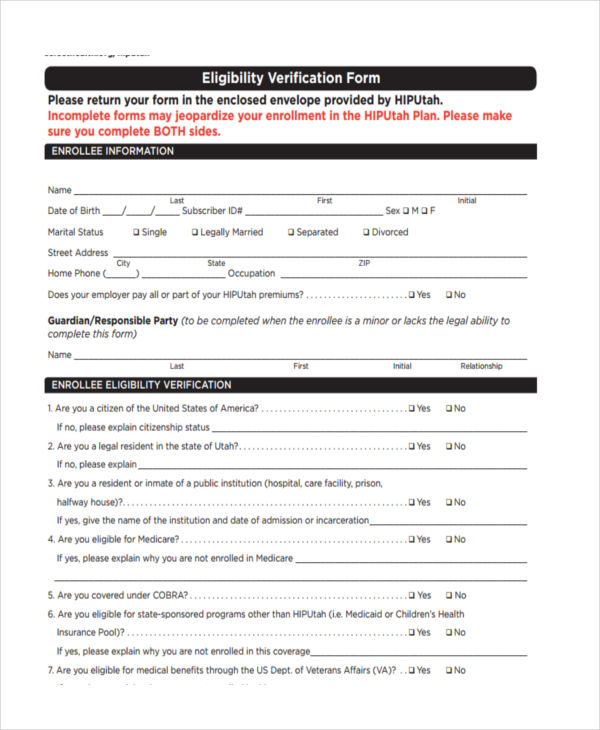

Free 23 Insurance Verification Forms In Pdf Ms Word

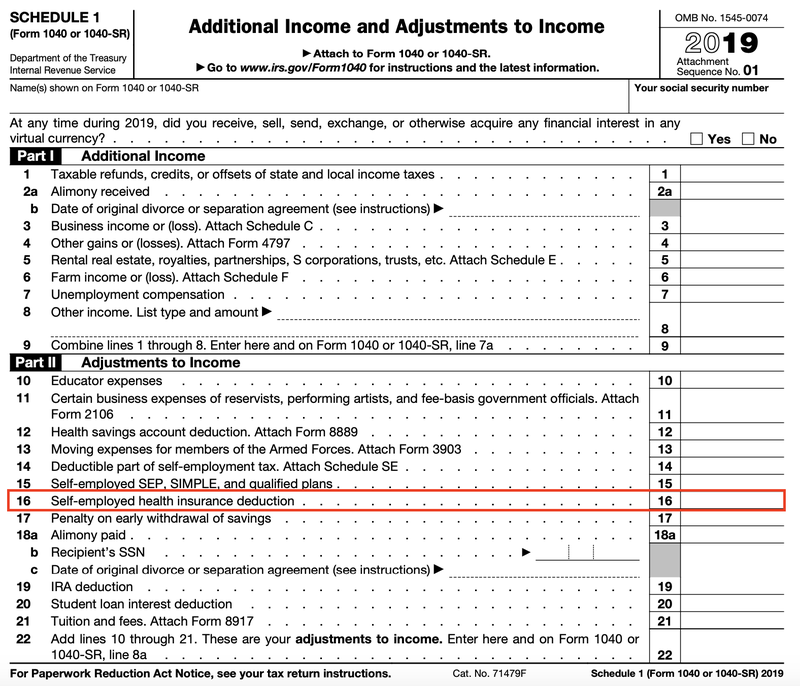

Forms 540 and 540NR can be used to report the premium assistance subsidy health coverage exemptions and the Individual Shared Responsibility Penalty.

Medical insurance coverage tax form. And theyll give you a Health Coverage Information Statement Form 1095-B or Form 1095-C as proof you had coverage. Contact Our Helpful Advisors Here. Contact Our Helpful Advisors Here.

Form 1095-A is your proof that you had health insurance coverage during the year and its also used to reconcile your premium subsidy on your tax return using Form 8962 details below. Form 540EZ can be used to report health coverage exemptions and the Individual Shared Responsibility Penalty but cannot be used to report. 10 2020 to get fast access to the tax form.

Get an Expat Quote Today. If you are required to file state or federal taxes you may self-attest your coverage as well. You need not make a shared responsibility payment or file Form 8965 Health Coverage Exemptions with your tax return if you dont have minimum essential coverage for part or all of the year.

Ad Dont let Culture or Language Delay Your Access to Quality Immediate Healthcare Abroad. The Form 1095-A Form 1095-C or Form 1095-B. In a normal year Form 1095-A is essential for preparing your tax return if you received a premium subsidy or if you paid full price for coverage through the exchange and want to claim the premium subsidy on your.

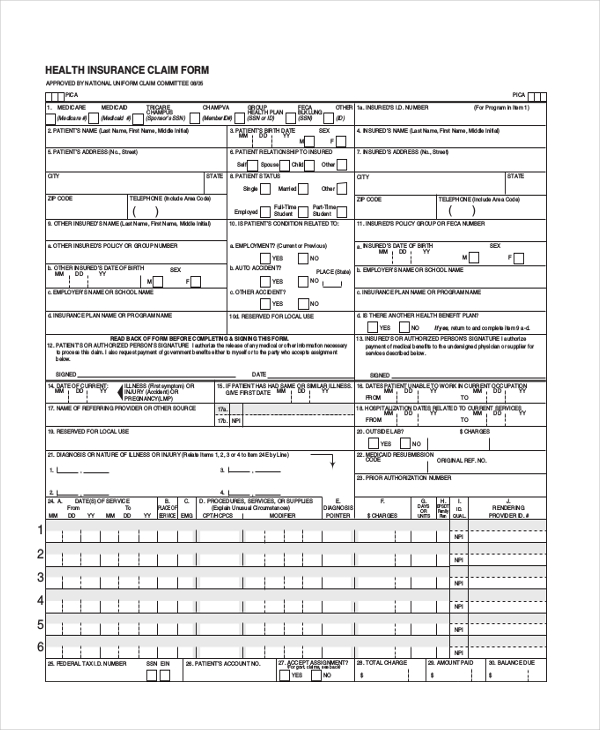

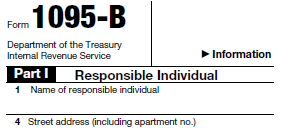

Citizens must have qualified healthcare coverage or pay a tax penalty. Form 1095-B is a tax form that reports the type of health insurance coverage you have any dependents covered by your insurance policy and the period of coverage for the prior year. Ad - Free Quote - Fast Secure - 5 Star Service - Top Providers.

Health Care Mandate Video - Forms for Tax Season. Ad Dont let Culture or Language Delay Your Access to Quality Immediate Healthcare Abroad. You can find it on Form 1040 PDF 147 KB.

Form 1095-B is used by providers of minimum essential health coverage to file returns reporting information for each individual for whom they provide coverage. Click here if you have more questions or call 877-617-9906. For each person covered on your policy the 1095-B lists.

Your Form 1095-B shows your Medi-Cal coverage and can be used to verify that you had MEC during the previous calendar year. Individuals who have health insurance should receive one of three tax forms for the 2020 tax year. Over 1 million Hospitals Clinics and Physicians Worldwide.

If you have form 1095-A and enter it in the federal return the information will flow to CA Form 3895. Get an Expat Quote Today. YOU CAN ACCESS YOUR IRS FORM 1095-B ELECTRONICALLY.

Get the Best Quote and Save 30 Today. Compare Top Expat Health Insurance In Laos. Beneficiaries should keep Form 1095-B for their records as proof they received health coverage during the tax year.

The form is simiilar to federal Form 8962 which is used to determine the premium tax credit for people who purchase medical insurance through the marketplace. The form is provided to you as proof that you meet the ACAs individual mandate and should not be subject to healthcare tax penalties. If you and your dependents had qualifying health coverage for all of 2020.

Complete your tax return. Get the Best Quote and Save 30 Today. The Affordable Health Care Act introduced three new tax forms relevant to individuals employers and health insurance providers.

For individuals who bought insurance through the health care marketplace this information will help to determine whether you are able to. If anyone in your household had a Marketplace plan in 2020 you should get Form 1095-A Health Insurance Marketplace Statement by mail no later than mid-February. Each year employers insurance companies and others who provide health insurance will tell the IRS who theyve covered.

Compare Top Expat Health Insurance In Laos. You can use this information to complete your state andor federal income tax returns. Under Helpful Links at the bottom left of the page click 1095-B Tax Form Reprint.

These forms help determine if you the required health insurance under the Act. To reprint your 1095-B tax form click here. Over 1 million Hospitals Clinics and Physicians Worldwide.

What forms do I need. Save it with your other tax documents. How to use Form 1095-A.

Forms 540 540NR and 540EZ include a check box to indicate qualifying health coverage for the entire year. We encourage you to consent to receive 1095-Cs electronically before Feb. Per the Internal Revenue Code Section 6055 the California Department of Health Care Services DHCS began issuing Internal Revenue Service IRS Form 1095-B to all Medi-Cal beneficiaries annually starting in January 2016.

If your child receives CHIP insurance visit the CHIP website. If you got Form 1095-B or 1095-C dont include it with your tax return. It may be available in your HealthCaregov account as soon as mid-January.

IRS Form 1095-C is for employees that worked full-time or received health coverage through their state employment at any point during tax year 2019. The forms are sent to individuals who are insured through marketplaces employers or. Go to Self Service select Benefits and then 1095-C Consent.

Beginning in tax year 2019 Forms 1040 and 1040-SR will not have the full-year health care coverage or exempt box and Form 8965 Health Coverage Exemptions will no longer be used. This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage. Premium Assistance Subsidy FTB 3849 Health Coverage Exemptions and Individual Shared Responsibility Penalty FTB 3853 California Health Insurance Marketplace Statement FTB 3895 For more information on Health Care Mandate forms check out this video.

Reporting health care coverage became mandatory with the 2015 tax year. Check the Full-year coverage box on your federal income tax form. Proving Health Insurance for Your Tax Returns.

Health care tax resources. Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment. Ad - Free Quote - Fast Secure - 5 Star Service - Top Providers.

Form 1095-B does not require completion or submission to DHCS. You must have your 1095-A before you file.

Can I Get Health Insurance Through My Llc

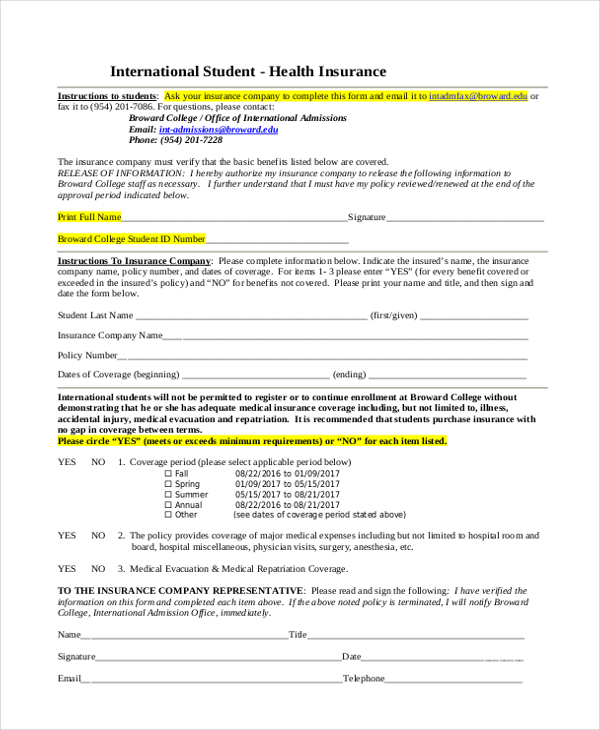

Free 10 Sample Health Insurance Forms In Pdf Word

A Beginner S Guide To S Corp Health Insurance The Blueprint

A Beginner S Guide To S Corp Health Insurance The Blueprint

To Pay Or Not To Pay That Is The Question Kaiser Health News

Es Posible Que Haya Recibido Recientemente Un Formulario Por Correo De Dhhs Su Empleador O El Ma Marketplace Health Insurance Tax Forms Healthcare Marketplace

Make Sure You Have Right 1095 Tax Forms Healthcare Gov

Which Tax Form To File Now That 1040a 1040ez Are No Longer Used Irs Com Tax Forms Estimated Tax Payments Income Tax Return

Free 10 Sample Health Insurance Forms In Pdf Word

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Printable Insurance Verification Form Fill Online Printable Fillable Blank Pdffiller

Form 1095 C Guide For Employees Contact Us

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095c Form Tax What To Do With Tax Form 1095 C The Affordable Care Act Tax Forms Affordable Health Insurance Employee Health

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Free 10 Sample Health Insurance Forms In Pdf Word

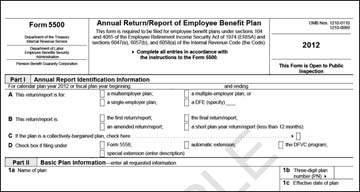

Form 5500 Erisa Plans With 100 Or More Participants Are Required

What To Do With Tax Form 1095 C Feedlinks Net Tax Forms Affordable Health Insurance Health Insurance

Posting Komentar untuk "Medical Insurance Coverage Tax Form"