What Is Not Covered By D&o Insurance

The term exclusions refers to those acts or losses that are not covered by the DO insurance policy. Although DO insurance does cover wrongful acts the policy will not cover a director or officer who deliberately commits fraud or breaks a law.

D O Insurance Directors Officers Insurance Quotes

Shes glad shes covered by DO insurance.

What is not covered by d&o insurance. Its a common misconception that DO. Directors and officers liability insurance. DO insurance is a complex cover requiring attention to what is and isnt covered Common risk scenarios include failure to comply with regulation or laws reporting errors or misrepresentation.

In addition extensions to many DO policies also cover costs for managers generated by administrative and criminal proceedings or in the course of investigations by regulators or criminal prosecutors. Employment practice liability insurance provides protection against employment related claims which account for a significant percentage of claims made against private companies and non profits. Claims covered by DO insurance include.

While Public company DO coverage restrict such claims solely to securities claims private company DO insurance provides broad coverage for claims made against the entity. Hiscox Insurance Company Inc No. EO insurance protects management and employees for mistakes made in carrying out their professional duties.

Typically any illegal or intentional wrongdoing will not be covered by DO liability insurance. Mike Hogan He outlines the details of the coverage and enhancements available as well as the limits of liability that banks of similar size purchase. Directors and officers DO liability insurance covers directors and officers or their company or organization if sued.

In this article we will explore the concept of exclusions in the context of the following coverages. You may also find that similar concepts apply to a broad range of financial lines insurances such. All DO insurances cover claims made by employees on officers.

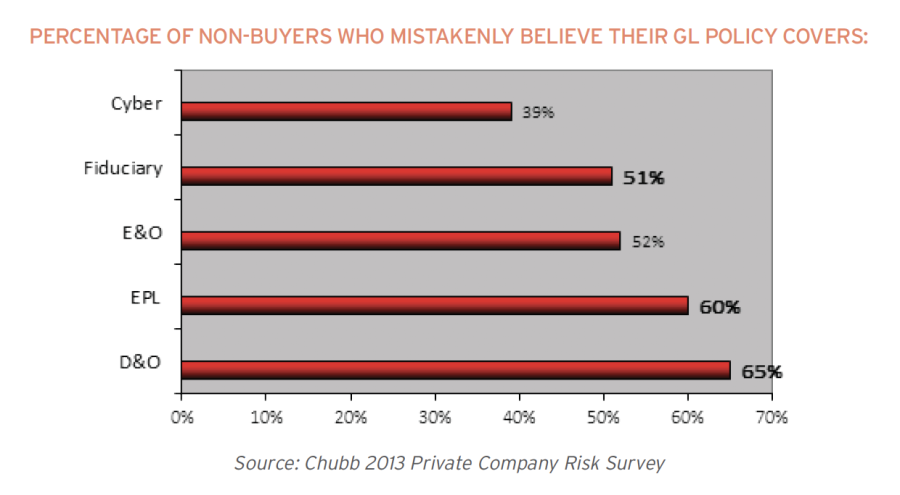

What is Covered by DO Insurance - What is Not. DO insurance covers claims for wrongful acts Although not identical DO policies generally define a wrongful act as any actual or alleged error misstatement misleading. DO insurance fills the gap that general liability and umbrella insurance do not cover when it comes to protecting company board members and executives.

Does Your Business Need DO Coverage. Cover for an act omission or dispute which occurs prior to the policy period which the director knew or ought reasonably to know was likely to give rise to a claim. Why Do Startups Need DO Insurance.

Misuse of company funds Insurance cover is not available if management makes or receives any illegal remunerations or to misrepresents the companys funds. When Does a Business Need DO Insurance. Thursday February 9 2017 300pm CST.

Homeowners can sue the board for a myriad of things but not all of them are typically covered by HOA Directors and Officers insurance. Mike Hogan Bio Mike Hogan has taught seminars for insurance agents and bank management on this subject for 25 years through various bank and insurance associations. In Springstone Inc.

For instance bodily injuryproperty damage exclusions exist to assure that the DO policy isnt called upon to cover those claims as they should be addressed by your commercial general liability policy. Nonprofits should also have it since these types of organizations are managed by a board of directors as well. A DO policy typically does not cover cases where directors or officers make amendments in financial figures to secure a deal or are convicted of any other crime.

Each insurer defines its DO policy in its own way but it generally includes any actual or alleged act or omission error misstatement misleading statement neglect or breach of duty by an Insured Person in the discharge of their duties. Associations not covered by DO insurance often have to impose a special assessment to pay those expenses. Dishonesty fraud criminal or malicious acts committed deliberately.

D. The DO policy will pay for defence costs and financial losses. Fighting against an employee-related lawsuit can cause financial and reputational loss to the company.

Employment practices liability insurance. Employment Practice Liability Insurance EPLI is the name of this extension. Insurance is created to transfer risk and not to cover the intentional acts of the insured.

20-6014 United States Court of Appeals Sixth Circuit September 17 2021 the Sixth Circuit was asked to compel an insurer to pay for defense costs resulting from a whistleblower law suit that Hiscox proved to the trial court it was not covered. Release of private information. What is Covered by DO Insurance - What is Not.

These coverage extensions are gaining more and more importance among company directors. Common exclusions include fraud intentional non-compliant acts and property damage. DO insurance for nonprofits.

FACTS POLICY WORDING. Typically a DO insurance policy will specifically exclude. However these DO exclusions can have an unintended effect and leave you the policyholder with gaps in coverage.

What Is Not Covered By DO Insurance. What is Errors and Omissions Insurance. DO insurance claims are.

Illegal acts or illegal profits are generally not covered under DO insurance. Claims With Prior Notice Every DO policy includes a prior notice exclusion which means if you are aware of a fact circumstance situation transaction or event that could lead to a DO claim it is excluded from coverage. Although policies can vary a majority of them dont offer coverage for wrongful eviction discrimination claims non-monetary claims defamation invasion of the right of privacy and emotional distress damages.

However unless you have an EPLI extension employment claims made on the company will not be covered.

![]()

Tech Firm S D O Insurance Claim Time Barred Business Insurance

D O Insurance Connect Auto Home Insurance

D O Insurance 101 Director S Officers Insurance Hoa Board Management

D O Insurance Basics Part 1 The Policyholder Perspective

A Buyer S Guide To Obtaining Comprehensive D O Insurance Coverage By Holland Knight Issuu

Directors Officers D O Insurance Coverwallet

Directors And Officer S Liability Insurance

Cover Overview Directors And Officers Liability Insurance

How Your Ownership Structure Impacts D O Coverage

Directors Officers Liabilities Insurance

The Real Deal On Side A Directors And Officers Liability Coverage

The Importance Of D O Insurance For Nonprofit Boards Boardeffect

Directors And Officers Liability Insurance Irda

D O Insurance Directors And Officers Liability Insurance

A Description Of D O Insurance Coverage Types Download Table

D O Insurance Glossary Of Terms Kbi

Obtaining The Full Benefit Of D O Insurance Corporate Compliance Insights

Top 17 Directors And Officers D O Insurance Faqs Answered

Directors And Officers D O Insurance An Overview Landesblosch

Posting Komentar untuk "What Is Not Covered By D&o Insurance"