Gap Coverage Title Insurance

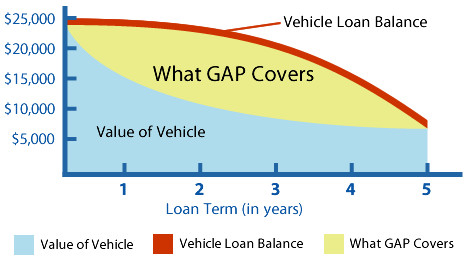

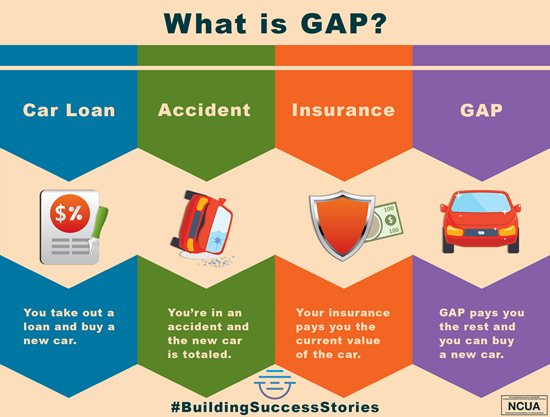

Gap Coverage insures both purchasers and lenders against losses due to intervening registrations on title between the date of closing and the date of registration. Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the cars depreciated value.

How Does Gap Insurance Work After A Car Is Totaled

Gap insurance may also be called loanlease gap coverage This type of coverage is only available if youre the original loan- or leaseholder on a new vehicle.

Gap coverage title insurance. Call your local Fidelity National Title Representative for more details or specific policy language pertaining to the Homeowners Policy of Title Insurance. To better understand why gap insurance is valuable it is important to understand how the gap period is defined along with other elements that come into play when title is being transferred. The first step in obtaining title insurance is for the title agency to provide the purchaser or lender.

Any used collateral not listed in the then current Established Retail Guide at the time of financing is not eligible for this GAP. Title insurance insures this gap in time should a title defect arise prior to the new deed of mortgage being filed. Title Insurance Gap Policy Title Commitment.

A title insurance company usually obtains a gap indemnity when there is a sit down closing because there is a gap of time between closing the real estate transaction and recording the instruments. Potential coverage over known survey and other defects. The title insurance policy also covers legal fees in defense of a claim against your property.

There is no additional cost as this gap coverage is included as a Covered Risk in the Policy. GAP insurance wont replace your primary health insurance. We are closely monitoring this pandemic situation and.

Result Chicago Title is providing local managers with authority where appropriate to issue policies providing coverage during the gap created by recording or posting delays created by government office closures. Title Policy Coverage Comparison Protect yourself as a REALTOR while protecting your clients with superior title insurance coverage. Upon recording an actual title policy can be issued by the closing agent this recording period can take from one day to.

The period between the time when the borrowers sign their loan documents and the actual filing of the deed of trust is commonly referred to as the gap period. Provided the Title Search is dated no later than 30 days of closing and all documentation required for registration is fully executed and ready for submission at the Land Titles Office Chicago Title will protect purchasers and lenders. Gap insurance is an endorsement added to the title policy that provides additional coverage for title defects that may arise during a gap period.

Lenders in the Pittsburgh metropolitan area have required title insurance for so long that gap coverage is fully understood in the surrounding counties. As with all forms of insurance there is much to consider when you purchase title coverage. The term gap coverage is commonly understood to mean coverage for instruments that are registered on title in the gap between documents are ready to go for registration and the time they are actually registered on title.

A gap period exists between the time that an instrument is submitted to the Recorder of Deeds for recording and the time that the instrument is actually indexed so that it can be found during a search of the public records. A title insurance policy contains provisions for the payment of losses which result from a covered claim. Survey Coverage It may eliminate the need for a new up-to-date survey of your property.

Commercial Gap Loan Policy of Title Insurance Available in Alberta only Stewart Titles Commercial Gap-Only Policy for either owners or lenders can be obtained for a low one-time premium and is intended to provide parties with the ability to close their transaction and advance funds prior to registration of their interest on title being completed. Title searchers and title insurance agents should be aware of the gap problem that may arise due to indexing delays in the Office of the Recorder of Deeds. When you buy a homeand insure your property title insurance.

Gap Coverage is automatically included in all of our residential and commercial title insurance policies and insures both purchasers and lenders against losses due to intervening registrations on title between the date of closing and the date of registration of the documents to the Land Titles or Registry office. Title insurance also allows a lawyer or notary to release residential mortgage proceeds before registration without an up-to-date Real Property Report but offers more extensive coverage such as. Title companies are assessing their willingness to provide gap coverage on a case-by-case basis so any atypical things in a closing such as nontraditional financing a seller who is in financial distress or the inability to obtain payoff information will make it less likely that the title company will provide gap insurance.

The GAP is the time period between the closing of the sale and purchase transaction when a title commitment is issued to the buyer and the actual recording of the sellers deed. The gap period between when a property purchase is finalized or closed and when the title is officially registered with the government. It has been a part of normal day to day operations.

GAP insurance claims are the insureds responsibility. Survey coverage to lender and homeowner. Gap coverage to lender and homeowner.

Choice of Title Insurer. There is always a waiting period called the gap period after the title agency provides the commitment. Even though Texas title insurance rules require the mortgagee title policy to be dated no earlier than the date of the deed of trust rather than the date of recording or funding see TDI Bulletin No.

When a title agent commits to insure over the gap the buyer and lender have the full guarantee of the title company and dont have to be concerned about interim issues. Gap Coverage It insures you for the gap between the time your property purchase is finalized home closing and the time your title is registered in Ontarios land registration system. In a sit down closing the title insurer assumes the risk that nothing will be recorded that could cause the title insurance policy holder a loss.

Learn more about Gap Coverage. Coverage can benefit the homeowner or the bank or mortgage company lender. GAP insurance coverage can cover gaps in your health insurance policy.

Value of the covered collateral including tax title and license as determined by your primary insurer via total loss payment less the primary insurance deductible amount. Httpswwwtditexasgovbulletins1995earlier152html our current Texas title insurance. GAP health coverage can provide affordable peace of mind su_box GAP insurance is designed to help the insured manage the gaps in their health insurance coverage.

Guidelines To Buy The Best Insurance Plan In The Philippines Professional Indemnity Insurance Disability Insurance Life Insurance Agent

Average 600cc Sportbike Insurance In Canada Life Insurance Quotes Cheap Car Insurance Quotes Travel Insurance Quotes

Gap Coverage Larson Automotive Group

What Is Gap Insurance And What Does It Cover Credit Karma

What Is Gap Insurance Do You Need It Landmark Title Assurance Agency

Guaranteed Asset Protection Swbc

East River Federal Credit Union What Is Gap Coverage

Click Here To See The Most Shocking News Ever Buy Health Insurance Health Insurance Health Insurance Plans

Gap Coverage What Is It How Does It Work Title Insurance Question

Gap Coverage Gap Insurance Refund Openroad Lending

Is There A Hole In Your Life Insurance Coverage Insurance Life Insurance Finance

Is Gap Insurance Transferable If I Sell The Car Autoinsurance Org

Should You Add Gap Insurance To Your Auto Insurance Policy Car Insurance Insurance Policy Farmers Insurance

Mostly Car Owners May Prefer The Third Party Car Insurance Over The Third Party Fire Theft Car Insurance Comprehensive Car Insurance Car Insurance Tips

Gap Coverage Plans Cadillac Protection

Where Can I Buy Large Health Insurance Dental Insurance Plans Buy Health Insurance Cheap Dental Insurance

Posting Komentar untuk "Gap Coverage Title Insurance"