Car Insurance Excess Cover Meaning

25 of Ksh 1000000 Ksh 25000. These policies cover the excesses youd pay on a wide range of other insurances such as pet insurance car insurance home insurance travel insurance and mobile phone insurance.

Car Insurance Motor Insurance Get A Quote Online Aig Hong Kong

Insurance excess is the defined amount you agree to pay towards any claim you make.

Car insurance excess cover meaning. It serves to motivate you to be more responsible to take better care of your valuables and to prevent small petty claims. Your excess payment will need to. Car insurance excess explained.

The excess amount is the first amount payable by you when your claim is settled or paid out. This insurance will pay for your excess in the case of an accident. Some insurance companies provide a specialised policy called car insurance excess protection.

What does an Excess Liability Policy Cover. 25 of car value minimum KSh 15000 maximum KSh 100000. Prepay Online Before You Go.

FAQ Section Car Hire Insurance Frequently Asked Questions What do zero excess car hire insurance policies offer. Car insurance excess cover from 35 per year to cover excess on your motor policy. Excess protection insurance covers the cost of your excess up to a limit you choose when you buy the policy.

Insurance excess is a pre-agreed amount of money that you need to pay to your insurance provider in the event of a claim such as a car accident or a flood at home. Voluntary excess is the amount of money youre willing to pay when you want to make a claim on your car insurance. What Does Excess Insurance Mean.

Book Insurance Separately With RentalCover Get Full Accident Coverage. The policy is designed to cover excesses of up to 10000. An excess is the most youll have to pay towards repairs to certain parts of a rental car.

It will cover the cost of the excess you pay if you make a claim against your car insurance. This is known as excess insurance. Car hire excess cover is a policy which shares similarities withtravel insurance in that you either buy it as a single or annual policy you may wish to consider an annual policy if you hire cars regularly or are hiring for more than 14 consecutive days.

Most insurance policies have a standard excess or a voluntary excess. The standard excess applies to every claim while voluntary excess is chosen by you and can reduce your premiumIf selected this nominated higher excess will replace your standard excess. An excess is a deductible or in other words the amount of money you have to pay out of pocket before your insurance policy will step in and cover the rest of the claim.

This type of policy will allow you to claim back your excess if you make a claim. Small businesses have varying needs and insurance requirements. The amount covered is usually a pre-agreed limit and applies to both voluntary and compulsory excess.

Collision Damage Waiver policies almost always have an excess. It applies to general insurance products such as motor travel pet health and home cover but not life policies. What is insurance excess.

You can buy it as a standalone policy or as a paid-for extra from some insurers. So if your excess is 250 and you make a claim for 1000 your car insurance provider might keep the first. In many cases youll be asked to pay the excess immediately so that the claim process can begin.

The car insurance excess is the amount you will be required to pay when you make a claim on your policy. You pay your excess first and when your claim is settled your excess cover policy refunds you. Most collision damage waivers CDW come with an excess meaning you have to pay the first xxxx of any damage done to the hire car.

Discover how this excess works and which parts of the car it applies to. Book Insurance Separately With RentalCover Get Full Accident Coverage. For instance if your car gets damaged and the cost to repair it is S3000 and you have a S700 excess you will pay the first S700 out of pocket and the remaining S2300 will be paid by.

Zero excess car hire insurance policies - what are they. Prepay Online Before You Go. Motor excess cover for all named drivers over the age of 18.

Some insurers offer policies that can cover the amount you pay on excess. Its an additional premium that you would have to pay and is typically separate from your insurance agreement. What is excess protection insurance.

In a nutshell your excess is a fixed amount that you have to fork out if you make a claim. When applying for car insurance youll find that if you increase the amount of voluntary excess youre willing to pay the overall premium may go down. It works using a slightly different method to compulsory excess as you set the amount you can afford.

The total amount that your excess insurance will cover varies depending on the amount agreed between you and then insurer. In other words its the amount you agree to. How much excess does the client have to pay before the car can be repaired.

At that point insurer will cover losses in excess of that sum up to the policy limit. The Excess section of the car insurance policy typically states the excess in this scenario as follows. Excess insurance is a form of insurance that works next to your traditional car insurance policies.

Ad No Hidden Costs - No Policy Exclusions - Zero Excess. Excess insurance runs alongside your car insurance policy. Three levels of motor excess cover for residents of the UK and the Isle of Man.

Ad No Hidden Costs - No Policy Exclusions - Zero Excess. You choose the upper limit of your excess insurance. Claim an unlimited number of times up to the maximum Motor Excess Reimbursement policy limit.

Excess insurance is insurance coverage that kicks in when a particular loss reaches a certain amount. Nothing gives you as much freedom as your own set of wheels and hiring a car can be a lot cheaper than you might think. Some states require owners to obtain Commercial Auto insurance before they can legally operate while other areas mandate small companies to carry at least General Liability insurance before they are allowed to offer products or services.

What Is Car Insurance Excess And What Should I Choose

Car Insurance Excess What Is Excess In Car Insurance Iselect

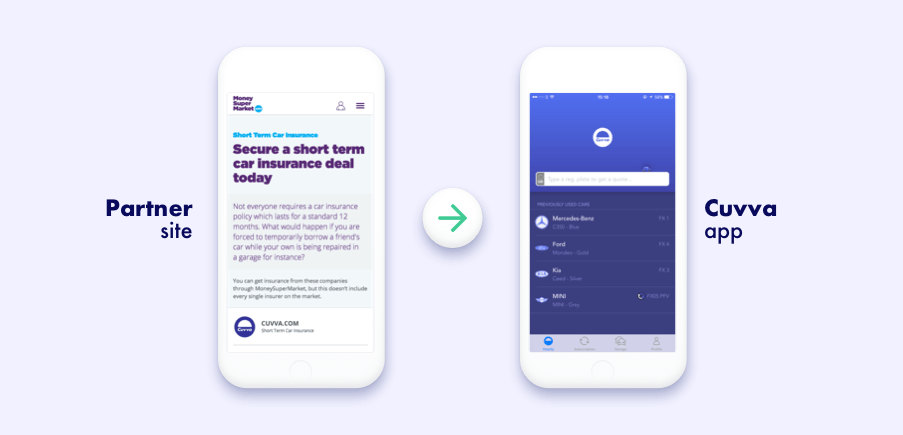

Car Insurance Excess Explained What It Means How It Works Cuvva

Compulsory And Voluntary Excess In Motor Insurance

Definition Of The Day Personal Umbrella Policy A Type Of Insurance Policy That Provides Excess Coverage Above And B Fast Facts Cheap Car Insurance Insurance

Car Insurance Excess What Is Excess In Car Insurance Iselect

Car Insurance Excess Explained Gocompare

Car Insurance Excess Explained Moneysupermarket

Saint Petersburg And Pinellas County Injury Law Firm Understanding Your Car Insurance What Car Insurance Comparison Car Insurance Personal Injury Protection

Car Insurance Excess Explained Moneysupermarket

How Your Excess Affects The Cost Of Your Car Insurance Insurance And Rego The Nrma

Compulsory And Voluntary Excess Explained Confused Com

Get Car Insurance Quotes In 2020 Insurance Quotes Auto Insurance Quotes Car Insurance

Ncd Excess Named Driver Important Car Insurance Terms You Must Know

Untitled Project 23 Car Insurance Insurance Ads

Primary Vs Excess Insurance In Personal Injury Claims Cheap Car Insurance Umbrella Insurance Business Insurance

What Is Car Insurance Excess How Does It Work Rac

Here S How Car Insurance Excess Works

Posting Komentar untuk "Car Insurance Excess Cover Meaning"