Gap Coverage Title Insurance First American

Covered Risk 9 concerns creditors rights issues and Covered Risk 10 is gap coverage for. On Record Matter Indemnity First American Title Insurance.

A gap period exists between the time that an instrument is submitted to the Recorder of Deeds for recording and the time that the instrument is actually indexed so that it can be found during a search of the public records.

Gap coverage title insurance first american. It should not be construed as representing the. Gap Indemnity Stewart Title Guaranty Company. Title being vested other than as stated in Schedule A.

Please do not hesitate to contact First Americans UCC Division for any assistance including the revised forms. Gap Indemnity First American Title Insurance. Attached to and made a part of.

In North Carolina. And 14 gap coverage. Bozarth Senior Staff Underwriting Counsel Richmond Virginia The discussion of title insurance coverage in this work is necessarily general in nature and is intended only for informational purposes.

Title Insurance Underwriting Review The ALTA Commercial Endorsements By Robert S. Title insurance is generally a two-step procedure and the period of time between those two steps is the gap period. The period of time from title search to recordation is the gap.

Download various NC title insurance forms from Statewide Title Inc. Old Republic Title Company Notarization Bulletin. Coverage in the amount of 25000 for the minimum premium of 3400 - and up to 250000 in coverage for only 8400 Gap Coverage.

Old Republic Title Company Gap Coverage Bulletin. While the intent of this provision is more to cause the parties to reach a mutually agreeable solution than to cause the offer to become null and void that can be the result. Ironshore Indemnity Inc NAIC 23647.

First American Title Insurance Company. Gap Coverage Any defect in or lien or encumbrance on the Title or other matter included in Covered Risks 1 through 9 that has been created or attached or has been filed or recorded in the Public Records subsequent to Date of Policy and prior to the recording of the deed or other instrument of transfer in the Public Records. Chicago Title Insurance Company.

In plain English what this says is that title insurance will NOT cover stuff put on the public record between the time of our initial title search the date of the Commitment and the time we record the mortgage or deed. Upon recording an actual title policy can be issued by the closing agent this recording period can take from one day to. American Land Title Association Loan Policy Adopted 6-17-06.

The obligations of Indemnitor hereunder shall continue as to any subsequent title insurance policies issued by the Company pertaining to all or any portion of the property. The Title being vested other than as stated in Schedule A. Knightbrook Insurance Company NAIC 13722.

Old Republic Insurance Company NAIC 24147. Ohio Indemnity Company NAIC 26565. Lyndon Southern Insurance Company NAIC 10051.

Features that Work in Your Favor Include. First Colonial Insurance Company NAIC 29980. A gap insurance policy protects buyers and lenders for title defects that may arise just before a real estate closing.

Great American Alliance Insurance Company NAIC 26832. The GAP is the time period between the closing of the sale and purchase transaction when a title commitment is issued to the buyer and the actual recording of the sellers deed. In this hands-on program you will learn about remote verifications electronic and remote notarization gap title insurance coverage orchestrating all parties for the closing and getting all funds in the correct amounts to the right.

It contains the text of each endorsement as used in the industry and is followed by a brief explanation and commentary. A title insurance gap policy provides insurance coverage to the policyholder for title defects that may arise. There is often a gap in time between the actual closing and disbursal of funds and recording of the deed or mortgage at the county.

The Endorsement Guide is intended to serve as an introduction to the most commonly requested title insurance endorsements in todays market. When Land Title closes the transaction and records the documents the Policy provides Gap Protection insuring against any defects liens encumbrances adverse claims or other matters appearing in the public records between the effective date of the title commitment and the recording date of the documents. If a gap endorsement or equivalent gap coverage is not available the buyer may give written notice to trigger the Title Not Acceptable for Closing subsection on lines 356-362.

Title insurance is issued utilizing standardized forms of policies and endorsements. This policy affirmatively insures the Insured against any loss or damage resulting from the creation or existence of any liens encumbrances or other title defects attaching between the time of execution of the mortgage insured hereby and the time of. Notwithstanding the provisions of Paragraph 3d of the Exclusions from Coverage the Company insures the insured against loss or damage including costs attorneys fees and expenses sustained or incurred by the insured as provided in the policy by reason of defects liens encumbrances adverse claims or other matters attaching or created subsequent to Date of Policy and prior to the recordation of the.

Courtesy Insurance Company NAIC 26492. Judgment Bankruptcy and Tax Lien Affidavait Chicago Title Insurance. Margolis The Margolis Law Firm.

Covered Risk 14 addresses gap coverage for matters occurring after the Date of Policy but before the insured Mortgage is recorded. First American Title Company - Financing. In the Owners Jacket Covered Risks 9 and 10 are not affected by Exclusion 3d.

LOAN POLICY OF TITLE INSURANCE Issued By BLANK TITLE INSURANCE COMPANY LOAN POLICY OF TITLE INSURANCE Issued By. Great American Assurance Company NAIC 26344. Learn more about Gap Coverage.

By the Company or Indemnitor as a result of efforts to obtain a release of any Gap Exceptions or to defend or prosecute any action pertaining to any Gap Exceptions. Gap Indemnity Old Republic Title Insurance Mississippi Valley Title Insurance. Title searchers and title insurance agents should be aware of the gap problem that may arise due to indexing delays in the Office of the Recorder of Deeds.

COVID-19 Gap Indemnity for Recording Office Closure. OnOff Record Matter Indemnity Fidelity National Title Insurance. This standard exception is placed in the Commitment to give.

There is no additional cost as this gap coverage is included as a Covered Risk in the Policy. Gap Coverage is automatically included in all of our residential and commercial title insurance policies and insures both purchasers and lenders against losses due to intervening registrations on title between the date of closing and the date of registration of the documents to the Land Titles or Registry office. Judgment Bankruptcy and Tax Lien Affidavit Commonweath Land Title Insurance.

A title insurance company usually obtains a gap indemnity when there is a sit down closing because there is a gap of time between closing the real estate transaction and recording the instruments. Title insurance insures this gap in time should a title defect arise prior to the new deed of mortgage being filed. In a sit down closing the title insurer assumes the risk that nothing will be recorded that could cause the title insurance policy holder a loss.

First American Title Home Facebook

First American Title Home Facebook

Gap Coverage What Is It How Does It Work Title Insurance Question

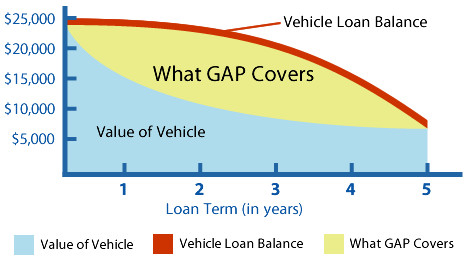

Gap Coverage Larson Automotive Group

First American Title Home Facebook

First American Title Home Facebook

First American Title Home Facebook

Posting Komentar untuk "Gap Coverage Title Insurance First American"