Renters Insurance Coverage Options

Renters insurance is an affordable way to protect your belongings whether theyre in your rental property or out with you in the world. Loss of use coverage.

13 Faqs About Renters Insurance Damage Coverage Mig Insurance

Renters insurance will pay for the medical bills of any guest that is injured in your residence even if you were not the cause of injury.

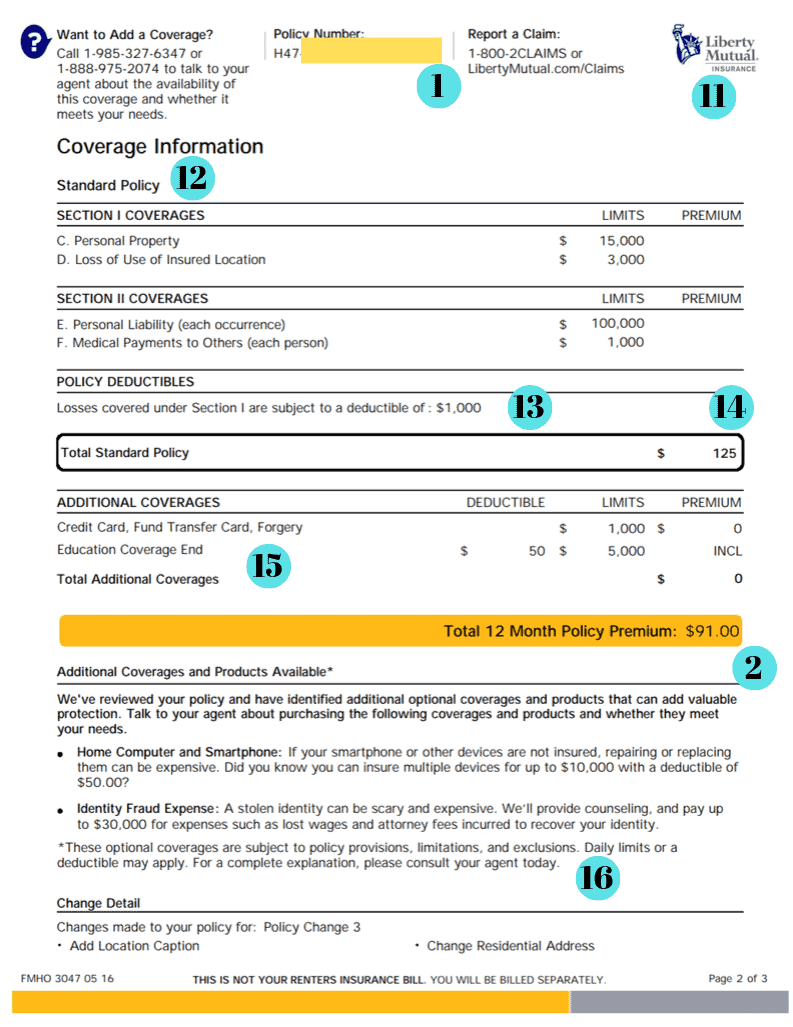

Renters insurance coverage options. Types of renters insurance coverage Standard renters insurance coverages include personal liability personal property loss of use and medical payments to others. Backup of sewers or drains. Renters insurance hurricane coverage in Florida.

The four most common risks we typically cover include. This coverage is limited only to the part of the building you rent but there are very few limitations on what kind of incidents are covered. Water damage from plumbing furnaceAC or water heater.

Personal property coverage protects items both in your home and elsewhere including belongings you keep in a storage unit. Renters insurance is designed to cover unexpected events including theft of your personal property and injuries to visitors. Personal belongings in your car.

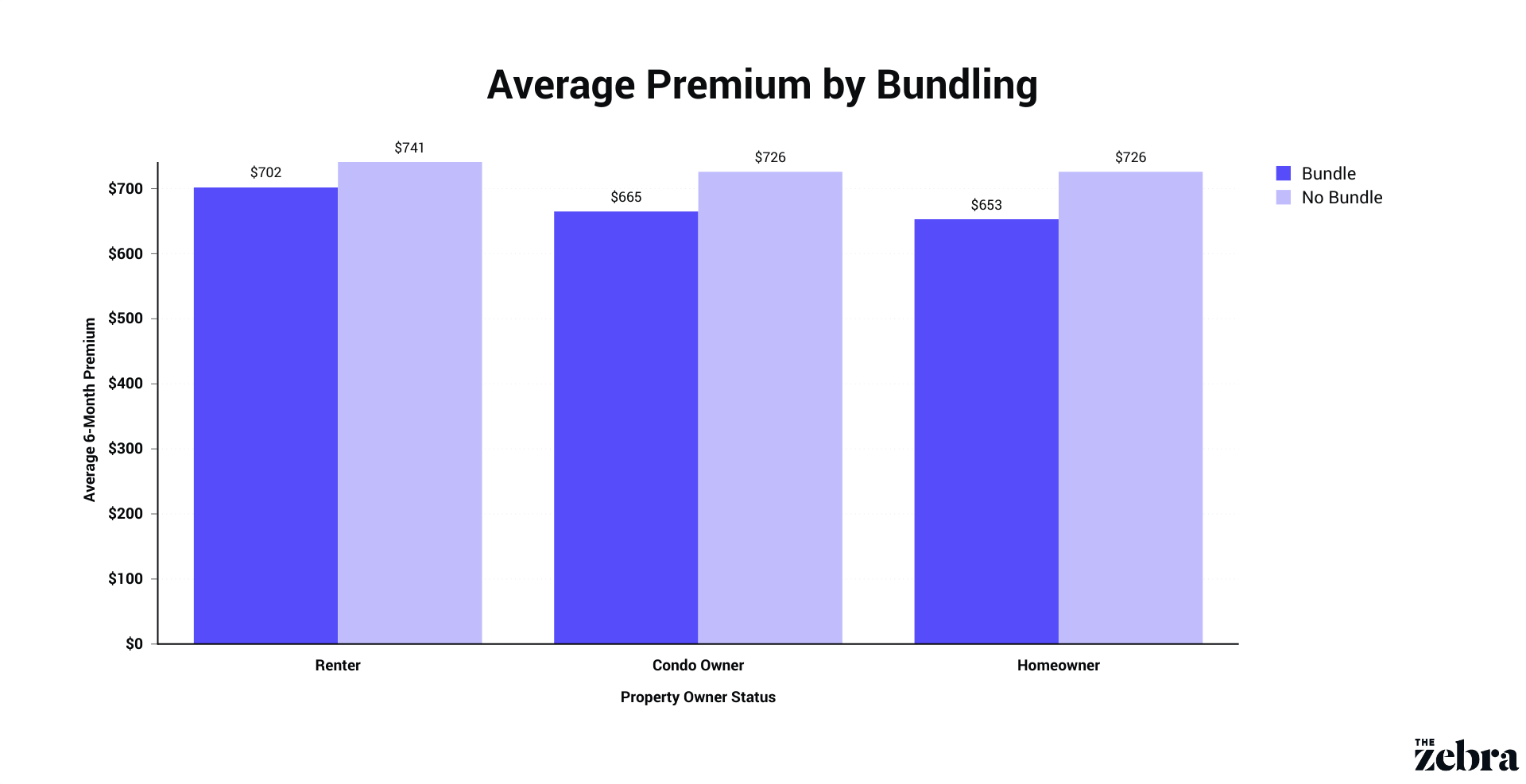

In insurance terms bundling refers to using one provider for different kinds of insurance. Personal property coverage personal liability additional living expenses and medical payments insurance. You may also be able to get coverage for the following situations under your Shelter renters insurance policy.

Nationwide renters insurance coverage options are available for personal liability to cover bodily injury or property damage to others an additional personal umbrella policy endorsement is also available that will add more liability protection to your policy water backup credit card coverage pays for unauthorized transactions on your creditdebit cards up to a specified limit. Renters Insurance is essential for anyone renting an apartment. What does a renters insurance policy cover.

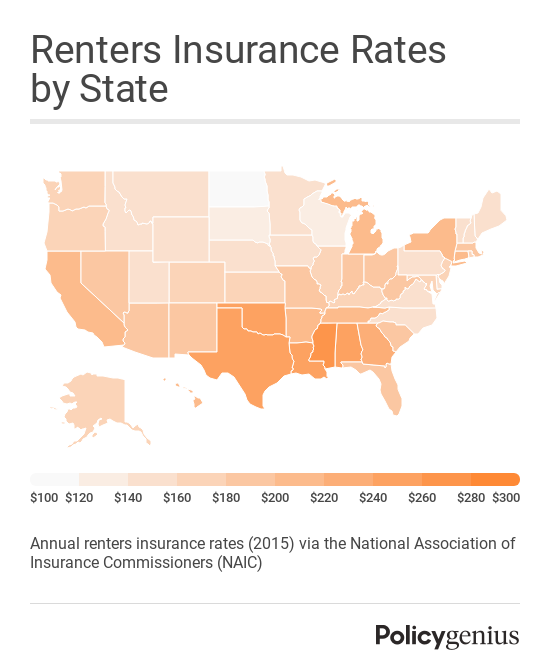

In addition to renters insurance. Owned or rented farms. Renters insurance rates are from Quadrant Information Services an.

Keep reading to explore these coverage options and how they can protect you and your belongings. Personal property coverage for your possessions. The following coverages are part of a standard renters insurance policy.

Renters Insurance Coverage Options Nerdwallet evaluated some of the top renters insurance companies for financial strength ease of filing and tracking a claim coverage options discounts and other factorsRenters insurance will help protect all the valuables that you store in your homeRenters insurance can do more than help protect your propertyRenters personal property insurance. When you quote renters insurance with Progressive you can customize your coverage and limits. We scored renters insurance companies based on price 20 coverage options and endorsements 50 and discounts 30.

Coverage for a credit card debit card theft charges or forgery. Expanded restoration cost for personal property. Standard renters insurance safeguards your personal belongings against damage from fire smoke lightning vandalism theft explosion windstorm water and other disasters listed in the policy.

That means auto and renters insurance can be purchased from a single company usually at a reduced rate. Serving clients in Little Falls Ringwood NJ and in NY and PA. These coverages offer protection against damage to your personal belongings from a covered loss and liability for someone elses damages or injuries plus additional living expenses if youre forced to live elsewhere due to a covered loss.

Optional Replacement Cost Coverage will replace your lost property with brand-new equivalents of the same quality. Renters insurance also covers much more than just your personal property like liability coverage. Renters insurance commonly provides three basic types of protection.

That means in the event of a covered loss your insurer will help cover the costs if youre held responsible for injuring another person or damaging another persons property including your landlords. The contents of your home are also covered if lost or stolen from a vehicle or while you travel. For instance if you accidentally damage the rental property itself or if somebody is injured while visiting you at your apartment your insurance would cover it.

Renters insurance provides personalized protection. Your renters insurance may have coverage limits for property stored outside your home. Allstate renters insurance protects you and your family in many situations involving the belongings you keep in your rented apartment or home.

Identity theft protection water backup extended coverage for scheduled personal property items. Renters insurance provides coverage for personal property loss of use such as having to move during home repairs and personal liability. Renters insurance coverage is broken down into four coverage types.

Coverage for medical payments to others who are not members of your household and who are injured in your apartment or rental home. American Family Insurance offers affordable coverage for renters that includes your personal property medical bills liability replacement costs for stolen items and hotel stays if. Additional Renters Insurance Coverage Options.

When you carry Renters Insurance you have Personal Property Personal Liability Additional Contents Guest Medical Payment and Loss of Use coverages. Its renters insurance premiums start as low as 5 a month and it provides the option of replacement cost coverage. Learn more about the renters insurance coverages we offer below then contact a local agent to discuss the right coverage for you.

Nationwides standard renters insurance policy comes with all of the things you would expect such as personal property protection medical and personal liability protection and loss of use coverage to help with housing costs if your rental is uninhabitable. Another way some renters policies protect you is through liability coverage. Theft from a home under construction.

Similar to homeowners insurance Renters Insurance protects these as well. Insurance companies want people to sign up for as many policies as possible and providers will offer valuable discounts to entice potential customers.

Ultimate Guide To Renters Insurance Find The Best Rates

The Best Cheap Renters Insurance In Ohio Valuepenguin

3 Things To Know About Renters Insurance Farmers Insurance Life Insurance Policy Renters Insurance

The Best Cheap Renters Insurance In Georgia Valuepenguin

/shutterstock_709343611.zimmytws.renters.insurance.cropped-5bfc335346e0fb0083c1e3dc.jpg)

A Comprehensive Guide To Renters Insurance

What Is Renters Insurance And How Much Do You Need

The Best Cheap Renters Insurance In North Carolina Valuepenguin

Renters Insurance In A Nutshell Renters Insurance Tenant Insurance Insurance Marketing

The Best Cheap Renters Insurance In Florida Valuepenguin

9 Best Renters Insurance Of 2021 Money

The Ultimate Guide To College Student Renters Insurance Renters Insurance Insurance For College Students Best Renters Insurance

What Does Condo Insurance Cover Nationwide

What Is A Renters Insurance Premium

Types Of Homeowners Insurance Hippo

The Best Cheap Renters Insurance In Georgia Valuepenguin

Renters Insurance Guide Coverage Com

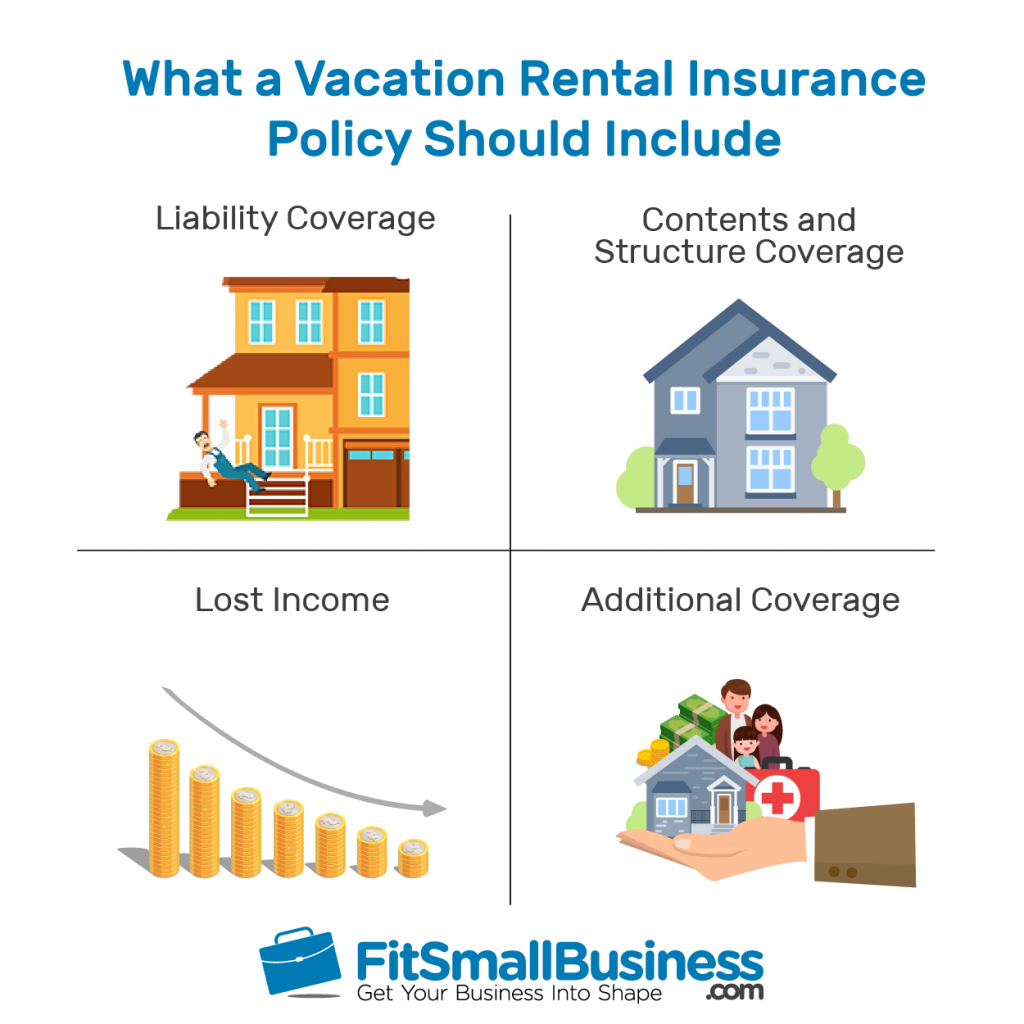

Vacation Rental Insurance Cost Coverage Quotes

Renters Insurance What To Know Before You Rent The Zebra

Renters Insurance Coverage What Does Renters Insurance Cover

Posting Komentar untuk "Renters Insurance Coverage Options"