What Does Coverage Length Mean In Life Insurance

The most common terms are 10 20 and 30 years though some insurers offer terms in five-year increments. Agent Application Beneficiary Beneficiary contingent Coverage Amount Face Amount Conversion.

Understanding The Life Insurance Medical Exam Policygenius

Life Insurance term length means the number of years that the policy will stay in effect.

What does coverage length mean in life insurance. The life insurance coverage that fit just fine when you first got your policy years ago might not be the best for your needs anymore. But it is also possible to get a term life insurance policy tailored to your specific needs. You might decide you need more coverage - or less.

Most term life insurance policies are 10 20 or 30 years but many companies offer additional five- or 10-year increments sometimes up to 35-. Follow these easy steps. Suicide is still covered by life insurance if the insured dies outside of the defined term in the policys suicide clause the insurance company will pay out the death benefit.

What does loss runs mean in insurance. Usually the coverage length is referring to how long the policy will stay in effect at a level premium level meaning the premium is guaranteed not to go up. You will only receive 80 of any loss you suffer.

A life insurance calculator takes into account your funeral costs mortgage income debt education to give you a clear estimate of the ideal amount of life insurance coverage. An Example of the Condition of Average being applied in an Insurance Claim. If a policy of insurance covering a building has a sum insured of 80000 and at the time of a loss the real insurance value is 100000 then the proportion of Average would be 80000100000 or 80.

Term life policies are ideal for people who want substantial coverage at low costs. Whole life Availability of coverage. The longer the term the more you will pay in premium because the risk of death increases the longer you are covered.

In general younger people select longer term life insurance policies while people closer to retirement pick shorter terms. These exclusionary conditions will prevent the insurer from providing the benefit. The goal for most people when choosing a life insurance policy length is to protect their loved ones throughout their income-earning years when their unexpected death would.

Most of the US. Insurance companies use it to analyze how many claims you make what types of claims and the financial impact of each. Go to What Does A Term Life Insurance Mean here Or directly access.

An optional provision in a life insurance policy that allows a specified percentage of the death benefit to be paid prior to the insureds death if a doctor certifies that the insureds life expectancy is limited usually 12 months or less. Another common life insurance clause is that the policy will not payout if. It allows for financial assistance to the insured individual while he or she is still alive.

Coverage length means the length of time that your life insurance policy will stay in effect. These reports are free and made readily available by all insurance companies. Permanent life insurance can also allow you to build cash value over.

Getting married or divorced having or adopting children taking on a mortgage and other life events can greatly affect your term life insurance needs. Term life insurance provides coverage for a certain time period term and the employee would submit premium payments directly to the carrier. A provision in most life insurance policies that allows the life insurance company to withhold the death benefit payout if the policyholder dies by suicide within the first year or two of the policy.

The cash value is. Living Benefits An advance cash payment of a portion of the insurance before the insured person dies. Length of time or term that you choose to have term life insurance coverage.

AG Select-a-Term allows you to choose a custom term length such as 10 12 or 15-35 years of term life coverage. Looking for what does direct term life insurance mean. How to shop for term life insurance.

Go to what does direct term life insurance mean page via official link below. Get direct access to what does direct term life insurance mean through official links provided below. The insurance company might also specify exclusions such as suicide or war as causes of death.

An insurance policy that has a coverage term equal to the lifetime of the insured person. But some policies guarantee the premium to stay the same level for only part of. A life insurance policys term length is the policys duration or how long it will last until expiring.

This is the dollar amount that the policy owners beneficiaries will receive upon the death of the insured. Typically term life insurance is issued in 5 year increments such as 10 15 20 or 30 years. Like a converted policy employees are eligible for Portability regardless of health status as long as they apply within the time frame listed in the certificate of insurance or policy usually 31 days after coverage loss.

When you buy term life insurance your premium payment buys coverage to insure your life for a specified term. Choosing a life insurance company. Use the life insurance calculator to discover how much coverage you should have.

Length of CoverageTerm Length. Usually the term length is also an indication of how long the policy premium will stay the same price. This figure is recorded in the schedule of benefits for the policy.

Permanent life insurance covers you as long as your premiums are paid which can effectively translate to lifetime coverage. Level premium term life insurance makes sure the costs stay level based on the length of term youre. Find the official insurance at the bottom of the website.

Choosing your life insurance term length.

Dios No Resta Ni Divide Dios Suma Y Multiplica Dios Multiplicar Palabra De Dios

Benefitgeek Health Insurance Companies Medical Insurance Best Health Insurance

Homecoming Dress Homecoming Dresses Orange Ballkleider Homecoming Kleider Kleider Kleiner Promis

What Is Term Life Insurance Money

A Guide To Open Enrollment That Won T Make Your Head Spin Huffpost Life Open Enrollment Health Insurance Health Insurance Plans

The Difference Between Short Term Disability And Fmla Patriot Software Medical Social Work Disability Human Resources

How Long Should I Have Life Insurance Progressive

Pin On Psicologia Desarrollo Personal

Https Bohouti Blogspot Com 2020 08 Faqs Salama Car Insurance Html Car Insurance Insurance Salama

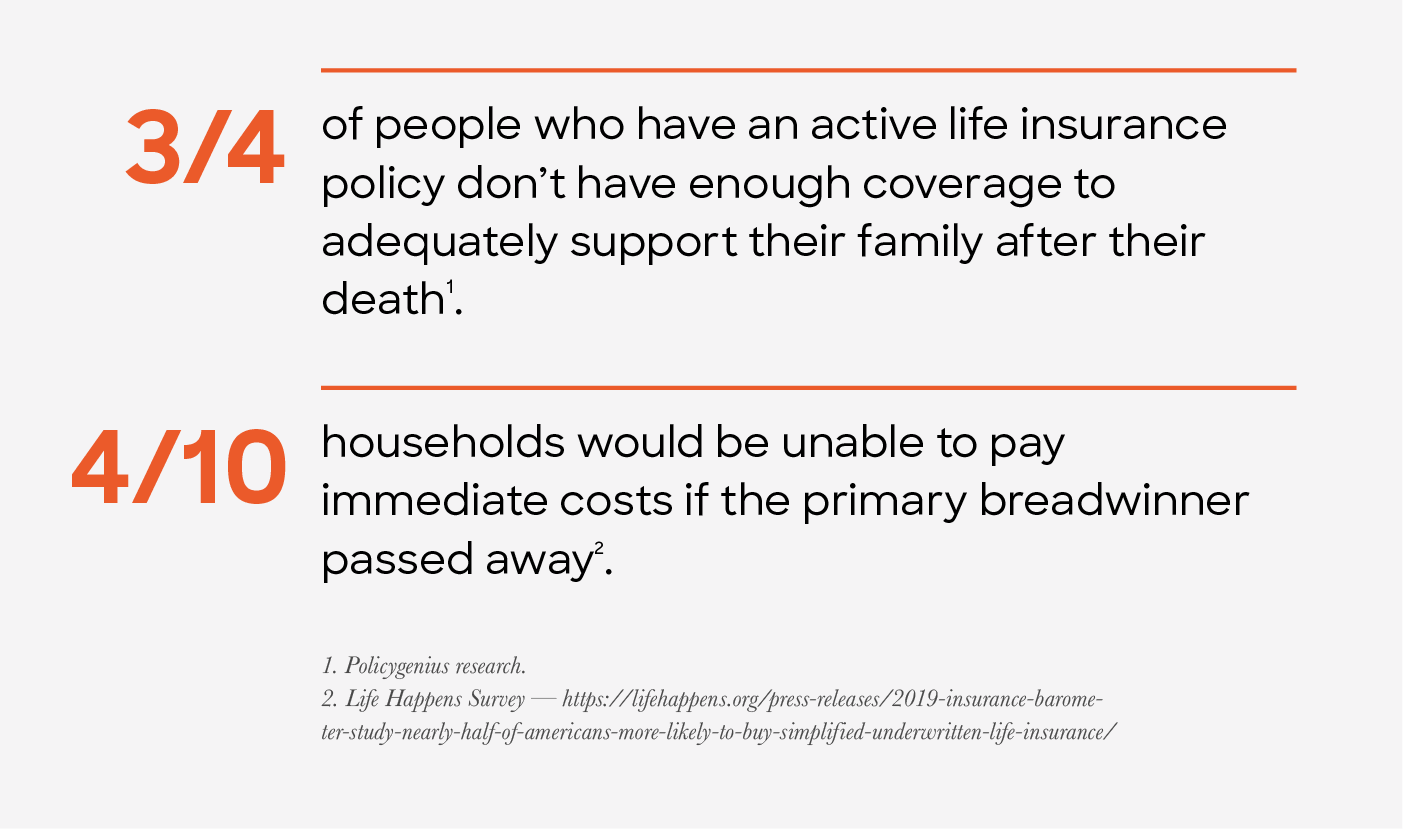

Risks Of Not Having Enough Life Insurance Coverage Policygenius

Understanding Your Life Insurance Policy Policygenius

Best Life Insurance For Seniors

Your State Farm Insurance Card Is Attached State Farm Insurance State Farm Life Insurance Insurance

13 Factors That Affect Car Insurance Rates In 2021 Car Insurance Car Insurance Rates Insurance

Term Life Insurance From Protective Life

Auto Owners Insurance W82txt Campaign Business Insurance Insurance Dental Insurance

It Cosmetics Cc Cream Review With Spf 50 Your Skin But Better It Cosmetics Cc Cream It Cosmetics Cc Cream Review Cc Cream Review

Posting Komentar untuk "What Does Coverage Length Mean In Life Insurance"