Flood Insurance Coverage Amounts

NFIP flood insurance rates by state. These policies can cover your belongings up to 100000.

Two Types of Flood Insurance Coverage The NFIPs Dwelling Form offers coverage for.

Flood insurance coverage amounts. Building Property up to 250000 and 2. Many factors go into calculating renters flood insurance premiums. After 2017 Hurricane Harvey estimates of houses covered by flood insurance in the Texas resulting in over 30bn in property losses with only 40 of homes covered by flood insurance.

The estimate will be based on. A number of factors are considered when determining your annual flood insurance premium. The insurance agent can provide you with an estimate of the total amount of flood coverage the house will need.

The coverage must be increased if necessary following completion of the renovation work to ensure that the coverage. The NFIPs flood insurance can be purchased through most insurers and agents so you can typically buy coverage through the insurer you already use for homeowners insurance. Flood risk eg your flood zone The type of coverage being purchased eg.

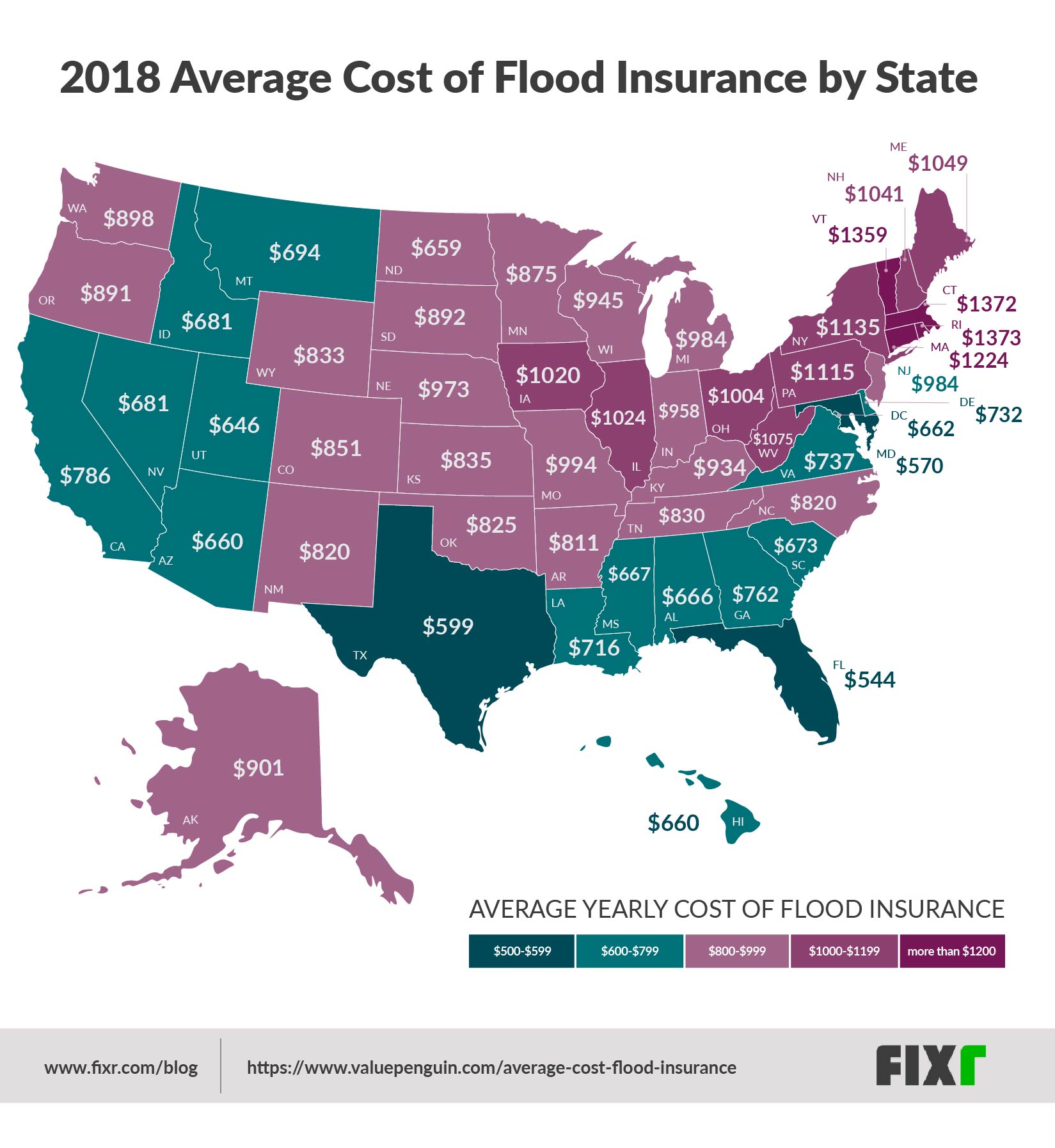

For other residential buildings the maximum coverage combination is 500000 building and 100000 contents. Building Property up to 250000 and 2. As of 2018 the average cost of an NFIP flood insurance policy is 700 according to the latest data provided by the Federal Emergency Management Agency FEMA.

2 rows The National Flood Insurance Act NFIA of 1968 and the Flood Disaster Protection Act FDPA. According to FEMA in the last decade alone floods have caused more than 155 billion worth of damage. For other non-condominium residential buildings and non-residential buildings the maximum amount of flood insurance available under the NFIP is 500000.

For a property under construction or renovation the flood insurance coverage must be in an amount equal to the as is value of the property. Personal Property Contents up to 100000. Flood insurance requirements are set by a lender in concert with FEMA through the National Flood Insurance Program.

For ICC coverage you could receive up to 30000 to cover the cost to elevate demolish or relocate your home. Unless you have contents. The NFIP ceiling for coverage is 250000 for the structure of a home and 100000 for personal possessions.

Basements are considered a higher risk for flooding so coverage for damages below the first floor is limited. Dan Persfull of The Peoples State Bank has provided a quick way to calculate the minimum amount of flood insurance needed for flood requirements. This spreadsheet requires three input values.

Please refer to Coverage D of your policy and. The age and build of your home. The location of your structure.

For example Lloyds of Londons Flood Insurance extends the coverage amounts beyond the maximum 250000 provided in the NFIP. Flood insurance is also available for renters. Building and contents coverage The deductible and amount of building and contents coverage.

Flood Coverage Additionally many private WYO flood insurance companies repackage the NFIP program and others repackage and improve upon the basic NFIP program. In March 2016 TypTap Insurance became the first private market admitted carrier in the state of Florida to offer non NFIP flood coverage to policyholders. Replacement Cost Value per appraisal 164115.

NFIP flood insurance policy options are the same in every state but the price is tailored to your home and flood. For commercial properties you can secure coverage up to 500000 for the building and 500000 for the building contents. The personal property portion of your flood insurance will cover the valuables you own like jewelry furs fine art and collectibles.

The National Flood Insurance Program provides coverage to certain homeowners residing in a flood prone area. If you need coverage beyond the limit you can purchase an add-on policy for valuables through your flood insurance. Your coverage amounts and type of coverage.

Personal Property Contents up to 100000. Flood insurance can be purchased in California through the NFIP or a private flood insurance company. Two Types of Flood Insurance Coverage The NFIPs Dwelling Form offers coverage for.

Lenders however generally are permitted to require and force place more flood insurance coverage than the minimum required by the Act. Contents and building coverage are purchased separately and there are always separate deductibles. The amount of insurance needed to protect a homeowner from losses associated with a flood is determined by the replacement value of the home.

Minimum Required Flood Insurance Coverage. However these items often have a low coverage limit. Why Choose Lloyds of London Flood Insurance.

Minimum Flood Coverage Calculator. Seeking some help in determining proper flood coverage for the following scenario. Refer to 42 USC 50 National Flood Insurance Act.

The NFIP encourages people to purchase both types of coverageYour mortgage company can require that you purchase a certain amount of flood insurance coverage. For 14 family dwellings the maximum coverage combination is 250000 building and 100000 contents. Your mortgage company can require that you purchase a certain amount of flood insurance coverage.

Up to 100000 contents-only coverage is available for all residential properties. The NFIP encourages people to purchase both types of coverage. Max available for dwelling policy 250000.

The NFIP estimates that nationally the average cost of a 100000 flood insurance policy is about 400 a year in a low-to-moderate-risk area. Commercial purpose loan secured by a 1-4 family investment property residential Potential Loan amount 120000. Your flood insurance costs are generally based on the following factors.

Flood insurance also provides coverage for interior property possessions or personal belongings such as appliances electronics and more.

Federal Register National Flood Insurance Program Nfip Conforming Changes To Reflect The Biggert Waters Flood Insurance Reform Act Of 2012 Bw 12 And The Homeowners Flood Insurance Affordability Act Of 2014 Hfiaa And

A 5 Step Florida Flood Insurance Guide To Save Money

How Much Does Flood Insurance Cost In 2021 Policygenius

Flood Insurance In A World With Rising Seas Econofact

Welcome To Ocean City New Jersey America S Greatest Family Resort Flood Insurance

How To Buy Homeowners Insurance Insurance Com

A Visual Comparison Flood Insurance Vs Flood Damage Repair

Fema National Flood Insurance Program Saratoga Springs Ut

National Flood Insurance Program Coverage

Flood Insurance In New Jersey Valuepenguin

Choosing A Flood Insurance Deductible Valuepenguin

First Major Real Estate Website Adds Flood Risk To Listings Npr

Best Flood Insurance Providers 2021 Quotes Benzinga

Posting Komentar untuk "Flood Insurance Coverage Amounts"