Health Insurance To Cover Covid-19 Pandemic

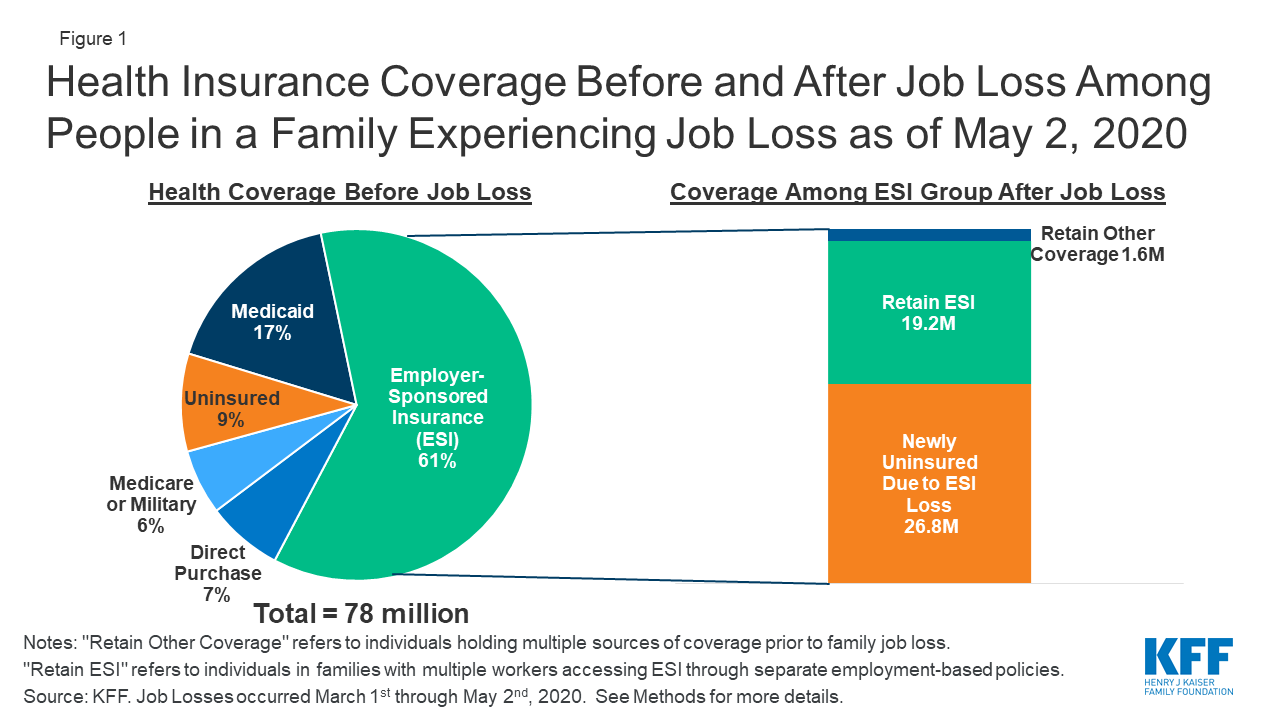

Federal law requires all private insurance plans to cover the entire cost associated with approved COVID-19 testing so long as the test is deemed medically appropriate. Lost their health insurance over a 12-week period in the spring and summer of 2020 during the COVID-19 pandemic according to a new study led by researchers.

Eligibility For Aca Health Coverage Following Job Loss Kff

All Marketplace health plans cover COVID-19 diagnostic tests even if you dont have symptoms or dont know if youve been exposed to COVID-19.

Health insurance to cover covid-19 pandemic. Insurers are mandated to cover hospitalization as well as quarantine expenses related to coronavirus. Can You Get Health Insurance if You Have Been Diagnosed With COVID-19. Check with your health insurer if itll cover Covid-19 when its declared a pandemic.

Typically policies with cover for COVID-19 disruption will offer cover for. Further as a Coronavirus disease is new it doesnt fall under the category of pre-existing diseases. Please note that all term insurance plans provide coverage for the treatment of COVID-19.

Hence a term insurance policy that covers the Covid-19 claims is beneficial to have. If you need medical care. Yes most likely you can still get health insurance if you have been diagnosed with COVID-19 but the insurance company might exclude Coronavirus from your coverage.

Most insurance companies are providing coverage to policyholders from day one of their diagnoses with Coronavirus disease. They minted more money in the last year as people did not seek medical care in fear of. The change was due in part to soaring profits among most providers.

Medical costs if you or anyone covered. Effects of the Covid-19 Pandemic on Health Insurance Travel and transportation to retail and manufacturing its fangs have reached all sectors leaving each stagnant and static. You will not need to use your private health insurance to cover.

Research published today has revealed that a quarter of expats took out new health insurance plans to cover family members amid the covid-19 pandemic with 355 of expats adding family members to their current insurance plan. This protects the family from any financial issue due to any unfortunate event because of coronavirus. In these testing times one never knows what lies ahead.

Insurance Profits Soared During The Pandemic. Medicare will pay all costs for any federally authorized COVID-19 vaccine and for testing ordered by a doctor or other health care provider. Health insurance companies were spending so much less than expected Matthew Rae director for the Program on the HealthCare.

For example if you want to make sure youre COVID-19 negative before visiting a family member you pay nothing to get tested. CMS has clarified that insurers cannot limit this coverage only to people who are symptomatic or who have a history of exposure to. There will be no out-of-pocket costs whether you have Original Medicare or a Medicare Advantage plan.

Due to the unique nature of traveling by cruise ship even prior to the COVID-19 pandemic travel insurance is strongly recommended for all travelers. Squaremouth recommends a minimum of 100000 in emergency medical and medical evacuation coverage in order to account for COVID-19 related medical care and evacuation expenses. Call before going to the doctor.

Americas major health insurers earnings are more than 11 billion in the second quarter a decrease from the same period last year 2020 when the COVID-19 outbreak was sky high. 06 January 2021. This coverage must be provided without consumer cost sharing.

Depending on the plan cruise travel insurance can protect against missed connections an emergency evacuation unexpected medical issues baggage loss and more. Is Medicare covering COVID-19 vaccines testing and treatment. Early in the pandemic insurance companies began waiving costs related to COVID-19 testing and treatment.

Urging uninsured Californians to obtain insurance to protect their health - On March 20 2020 Commissioner Lara urged uninsured Californians and those who have lost coverage due to COVID-19 to purchase health coverage through Covered California or through health plans and health insurers offering coverage outside the health insurance benefits exchange during a new. This is because a specially designed coronavirus health insurance plan covers you against the hefty expenses associated with the treatment of this highly infectious disease. And while its impact on the health insurance industry has been relatively less it is still going to see its effects for long disrupting business continuity and operating profit.

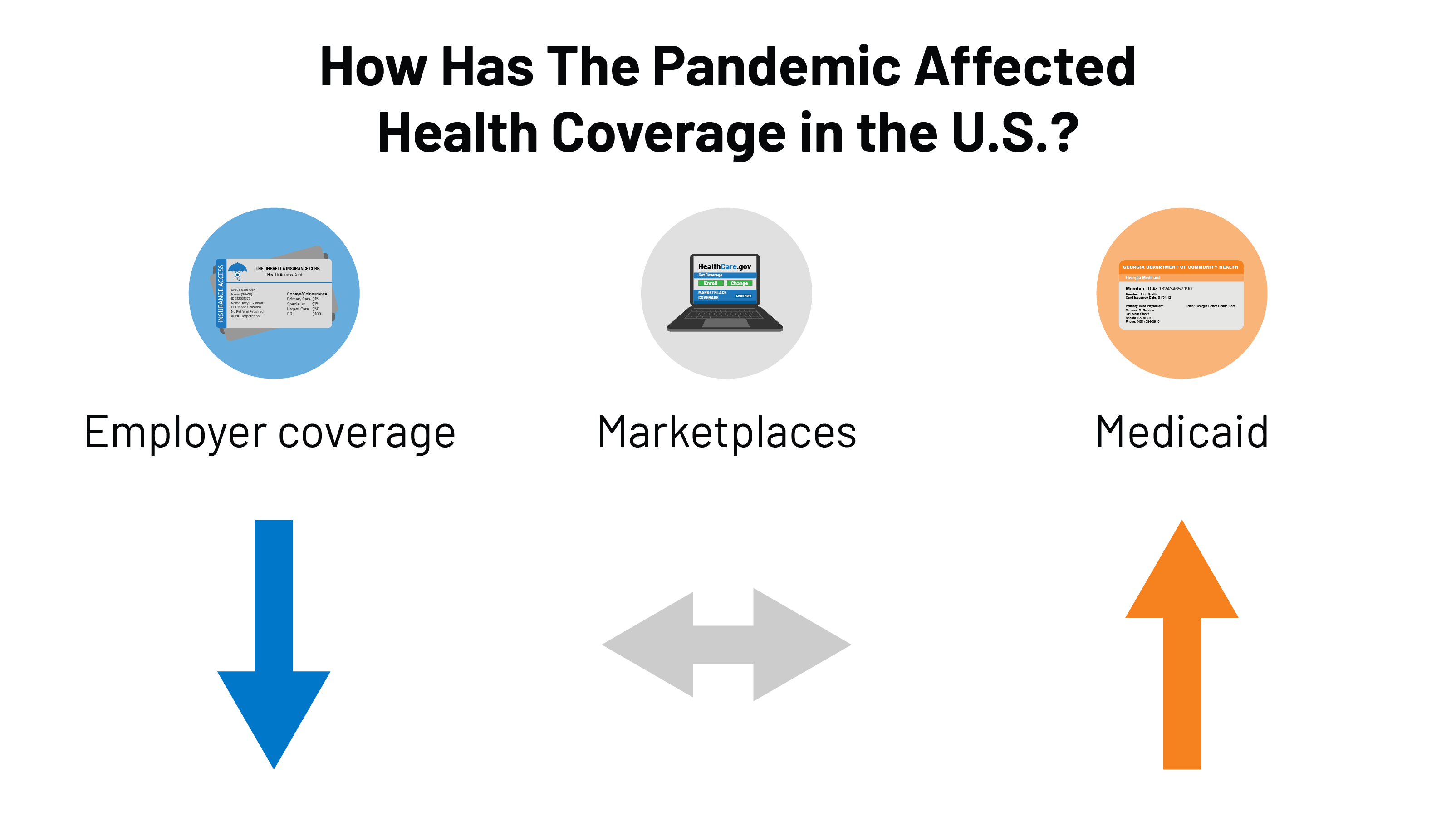

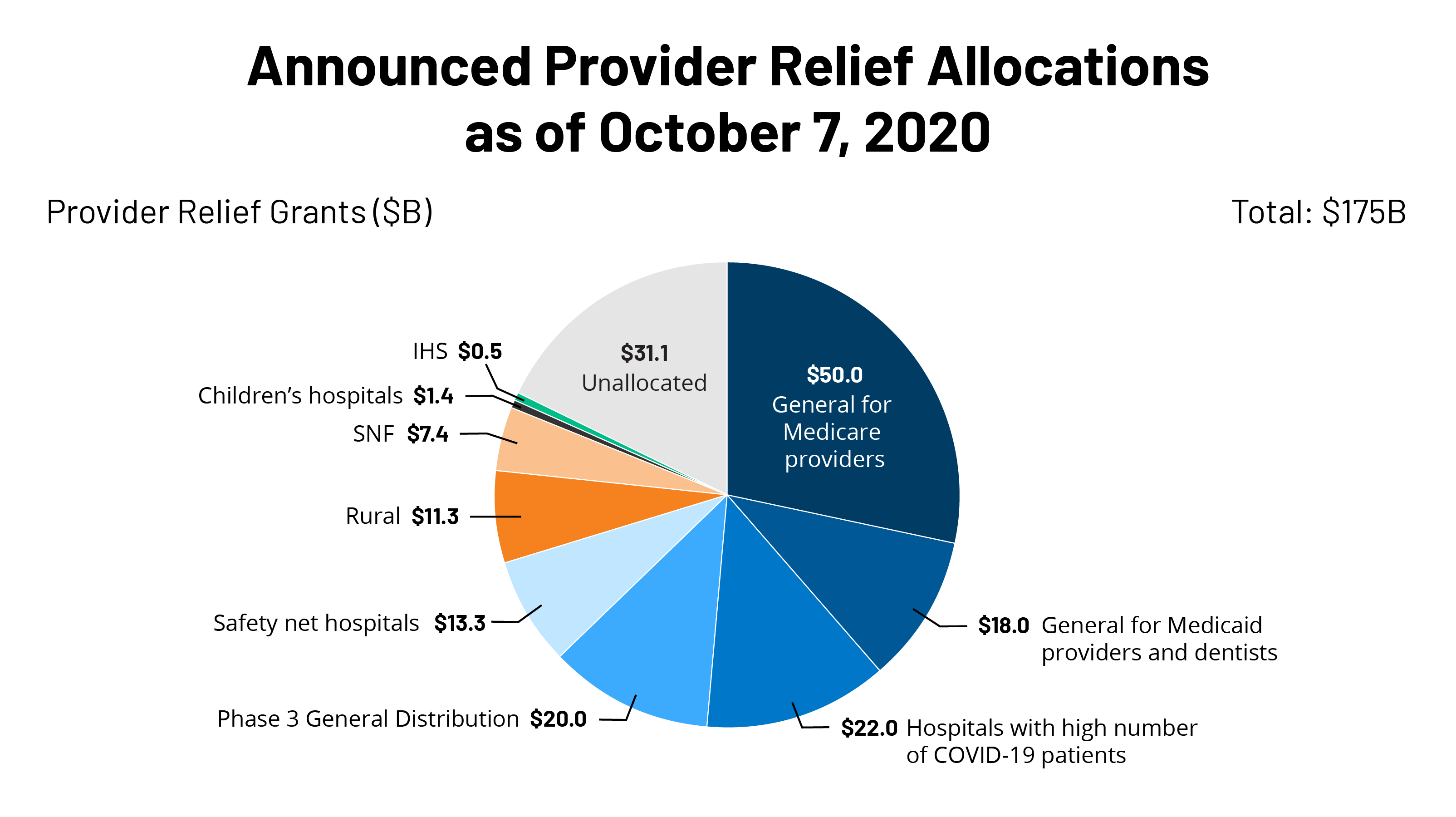

Effect of the COVID Pandemic on the Health Insurance Industry in the USA. This is because insurance companies will consider COVID-19 as a pre-existing condition. The Australian Department of Health announced the COVID-19 vaccine will be provided at no cost to all Medicare-eligible Australians permanent residents and temporary visa holders who are aged 16 years and older.

Government pre-paid for COVID-19 vaccines and required COVID-19 vaccines be made available at no out-of-pocket costs regardless of whether the vaccine recipient is insured. In February 2021 CMS published updated guidance regarding health insurance coverage of COVID-19 testing. Cancellation if you or anyone covered by the policy gets coronavirus before you travel.

COVID-19 being a viral infection will be covered under the health insurance policy. A standard health insurance plan the Arogya Sanjeevani policy covers you for COVID-19 hospitalization expenses day care procedures AYUSH treatment day care treatments road ambulance expenses cataract treatment and many listed. Health insurance plans to cover COVID-19 testing administration of the test and related items and services as defined by the acts.

In this ongoing pandemic situation where coronavirus COVID-19 is not looking to go away soon having coronavirus COVID-19 insurance can be highly beneficial. Ensuring that those who have paid premiums pre-COVID are able to continue health insurance coverage during a pandemic is an obligation of the insurers who find themselves with unexpectedly large profits from premiums intended to cover care that was never received. Nearly 27 million people in the US.

What COVID-19 risks can travel insurance cover.

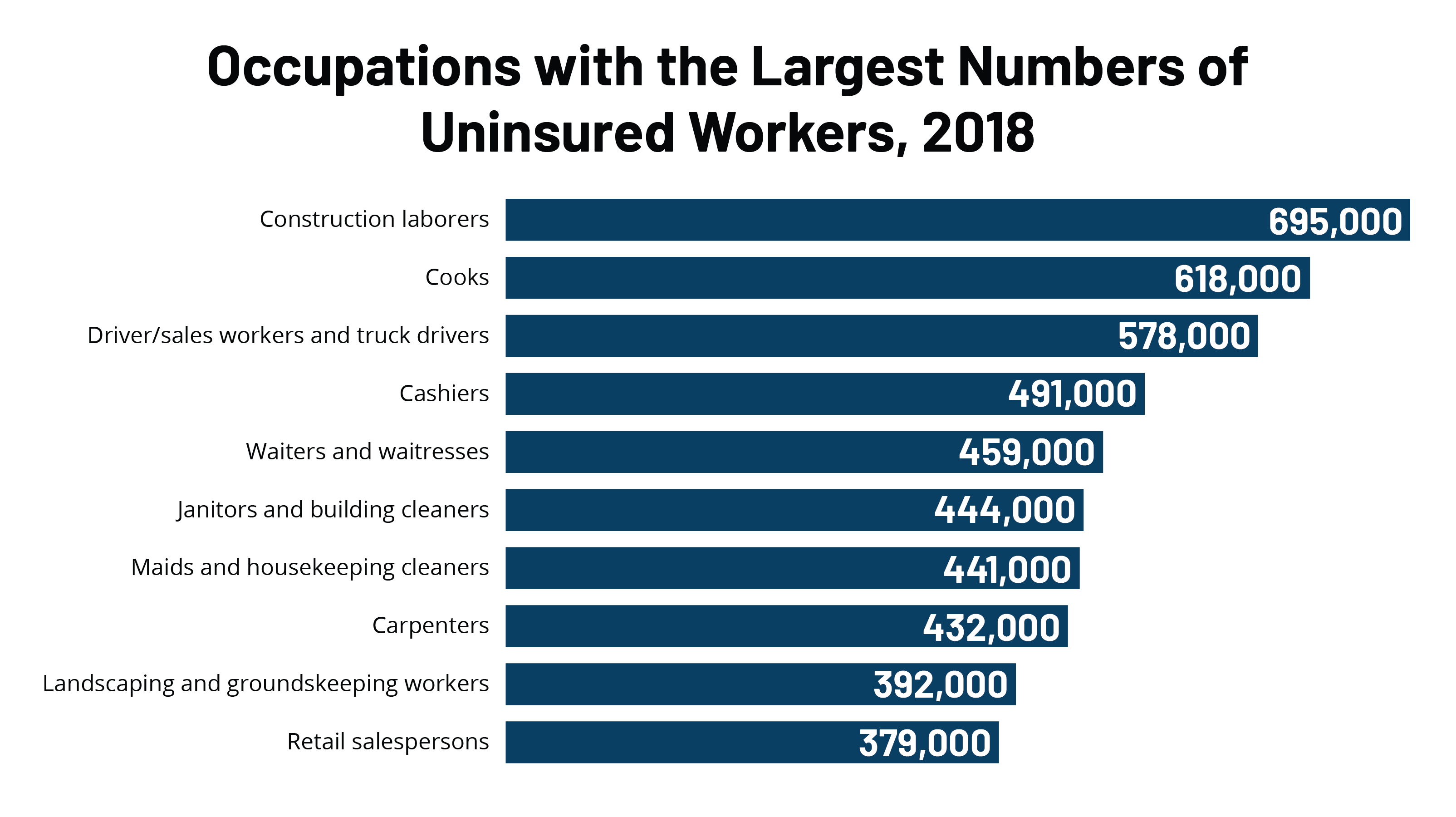

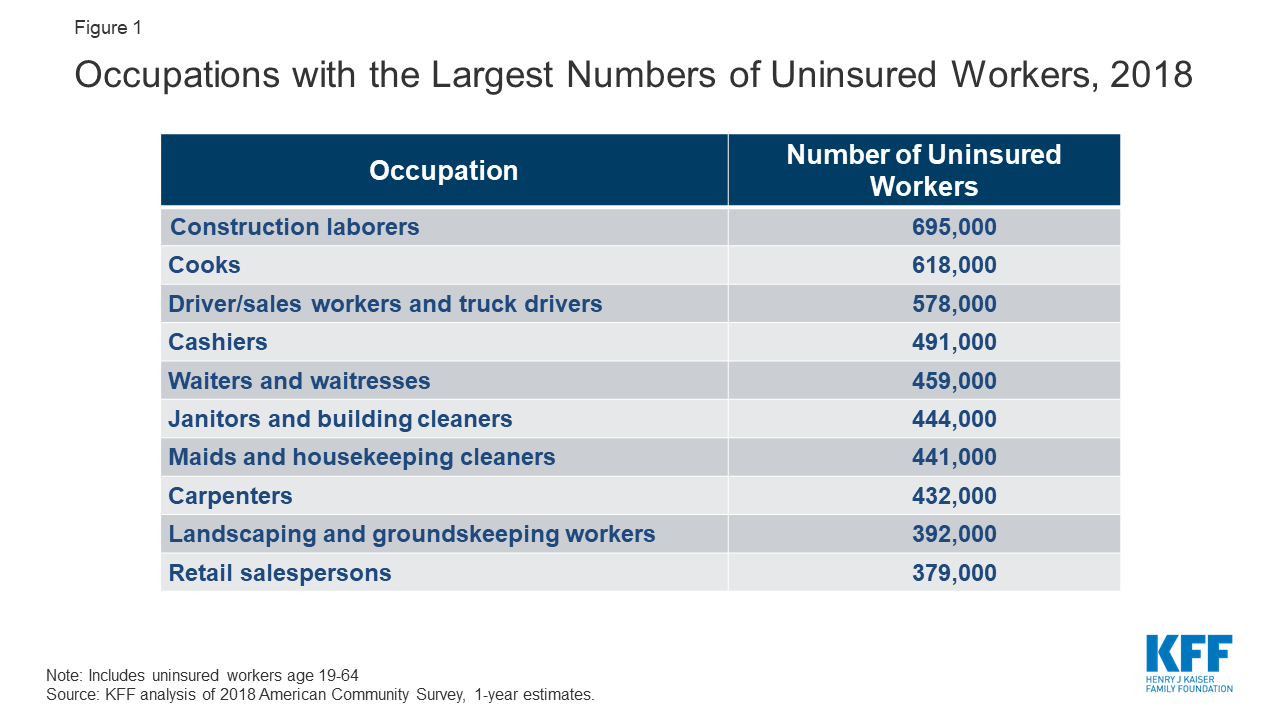

What Issues Will Uninsured People Face With Testing And Treatment For Covid 19 Kff

What Issues Will Uninsured People Face With Testing And Treatment For Covid 19 Kff

Private Health Coverage Of Covid 19 Key Facts And Issues Kff

Corona Kavach Policy Buy Corona Kavach For Covid 19 Online

How Has The Pandemic Affected Health Coverage In The U S Kff

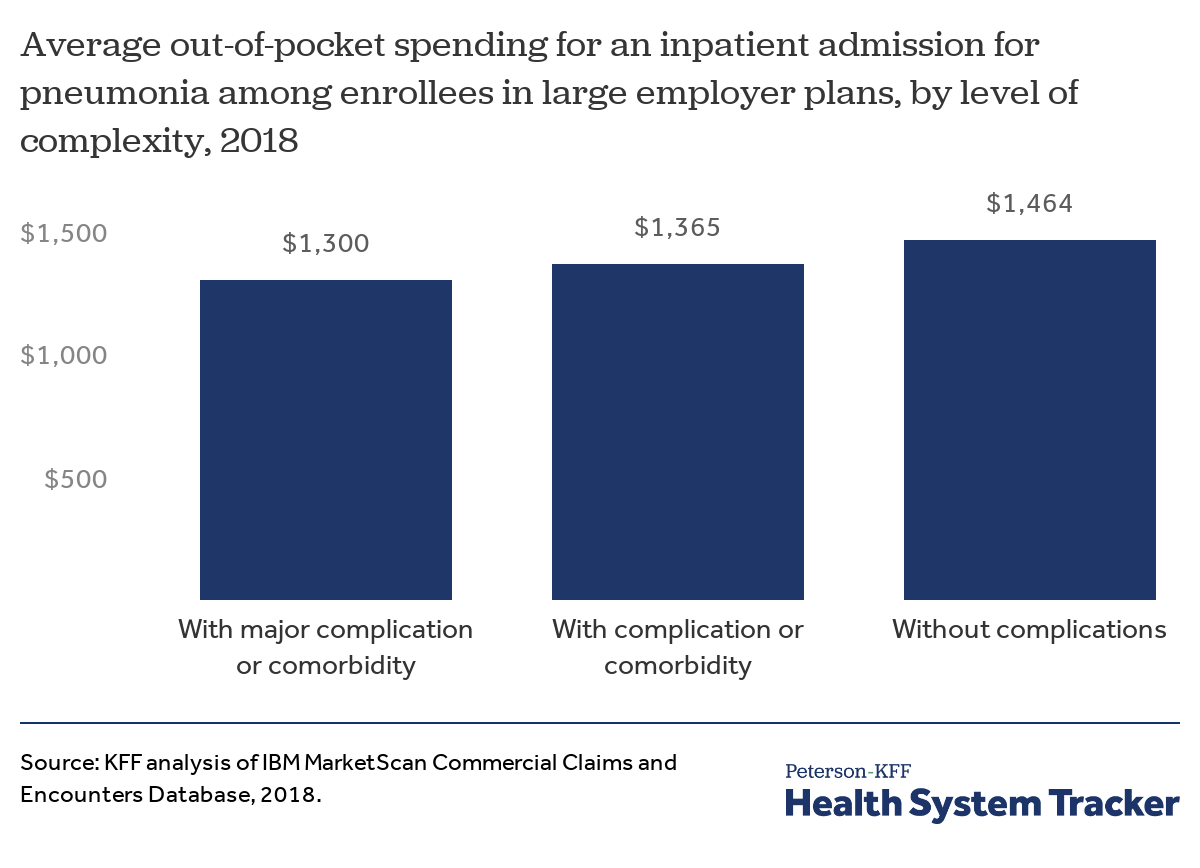

Potential Costs Of Covid 19 Treatment For People With Employer Coverage Peterson Kff Health System Tracker

![]()

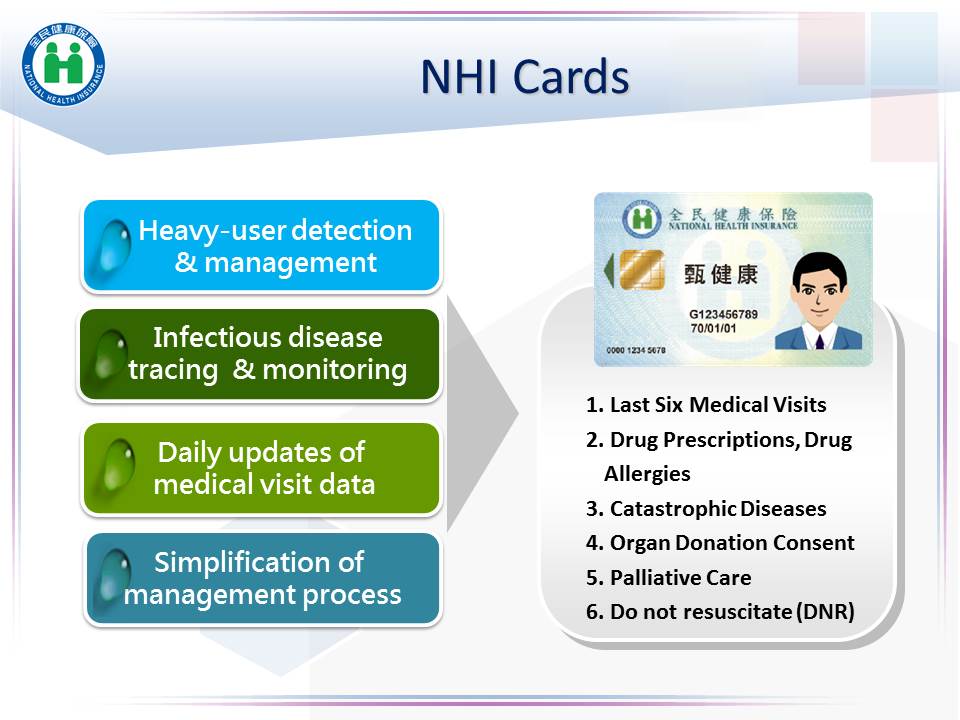

National Health Insurance Administration Ministry Of Health And Welfare Taiwan Can Help National Health Insurance S Contribution In Combating Covid 19

Equinet S Response To Covid 19 Equinet

Millions Lose Health Insurance During A Pandemic Only In America Public Citizen

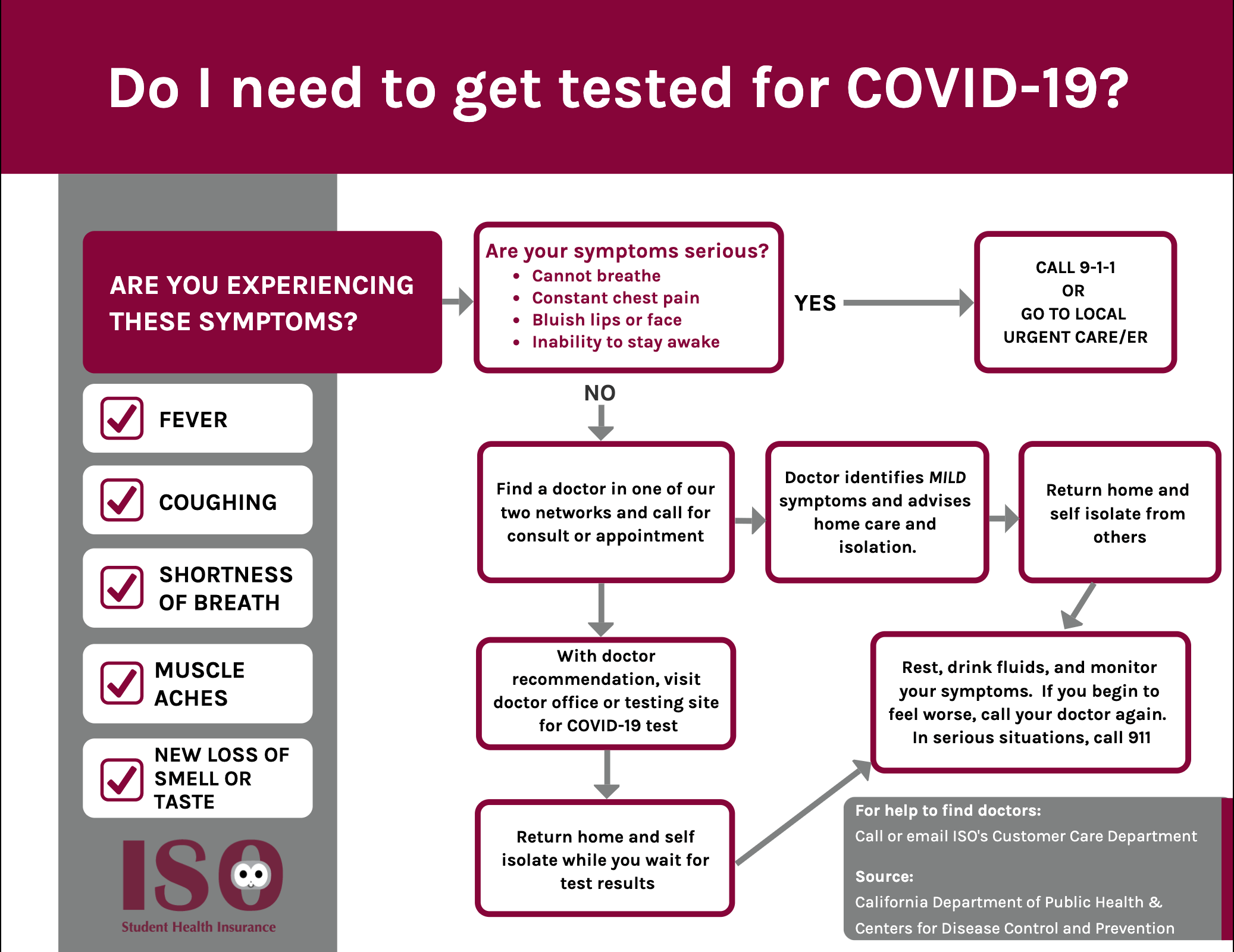

Iso International Student Insurance

Amid Covid 19 Pandemic India S Insurance Sector Has Seen Contrarian Growth Business Standard News

Taiwan Can Help National Health Insurance S Contribution In Combating Covid 19 Crucial Policy For Combating Covid 19

![]()

Potential Costs Of Covid 19 Treatment For People With Employer Coverage Peterson Kff Health System Tracker

Key Economic Findings About Covid 19 Bfi

Cdc Update On The Covid 19 Pandemic And Delta Variant Lincoln County Oregon

Limitations Of The Program For Uninsured Covid 19 Patients Raise Concerns Kff

Posting Komentar untuk "Health Insurance To Cover Covid-19 Pandemic"