Insurance Limits Extended Coverage

Windstorm hail explosion except of steam boilers riot civil commotion aircraft vehicles and smoke. The limit for the ICC in the base form is the lesser of 10000 or 5 percent of the direct damage insurance that applies to the damaged building.

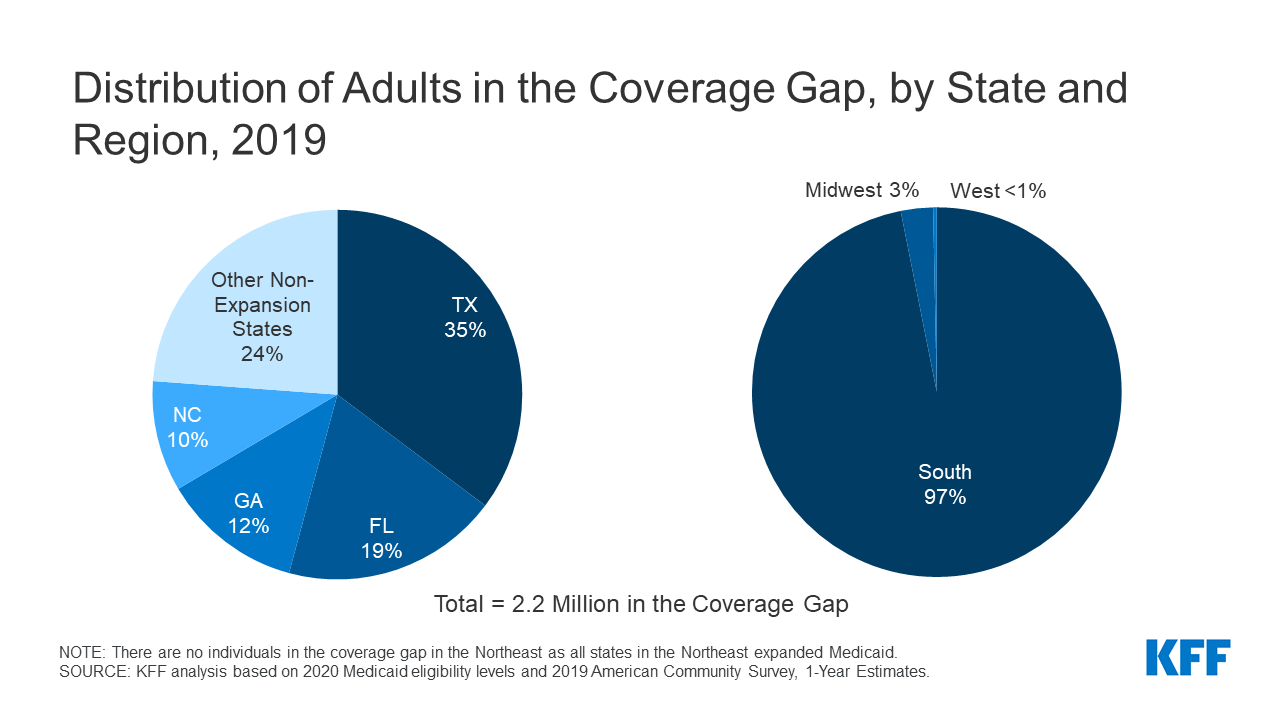

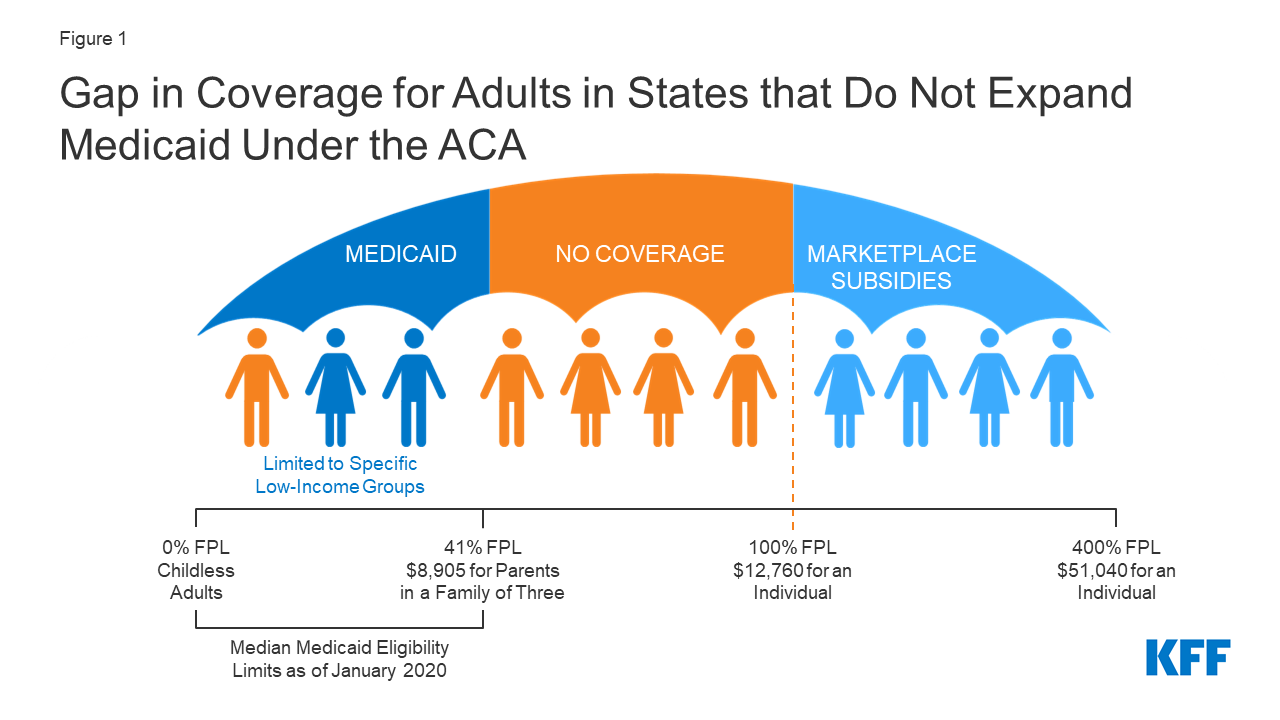

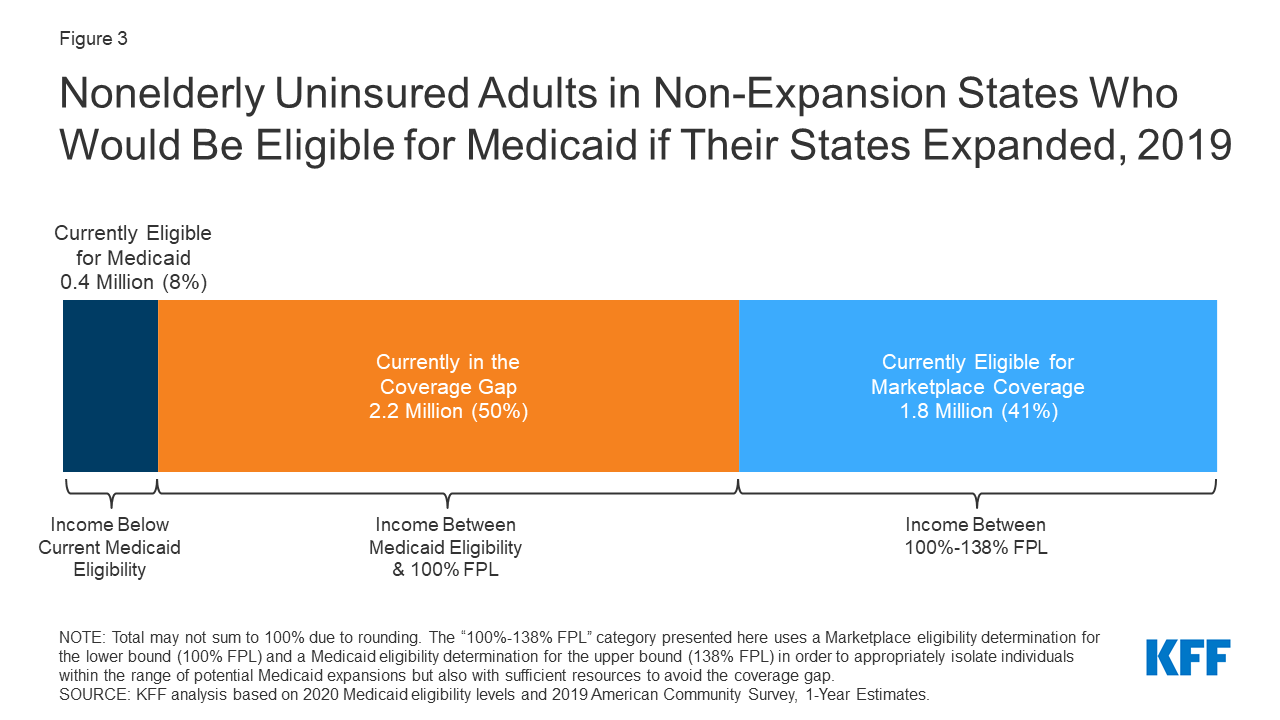

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

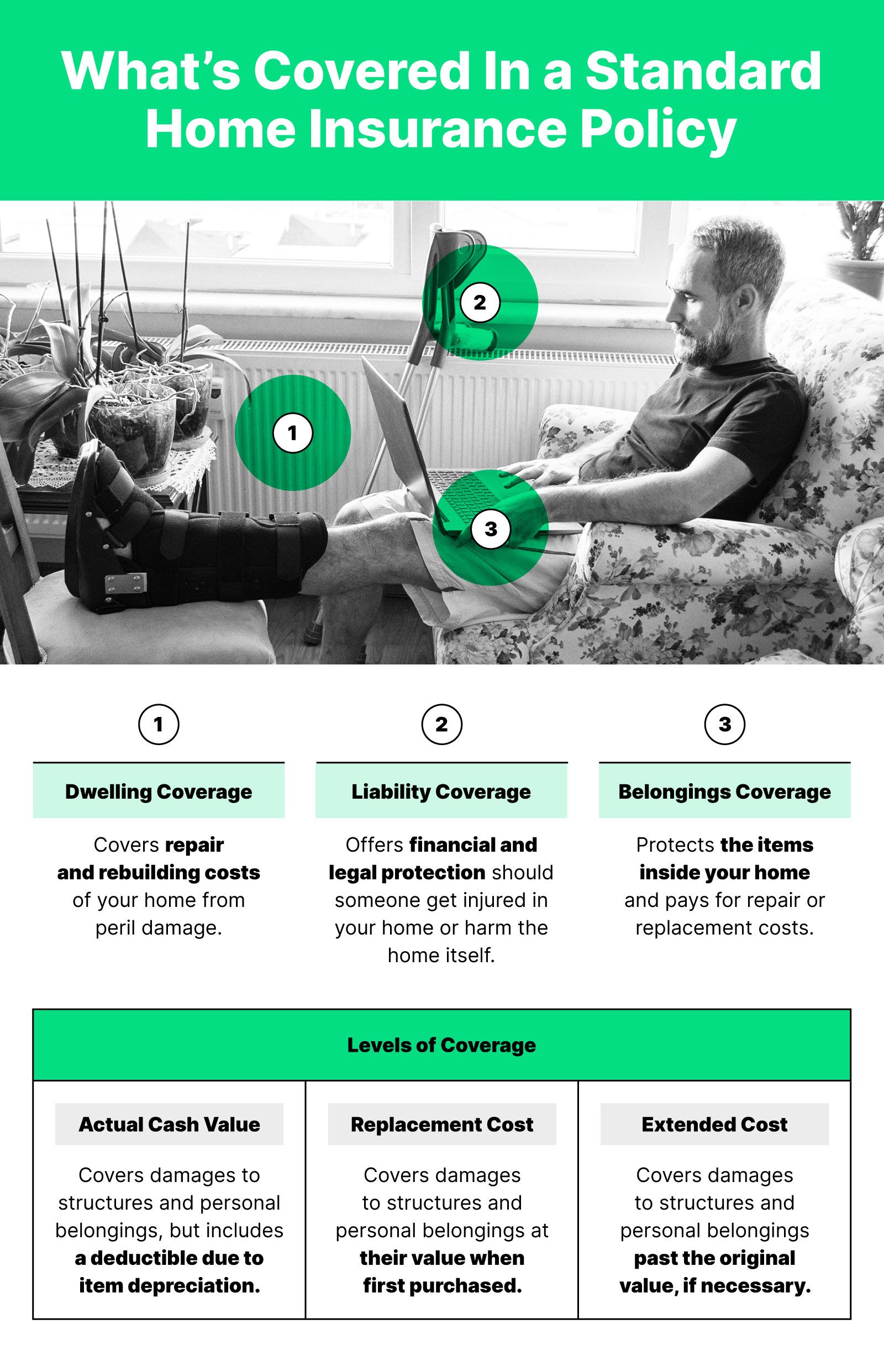

Extended replacement cost insurance adds money to what you can draw from to rebuild allowing you to afford these increased costs if such an event occurs.

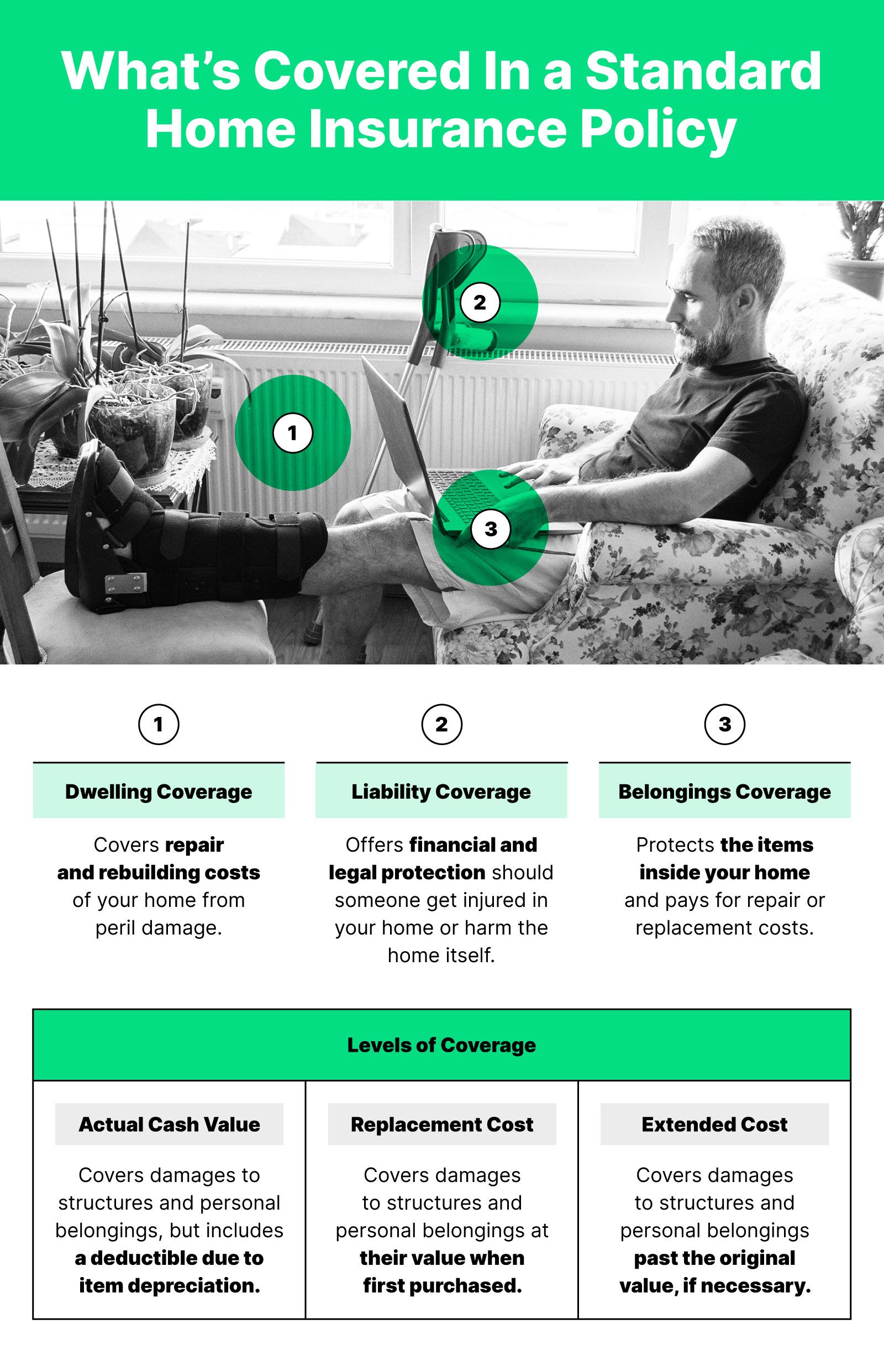

Insurance limits extended coverage. Extended Home Insurance coverage provides an additional amount of funds in the case that the estimated cost to rebuild a home is more than what the Coverage A limits allow for. This is typically between 10 percent and 25 percent. 20 of the dwelling coverage limit.

Coverage Limits for Home Insurance Policies. An acronym for extended reporting coverage. Insurance Limits and Coverage.

In the event the Company becomes in default. While this is a valuable addition to your Home policy the extended liability coverage also applies to your. Extended Coverage EC Endorsement an endorsement to a standard fire policy adding coverage for the following perils.

The minimum limit may vary by state so it is important to determine the coverage you should carry in. Personal Umbrella Liability You can add between 1 million to 5 million of liability coverage over and above your current policy limits and with no deductible. Who needs extended replacement cost insurance.

Coverage is extended to third party monies or be extended coverage under the policy issued to the association. Extended coverage is insurance coverage that goes beyond what a standard policy offers. So back to the 400000 coverage on the house.

The extended coverage is typically shown as 125 to 150 percent of the stated limit of coverage depending on which one you choose. If 25 extension then the limit of coverage is increased to a maximum of 500000 400000 X 125 I hope that helps. Your decision should be based on certain factors such as the cost to repair replace or rebuild your property.

What the extension does is give you an extension to another limit if needed. But with extended replacement cost you would be reimbursed for a certain percentage over your policy limit. Depending on the percentage you chose your new coverage amount could be anywhere from 275000 to 375000.

Say your home has a dwelling coverage limit of 300000. The aggregate limit is now 75000. FDIC Insured Banks 250000 Coverage Limits Extended When first implemented the increased insurance limits on FDIC savings accounts and other FDIC insured accounts at most banks was set to expire at the end of 2009.

1 The limit of liability for your dwelling is at least 100 of replacement cost. 10 of the dwelling coverage limit. Coverage applies to increased costs required by enforcement of ordinance or law to meet current building codes.

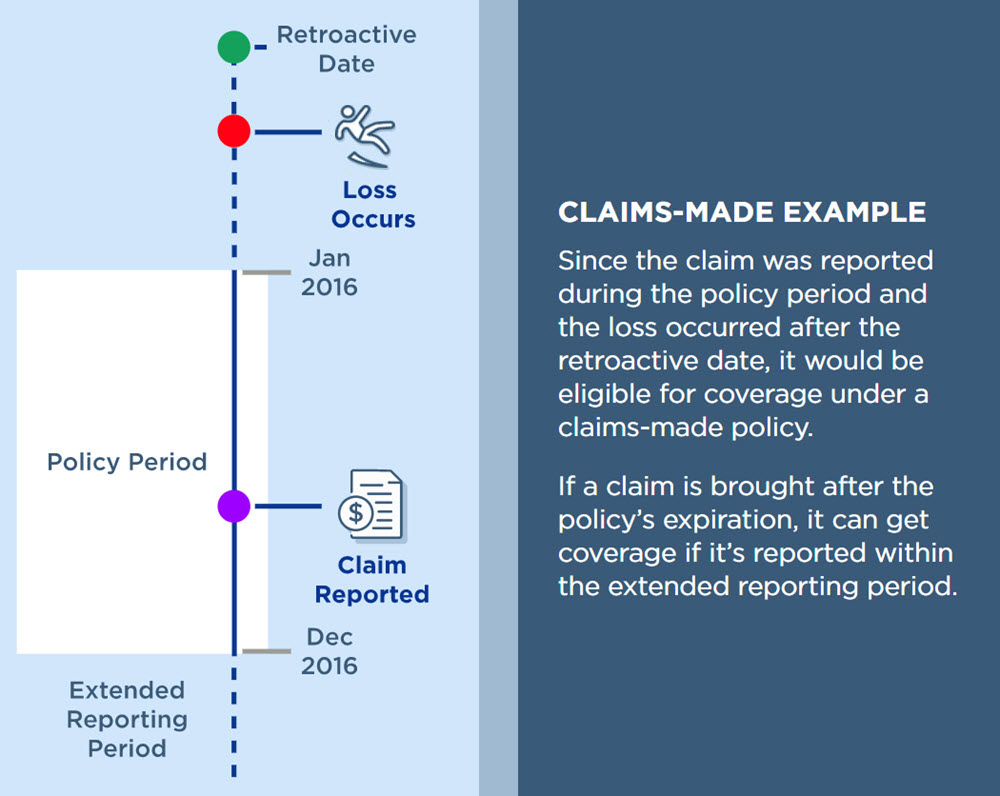

50 of the dwelling coverage limit. The limits you choose affect the amount you pay for coverage the higher your limit the higher your premium likely will be. Coverage is provided for claims made and reported after the expiration of a claimsmade policy if such claims arose from acts or omissions occurring during an insured period of time before the ERC was issued or effective.

Coverage limits for Fidelity must be sufficient to cover at least 3 months 25 of the associations operating budget and the full value of their replacement reserves. It often covers perils less likely to occur. The Company must maintain the following limits and coverages uninterrupted or amended through the term of the Purchase Order.

Types of Extended Insurance Coverage. Almost anyone should consider this extended dwelling coverage. If you meet the following 3 conditions at the time of a covered loss we will increase the limit of liability for damaged buildings structures under Coverage A Dwelling Protection by 20.

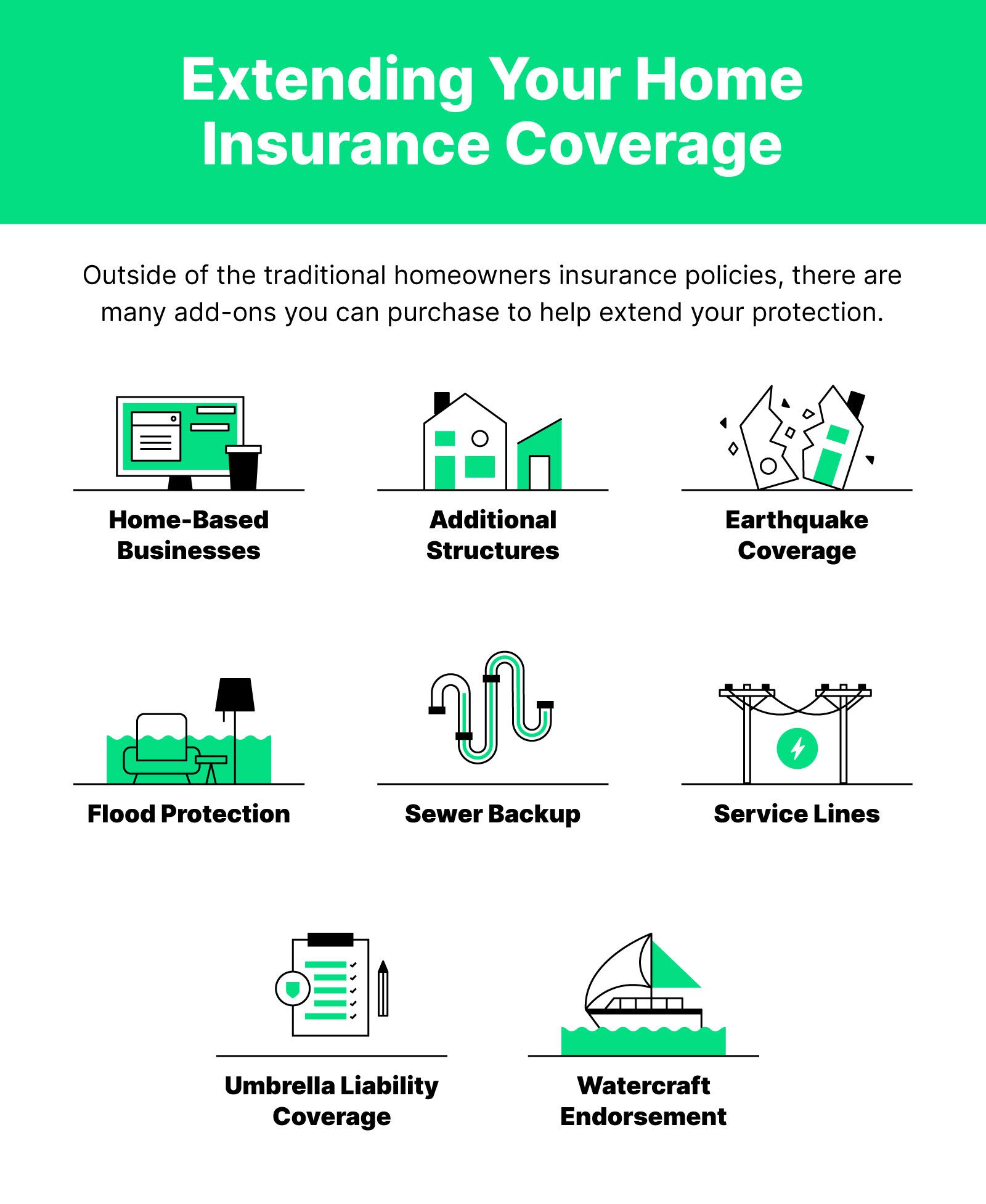

This is known as extended dwelling coverage. Although the extended coverage options your insurance company offers may vary depending on your states insurance regulations there are usually different types of optional coverages you can add to your policy. Personal property.

What is extended dwelling coverage. And you have extended replacement cost that insures you for 125 percent of your policy limit. Typically it is purchased separately from a standard policy and functions as an extension of the primary coverage.

Clearly the insurance premium reflects that the 215000 extended limits coverage will should never be called upon except in an emergency. You choose your limits for other coverages such as those for dwelling or personal property coverage. The EC perils are now included in most property policies without the need for a separate endorsement.

This extra coverage would come in handy during a large disaster affecting several properties at the same time in one area. There are many types of extended coverage and this is only a partial list. In some cases you may want to purchase coverage beyond the full replacement cost of your home.

The extensions are usually sold in percentage increments such as 25 50 or even 100. It helps to read over your standard policy so that youre clear about what it covers before laying out more money for added coverage. If the insured makes a single claim for 50000 the insurance company pays only 25000 the per claim limit even though it is under the aggregate limit.

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

Rental Car Insurance In Canada Save A Bundle With A Little Research Creditcardgenius

Home Insurance With Extended Or Guaranteed Replacement Cost Forbes Advisor

What Is Dwelling Extension In Homeowners Insurance

Everything You Need To Know About Certificates Of Insurance Bcs Compliance

Vendors Endorsement Extend Coverage To Your Vendors

Open Enrollment 2022 Guide Healthinsurance Org

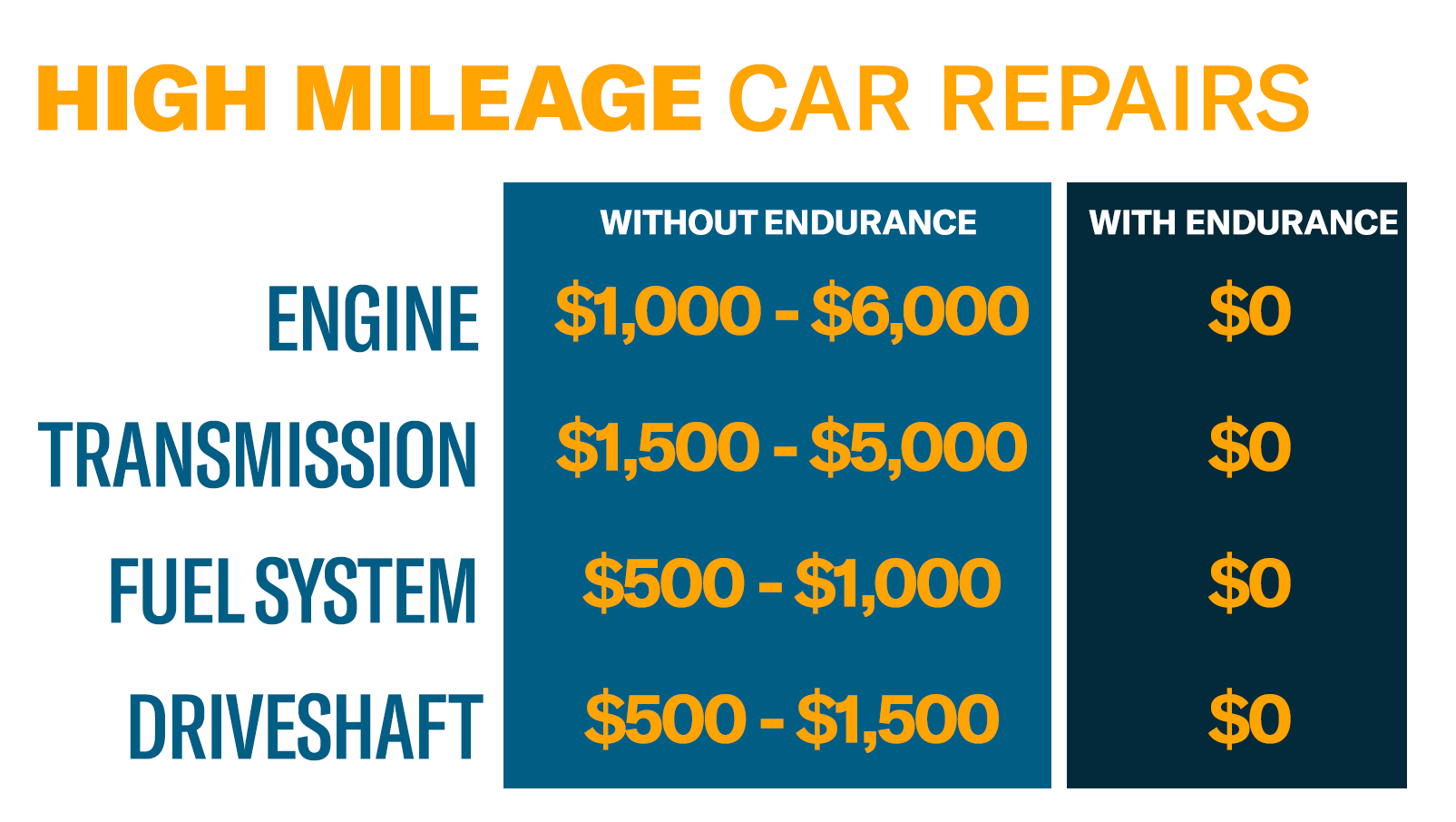

Extended Warranty For Cars Over 150k Miles Endurance

Types Of Homeowners Insurance Hippo

So Long To Limits On Short Term Plans Healthinsurance Org

How Many Uninsured Adults Could Be Reached If All States Expanded Medicaid Kff

Types Of Homeowners Insurance Hippo

Types Of Homeowners Insurance Hippo

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

Which Motorite Warranty Cover Is Right For You Warranty Extender

Posting Komentar untuk "Insurance Limits Extended Coverage"