What Are The Five Basic Areas Of Coverage On A Homeowners Insurance Policy

Dwelling coverage-- this is what covers your home. What homeowners insurance covers.

Benefits Of Having Comprehensive Car Insurance Comprehensive Car Insurance Car Insurance Best Car Insurance

However if these items are very valuable you may need extra contents coverage to protect those belongings that exceed the value of your policy.

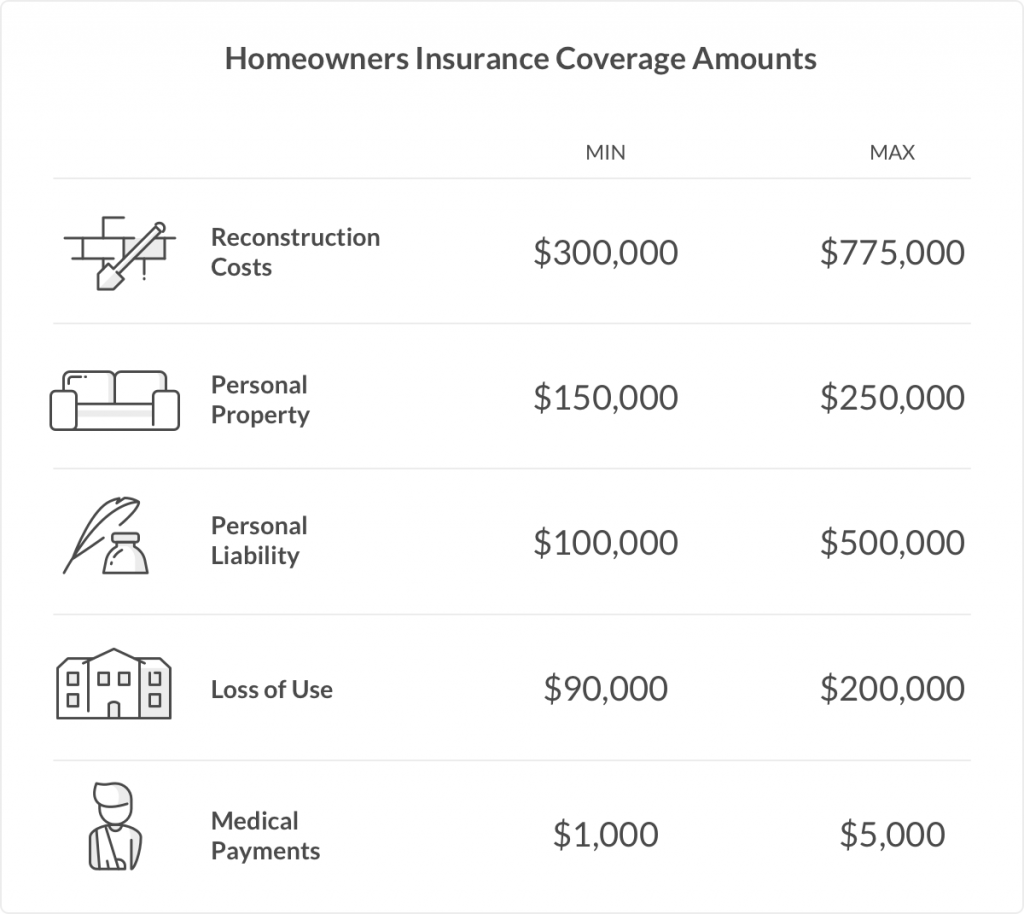

What are the five basic areas of coverage on a homeowners insurance policy. The levels of coverage you need for these six different areas are what your insurance company will base your premium calculations on. Coverage D aka loss of use insurance. Typical homeowners insurance policies offer coverage for damage caused by fires lightning strikes windstorms and hail.

Other property-- this is what covers detached structures on your property. If your home is damaged by a covered event like strong winds dwelling coverage can help pay to repair it. A type of coverage designed for condo owners.

Dwelling coverage -- this is what covers your home. A policy type that is specifically for renters. What are the five basic areas of coverage on a homeowners insurance policy.

Dwelling other structures personal property and liability. What are the five basic areas of coverage on a homeowners insurance policy. It covers any additional living expenses that come as a result of being unable to use your home.

Other property -- this is what covers detached structures on your property. There are four basic types of coverage for homeowners which are further broken down into six separate types of coverage below. This is coverage that many homeowners in disaster-prone areas should make sure to have.

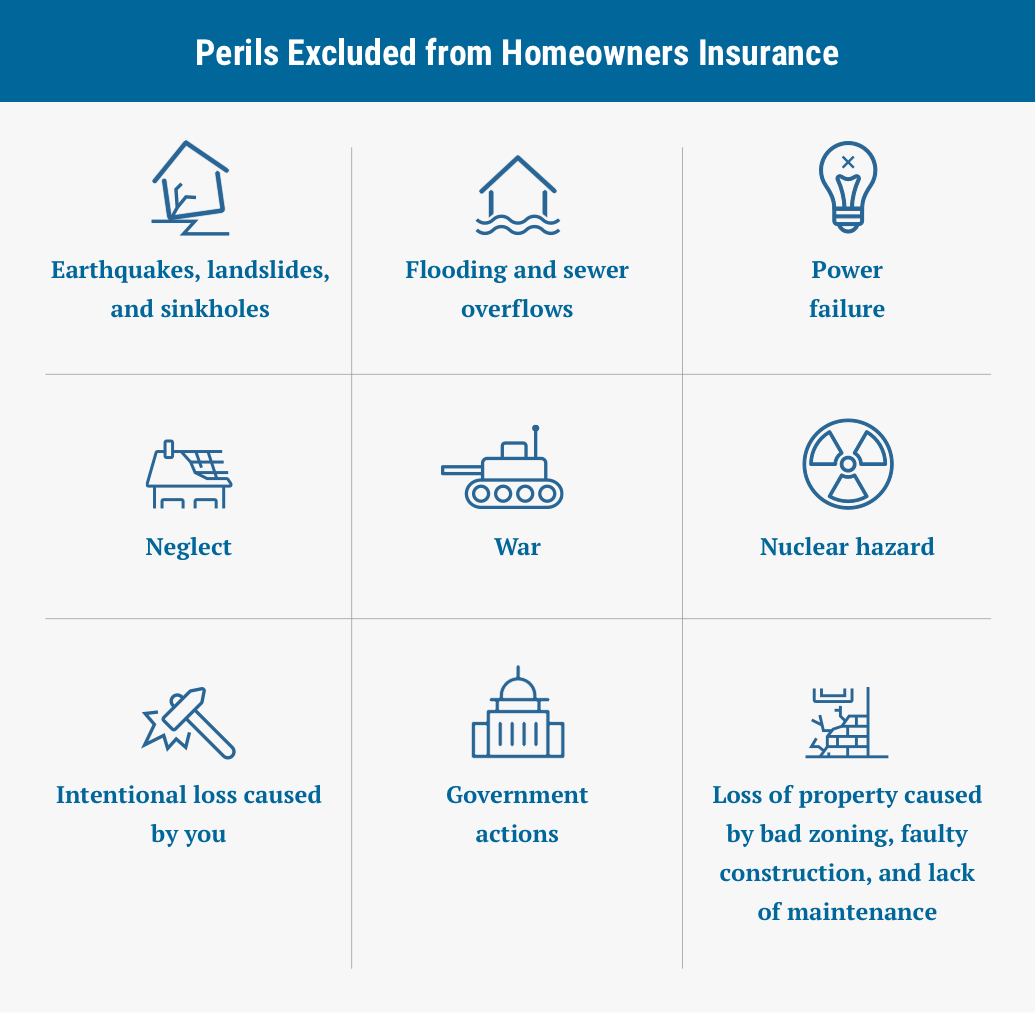

What is covered and what isnt covered is clearly explained in your policy before it goes into effect but homeowners policies can be pages long and the jargon can be confusing. There are three coverage options. The most basic home insurance policy usually covers at least five coverage areas.

Dwelling other structures personal property and liability. Homeowners insurance covers your home and personal belongings in the event that they are damaged or destroyed. This is the standard home insurance policy.

Replacement Cost This policy pays the cost of rebuilding or repairing the home or replacing possessions without a deduction for depreciation. The most common type of homeowners insurance policy with broader coverage than the HO-2. Homeowners insurance can also protect you if someone is injured in your home and decides to sue you.

Personal property coverage-- this is what covers the property within your home. This form is a broader version of HO-1 covering more than the basic 10 named perils. Dwelling other structures personal property and liability.

If your home is damaged by a covered event like strong winds dwelling coverage can help pay to repair it. The most basic home insurance policy usually covers at least five coverage areas. A standard policy includes four key types of coverage.

An HO-1 homeowners insurance policy provides the most basic coverage. What are the five basic areas of coverage on a homeowners insurance policy. A standard policy includes four key types of coverage.

Actual cash value replacement cost and extended replacement costvalue. Personal property coverage -- this is what covers the property within your home. Three basic levels of coverage exist.

This includes a hotel if your home is unusable or the restaurant costs if your kitchen is ruined and youre unable to. A home air conditioning unit or system is covered for theft fire storm damage or any other reason included in a standard homeowners insurance policy subject to the limits of that policy. A standard policy includes four key types of coverage.

Actual Cash Value This policy pays to replace the home or possessions minus a deduction for depreciation. But its important to know that not all natural disasters are covered by. What is Coverage A and B.

The most comprehensive form of homeowners insurance and the second most common policy type for single-family dwellings. Types of Homeowners Insurance Coverage. It typically covers damage caused by about 10 different events including fire lightning windstorms hail and explosions.

It is possible that your jewelry collectibles and art will be covered by your home insurance policy. Policy rates are largely determined by the insurers risk that youll file a claim. A basic form policy the HO-1 offers the most basic of coverage covering only 10 named perils on both the building and contents.

These include the following. An HO-1 policy usually covers smoke damage explosions damage caused by civil unrest and volcanic eruptions as well. If your home is damaged by a covered event like strong winds dwelling coverage can help pay to repair it.

Mobile Dog Grooming Insurance Infographic Infographic Dental Hygienist Education Dental

Description Prudential Life Insurance Assessment Life Insurance Life Insurance Policy Home Insurance Quotes

Sparks Insurance Quote Life Insurance Quotes Home Insurance Quotes Health Insurance Quote

How To Reduce Homeowners Insurance Home Insurance Quotes Home Insurance Cheap Home Insurance

What You Should Know About Your Ho5 Insurance Policy Dictionary By Lemonade

Understanding Your Home Insurance Declarations Page Policygenius

Home Insurance Buy Property Insurance Policy Online

6 Best Homeowners Insurance Companies Of October 2021 Money

Photo By Dzynpro Home Insurance Quotes Home Insurance Insurance Quotes

What Is Dwelling Coverage Insuropedia By Lemonade

6 Best Homeowners Insurance Companies Of October 2021 Money

Understanding Home Insurance Policies Insurance Policy Home Insurance Homeowners Insurance

Avoid Common Homeowners Insurance Mistakes Nationwide Homeowners Insurance Home Buying Home Mortgage

5 Tips Every Renter And Homeowner Should Know About Insurance Homeowners Insurance Homeowner Renters Insurance

Homeowners Insurance Policy Types Progressive

/GettyImages-1144543928-efef60971f5d403aa7fe5526a6fa2fa0.jpg)

Homeowners Insurance Guide A Beginner S Overview

Home Insurance Looking For More Coverage Home Insurance Flood Insurance Insurance Ads

Basic Coverage And Adding Coverage Department Of Financial Services

Posting Komentar untuk "What Are The Five Basic Areas Of Coverage On A Homeowners Insurance Policy"